Real Estate / Вusiness / Investments / Analytics / Research / Georgia / Real Estate Georgia 24.02.2025

Didi Digomi Becomes the Most Popular District in Tbilisi's Primary Market

In 2024, demand in Tbilisi's residential real estate market remained stable, as noted in a report by the investment company Galt & Taggart. The total volume of apartment sales increased by 1% compared to 2023, while the market volume grew by 7.1%. The average price in the primary market rose by 11.6% year-on-year. Rental yields continued to be more attractive than alternative investment options.

Apartment Sales in Tbilisi

In the first four months of 2024, sales from developers progressed successfully, but a decline was observed in May, attributed to an abundance of holidays. In June, demand partially recovered, and by July, it returned to its previous level, driven by the launch of several large-scale projects that expanded buyer options.

In October, the pre-election climate led to another slowdown, but in November, sales rebounded due to pent-up demand. As expected, sales declined in December, although the drop was more moderate than anticipated. Overall, apartment sales in developer projects covered by the study grew by 4.5% year-on-year.

In January 2025, Galt & Taggart surveyed 17 major developers engaged in 85 residential projects in Tbilisi. The results show that the local population consistently accounts for about 80% of total transactions, remaining the primary driver of market demand.

The share of Russian buyers decreased from 6% in 2024 to 2%, while demand from Israeli citizens increased from 4% to 10%. In projects scheduled for completion in 2025, 75% of apartments have already been sold, with most transactions conducted through internal installment plans offered by developers.

In 2024, the number of apartments sold on Tbilisi's secondary market totaled 20,207 units, down 4.8% from 2023. Analysts attribute this decline to a 12.5% drop in transactions involving older projects. Meanwhile, sales of newly completed projects increased by 8.1%.

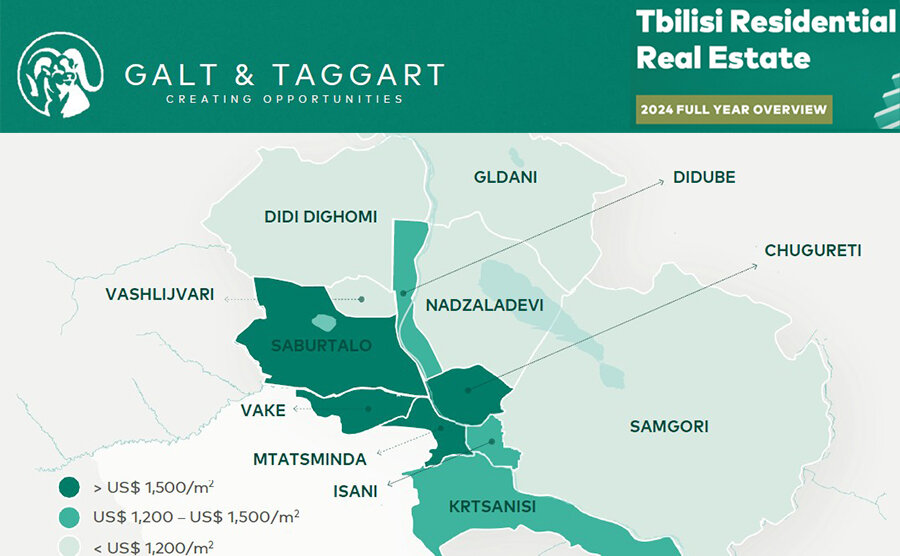

A total of 40,300 apartment transactions were registered in Tbilisi in 2024. The majority were in Didi Digomi (7,900), Saburtalo (6,400), and Samgori (5,600). The report highlights that Didi Digomi was the most in-demand district in the primary market due to the large number of ongoing developments.

In 2024, 255 permits were issued for residential construction projects covering a total area of 1.8 million square meters. Most permits were granted in Saburtalo (23% of the total), followed by Didi Digomi (18%) and Samgori (17%).

Housing Prices in Tbilisi

The most expensive housing in 2024 was found in the districts of Mtatsminda ($2,910 per sq. m), Vake ($2,478), and Chugureti ($1,837). The lowest prices were recorded in locations such as Vashlijvari ($1,027 per sq. m), Gldani ($1,038), and Didi Digomi ($1,042).

Prices varied not only based on location but also on the stage of project completion.

The total market value of apartments sold in Tbilisi amounted to $3,132.1 million, reflecting a 7.1% year-on-year increase. Other key market characteristics remained unchanged. Mid-sized apartments (51-80 sq. m) remained the most popular due to affordability and ease of rental, while the share of budget segment sales (under $1,000 per sq. m) declined.

Rental rates in Tbilisi remained generally stable, averaging around $10 per sq. m. In December 2024, a rental apartment of 50-60 sq. m cost an average of $9.7 per sq. m.

Rental yields continued to be attractive compared to alternative investments. Cities that received the highest influx of migrants following the outbreak of hostilities in Ukraine still exhibit the highest returns.

Hotels

Earlier, Galt & Taggart analysts published a report on the hotel business in Georgia. The study noted that hotel performance in Tbilisi declined in Q4 2024, while Batumi saw an increase in average occupancy from 36.9% in the same period of 2023 to 52.5%, with ADR remaining stable. This growth was likely driven by a sharp increase in visits from Middle Eastern countries, which accounted for more than half of total overnight stays sold in the Adjara capital.

Demand for Airbnb in Tbilisi grew by 9.5% in Q4 2024 to 151,300 total nights. In Batumi, this figure rose by 20.8% to 56,200 nights. Airbnb prices decreased in Tbilisi, where the quarterly ADR was $50 (-4.6% YoY), while in Batumi, prices increased to $37 (+13.4% YoY) in Q4 2024.

The number of hotels in Georgia increased by 2.4% year-on-year to 1,212, while the total number of rooms rose by 4.7% to approximately 37,000. According to the Georgian government, there were fewer than 800 hotels in the country in 2012, whereas by 2024, this number had nearly tripled to almost 2,400, with available accommodations growing from 23,000 to 108,000.

According to PMCG, 17 new hotels are set to open in Georgia in 2025. Major projects include Hilton Garden Inn Adjara, Hilton Tbilisi, Hotel Sololaki Hills, Ambassador Batumi, and Paragraph Golf & Spa Resort Tabori Hill, with 172 to 200 rooms each.

Additionally, the first properties in the Wyndham Grand Batumi Gonio hotel complex are expected to launch in 2025. This project includes 1,055 rooms in various formats—family residences, hotel townhouses, and villas—featuring Georgia’s first 5-star all-inclusive resort infrastructure. The development is located in the prestigious Gonio resort area, which has recently attracted the attention of one of the largest developers in the Middle East.

Eagle Hills, a major Abu Dhabi-based developer, has announced plans for large-scale projects in Tbilisi and Gonio. The Gonio Marina development will cover 260 hectares and feature branded residences, hotels, shopping areas, public parks, and a yacht marina. Another project in Tbilisi, Krtsanisi Park, will be a multifunctional residential and commercial complex spanning 590 hectares, with 170 hectares designated for parks and green spaces. The total investment is estimated at around $6 billion.

In 2024, Georgia recorded over 7.3 million international traveler visits, up 4.2% from 2023. A total of 5,091,732 arrivals were for tourism purposes. Tourism revenues reached $4.4 billion in 2024, marking a 7.3% annual increase, the highest level in the past 14 years.

Overall, the country's economic outlook remains positive. By the end of 2024, Georgia's GDP grew by 9%. Prime Minister Irakli Kobakhidze considers further growth of 10% or more in 2025 to be realistic, given the existing potential. Georgia leads among 22 European and Central Asian countries in economic growth rates. Analysts estimate that Georgia's projected GDP growth in 2025-2026 will be 1.5 times higher than other EU candidate countries and five times higher than the eurozone’s economic growth rate. Previously, international experts, including the IMF, upgraded their forecasts for the country's economic development.