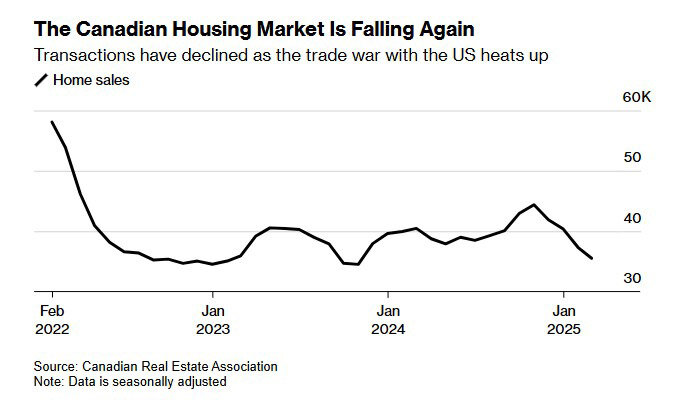

Canada’s Housing Market Freezes Amid Trade War and Recession Fears

In March 2025, Canada’s housing market experienced its sharpest decline for the month since 2009. According to Bloomberg, home sales dropped by 9.3% year-over-year, with the steepest declines in Toronto (-24%), Calgary (-17%), and Vancouver (-13%).

Economic Uncertainty Fueled by Trade Conflict

The key driver behind the slowdown is rising uncertainty linked to the escalating trade war with the U.S., initiated by the Trump administration. Both business and consumer confidence have weakened, impacting real estate first.

“We’ve gone from steady recovery to uncertainty in no time,” said CREA’s Chief Economist Shaun Cathcart.

Buyers Step Back, Sales Stall

Toronto-based blogger Eric Strack, 23, told Bloomberg he paused his plans to buy a two-bedroom condo, even with a full down payment ready. With monthly costs up CAD 1,600 over rent, the deal seemed too risky.

“It’s not just mortgage stress—it’s instability stress,” he said. “Who knows what comes next, especially with Trump’s trade policy.”

Job numbers fell for the first time in eight months, and Canada’s small business confidence index hit a 25-year low. BMO economist Robert Kavcic warns that this uncertainty may lead to a long-term housing stagnation.

CREA Adjusts Forecast: From Growth to Flatline

CREA had originally forecasted 8.6% growth in sales for 2025, but now expects a flat outcome with just a 0.02% change. The market has essentially stalled.

Real estate is a traditional engine of economic growth, sparking downstream spending on appliances, furniture, and home improvements. But both construction (13% of GDP) and exports (30%) are losing momentum.

“People are waiting and watching,” said economist Mike Moffatt (Western University). “The trade war creates so much uncertainty that people fear making big financial decisions.”

Falling Prices, Lower Mortgage Rates—But No Recovery

Despite a nearly 16% drop in home prices since 2022, growing supply, and mortgage rates at 3-year lows, buyers are reluctant.

“Rates don’t matter if you think you’ll lose your job,” said Vancouver broker Adil Dinani.

“The market’s so quiet it feels weird to be working,” added Hamilton agent Brooke Hicks.

Sentiment Drops Post-U.S. Election

Before the 2024 U.S. election, 46% of Canadians expected housing prices to rise. Now, just 34% remain optimistic, while 17% foresee declines, according to Nanos Research.

Valery.ca agent Daniel Foch says a dozen clients have paused their home search, fearing income loss and market volatility.

“People are scared. No one wants to make a big move without stability,” he says.

Market Outlook: Modest Decline Ahead

According to True North Mortgage, the average home price in Canada is expected to drop by 3.2%, with sales volume down 0.9% in 2025. The worst-hit provinces: British Columbia and Ontario, facing oversupply and rising debt loads.

In February 2025, Canada’s GDP contracted by 0.2%, the first decline in four months, reports Reuters.

March growth is expected to be just 0.1%.

A New Political Course: Will It Help?

In April 2025, former Bank of England governor Mark Carney became Prime Minister. He has pledged to diversify Canada’s global trade and reduce dependence on the U.S.—a move analysts hope could ease pressure on the economy and housing.

Conclusion: Recovery or Risk?

Canada’s real estate market in spring 2025 sits at a crossroads—caught between lower rates and lingering uncertainty. Buyers remain hesitant. The return of confidence will determine how quickly the market can bounce back.

Подсказки: Canada, housing market, real estate, home prices, mortgage rates, economic crisis, trade war, recession, Toronto, Vancouver, investment trends