France’s Real Estate Market in H1 2025: Capital Gains and Regional Declines

Photo: Needpix.com

France’s real estate market closed the first half of 2025 without any strong momentum, reports SeLoger. Price changes were moderate, market activity was restrained, and outlook for the second half remains uncertain. One key factor was the halt in mortgage rate declines this spring, which had previously supported buyer demand.

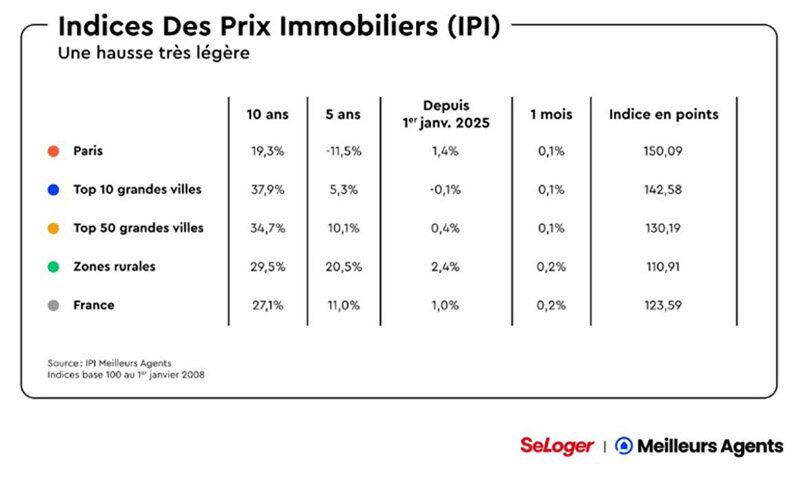

At the national level, the average housing price increased by only 1% in the first six months of 2025, compared to 1.8% in the same period in 2024. In Paris, prices began climbing gradually in December 2024, with monthly gains of 0.2%, totaling a 1.4% increase over six months. Rural areas, which had been largely unaffected by earlier price corrections during interest rate hikes, continued to show stable growth, with a 4.2% increase by June 2025, continuing a trend dating back to the pandemic.

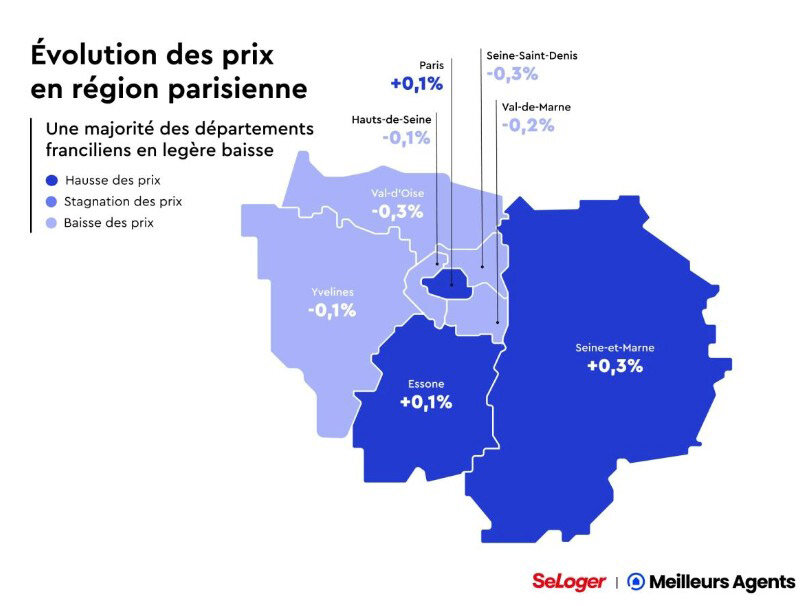

In contrast, urban markets outside Paris showed stagnation. Among the top 10 cities (excluding Paris), average prices were flat (0%) versus a 1.4% increase in H1 2024. The top 50 cities saw a marginal 0.2% rise. Just 65 departments recorded positive price changes, compared to 84 last year. Meanwhile, Paris saw a slight acceleration, with Q2 2025 prices rising 0.6%, compared to 0.4% a year earlier.

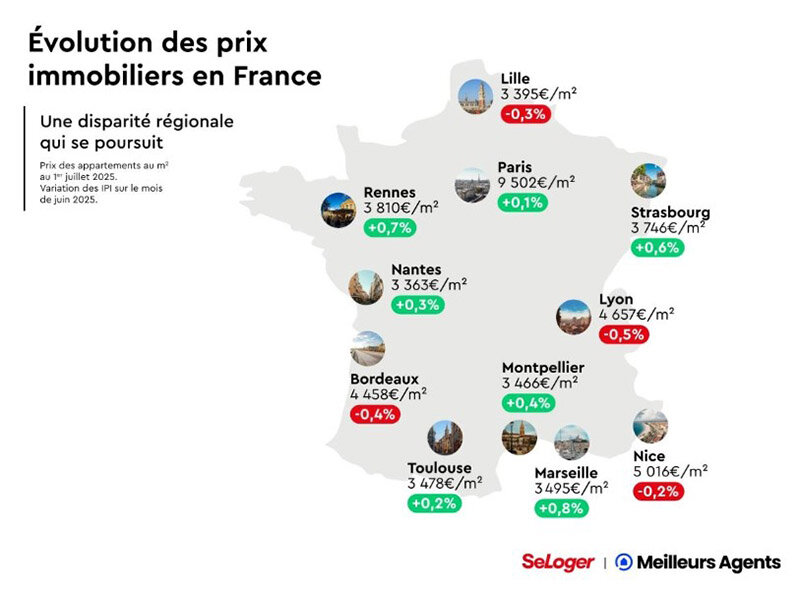

The regional picture remains mixed. Half of the 10 largest metro areas saw price gains, while the rest recorded declines. Marseille (+2%) and Montpellier (+2.1%) led the way. Both cities had already posted strong post-COVID growth — +22% and +17% from Jan 2020 to July 2022. Price corrections between 2022–2025 were relatively mild: −4% and −2%, respectively.

More modest growth occurred in Bordeaux (+0.9%), Toulouse (+0.8%), and Rennes (+0.7%). Prices fell in Nice (−2.9%), Lille (−2.8%), Lyon (−1.6%), Nantes (−1%), and Strasbourg (−0.6%). The sharpest drop in Nice was linked to its luxury housing market, which had remained active during the interest rate hikes.

Despite sluggish price dynamics, affordability improved. Purchasing power increased due to a 1-point drop in mortgage rates and modest price growth. In the top-10 and top-50 cities, buyers could afford roughly 2 additional square meters. In Nantes, a 1.3% price drop allowed for 4 extra sqm — from 57 to 61 sqm. In Montpellier, despite a 2.2% price increase, affordability remained stable at 44 sqm.

Interest rates remain a key market driver. From late 2023 to early 2024, rates fell from 4.5% to 3.2%, but this trend slowed in spring. In April, rates edged up and then stabilized at around 3.35%, according to broker Pretto. This contributed to the lack of strong price movement, particularly in credit-sensitive regions.

Rate trajectories remain uncertain. ECB policy and government bond (OAT) yields have contradictory effects. In June, the ECB cut its key rate, but President Christine Lagarde warned that no further cuts should be expected in 2025. At the same time, French OAT yields rose from 2.8% to 3.2%, dampening the ECB's easing effects.

Domestic uncertainties — political tensions, budget challenges, changes in subsidies — also weigh on sentiment. New tax rules for short-term rentals and global tensions further complicate buying decisions and increase buyer caution.

According to Groupe BPCE, France’s housing market will recover slowly in H2 2025. Transactions are expected to grow by 3.3%, reaching 959,000 deals — 85% of which will be in the resale market. Activity in this segment will remain modest due to household uncertainty and possible regional tax hikes. However, government support in the 2025 budget could stimulate new construction.

First-time buyers remain key players. In 2024, they accounted for 41% of new mortgages. In 2025, 71% plan to use the PTZ (interest-free loan) scheme. These buyers are typically 35 years old, often based in the Paris region, but looking for homes in smaller towns and mid-sized cities.

Mortgage lending is expected to accelerate in H2. The share of loan-financed purchases may reach the long-term average of 80%. Home prices will likely grow just above 1%, with wide regional and property-type variations.