US Real Estate Hit by Inflation: Steepest Decline in 15 Years

Photo: Unsplash

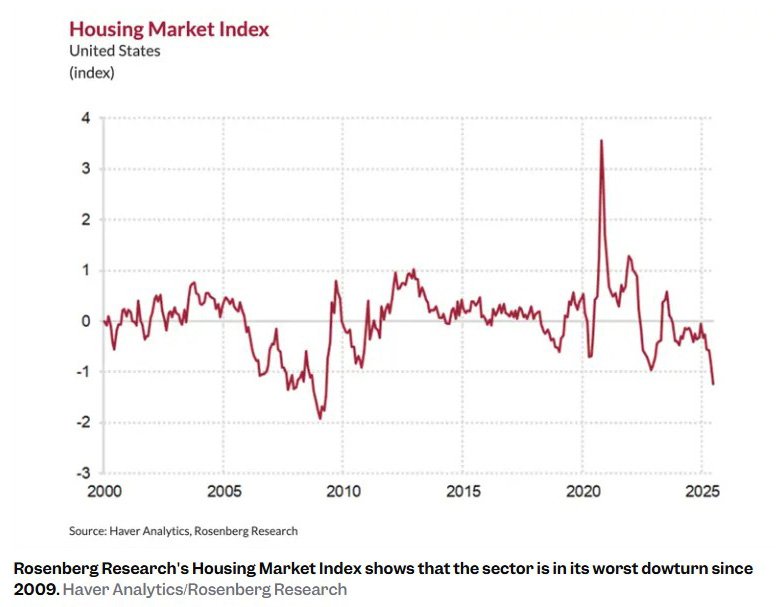

The U.S. housing market is experiencing its sharpest downturn since 2009, reports Business Insider, citing Rosenberg Research data. Construction, sales, and rentals are dropping at double-digit rates, and the sector is emerging as the main driver of a sharp disinflationary shift in the country.

Rosenberg Research tracks the decline via its proprietary Housing Market Activity Index, which combines 11 indicators — almost all of which fell over the past six months, notes senior economist Robert Embry.

New housing starts plunged 23.9%

New home sales declined 23.7%

Existing home sales dropped more than 16%

Rental contracts fell 14.2% over two quarters

Buyer interest slipped by seven points, a key factor in the index.

According to Reuters, U.S. Commerce Department data show that July 2025 home sales fell 8.2% year-over-year to 652,000 units and 0.6% month-on-month. Regionally, sales slumped in the Midwest (–6.6%) and South (–3.5%), remained flat in the Northeast, and rose 11.7% in the West.

The Case-Shiller Index covering the 20 largest metros still shows slight growth of under 1% in six months. Analysts warn this is temporary: with demand falling, sellers will be forced to discount, pushing prices into negative territory soon.

Median new home prices dropped 5.9% year-on-year in July to $403,800, the lowest in eight months. Most sales involved homes priced under $499,000. Inventory remains excessive: 499,000 unsold homes were listed in July, requiring 9.2 months to clear at the current pace. Completed new-build stock hit a 16-year high, dampening appetite for new construction.

Freddie Mac data show 30-year mortgage rates fell from 7.04% in January to 6.58% in July. Yet annual wage growth slipped from 4.3% in early 2024 to 3.9% by mid-2025. Even with lower rates, affordability remains constrained as loan-servicing costs outpace income growth.

Economists expect no quick recovery. Daniel Fielhaber (Nationwide) highlights affordability problems and slowing job growth as drags on housing. Nancy Vanden Houten (Oxford Economics) points to excess inventory of completed homes as limiting new projects and future price gains.

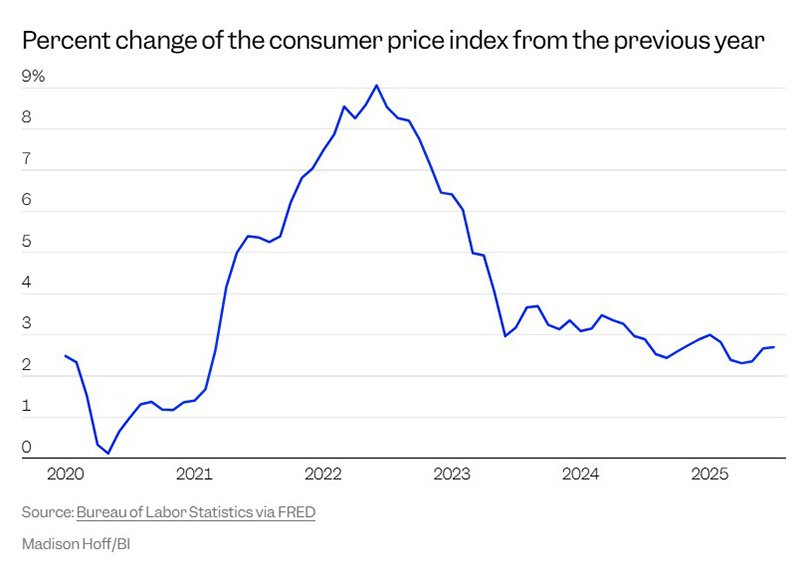

Embry of Rosenberg Research believes falling rents will have a disinflationary effect with a one-year lag, potentially slowing U.S. CPI from 2.7% to 1.2–1.8% by mid-2026, depending on tariff shocks.

David Rosenberg, chief economist and founder of Rosenberg Research, warns of not just disinflation but a possible deflationary shock. Risks include tighter immigration policies and population aging, which could weigh on consumption.

Jay Hatfield (Infrastructure Capital Advisors) adds that double-digit declines in both money supply and oil prices signal deflationary risks. Pantheon Macroeconomics analysts estimate falling housing costs could offset half the inflationary impact of tariffs.

Wall Street, however, remains largely unconcerned about deflation, focusing instead on inflationary pressures from tariffs as the key risk.