Housing in the Netherlands: Rising Prices, Shortages, and New Rental Rules

Photo: Unsplash

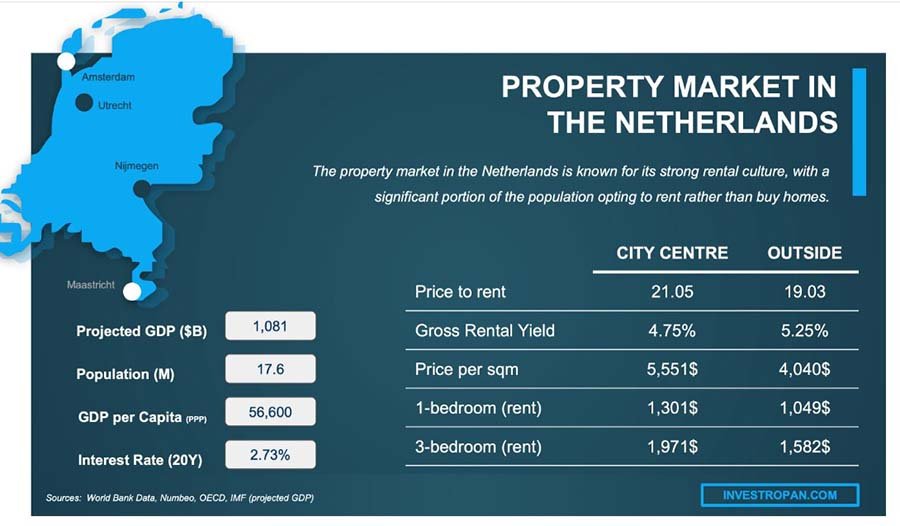

The Dutch housing market in 2024–2025 is accelerating in both sale prices and rents. Key drivers are a chronic supply shortage, infrastructure and planning constraints, and changes in rental regulation, notes Global Property Guide.

Price and Transaction Dynamics

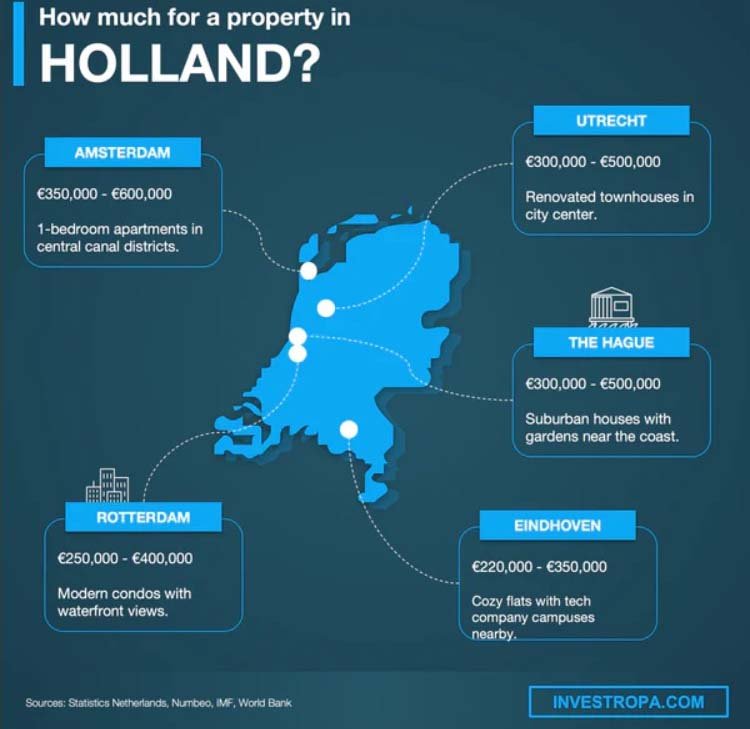

The market rebounded quickly after the 2023 dip, when the existing-home price index fell by 2.91%. In 2024, prices rose 8.77% (5.24% in real terms), and by April 2025 growth had accelerated to 10.23%. According to CBS, the average selling price in Q1 2025 reached €470,028, up almost 9% from the same period in 2024. Amsterdam remains the priciest at €632,733, while Rotterdam is the most affordable at €406,180. Growth was uneven: Utrecht saw a 14.19% y/y increase, The Hague 10.75%, and Amsterdam a more modest 6.36%. ABN AMRO and Rabobank expect nationwide prices to rise 7–9% in 2025, with slower gains in the largest cities due to investor sell-offs of rental stock.

In 2024, transactions increased 13.19% to 206,460 units, and by Q1 2025 they were up another 15.82%, the best result in four years. Activity is rising fastest in major cities, where investors are offloading assets in response to tax changes and the “affordable rent” law.

The rental market shifted sharply after the law took effect in July 2024. It brought an additional 300,000 dwellings under regulation, triggering a mass exit by private landlords. Pararius reports that in Q1 2025 such listings fell by 35.5%, while responses per listing jumped 47%. Rents are climbing—especially at the lower end: Rotterdam rose 8% y/y, The Hague 6.4%, Utrecht 4%. The national average is €19.64 per sq m per month; Amsterdam is €27.

Supply remains the weak link. In 2024, 69,129 new homes were completed—6.12% fewer than a year earlier. Permits totaled 68,112, but in Q1 2025 their number fell by 22%. The shortage is estimated at around 400,000 homes. Experts consider the government’s target of 100,000 new homes per year unattainable due to rising construction costs and infrastructure bottlenecks.

Demand is also being lifted by the ECB’s key rate, which declined to 3.46% in 2024–2025. New mortgage originations rose 24.2% to €100.1 billion, and the total market size exceeded €851 billion.

The macro backdrop is mixed: inflation fell to 3.2% in 2024 but rose again to 4.1% in April 2025. The European Commission projects GDP growth of 1.3% in 2025, with unemployment rising from 3.6% to 3.9%. Even so, wage growth of more than 6% is improving purchasing power and supporting the market.

Outlook: New Growth Centers and Trends

Research by Investropa highlights a range of forces set to shape the Dutch housing market. One is migration to rural and suburban areas. The thesis rests on the fact that 65% of Dutch residents worked remotely in 2022, moving out of expensive municipalities. In 2023–2024 demand for homes outside major cities rose by 80%.

In 2025, interest is expected to shift toward northern provinces such as Groningen, where housing is cheaper and yields are higher. Suburbs of Utrecht and The Hague should also strengthen as families seek more space and infrastructure. Yields here may reach 7–8% per annum, contrasting with Amsterdam, where returns are declining.

The rental market will keep expanding due to constrained supply and urban population growth. Analysts note last year’s rent increases of almost 6% in Rotterdam and Utrecht. At the same time, the premium rental segment could cool. Interest in historic canal houses is likely to fade because of high maintenance costs and low energy efficiency. Even so, prime property in Amsterdam and The Hague should remain attractive: the growing number of affluent buyers and limited land will keep pushing prices up.

The shift to “green,” energy-efficient projects will accelerate: the state is allocating hundreds of millions of euros to support sustainable construction, and developers are actively implementing such systems. In 2025, the “smart home” will become a key sales argument; by 2029 it should be standard in most new apartments.

Social factors matter, too. One-person households—already around 19%—will continue to grow, driving demand for studios and compact units. An aging population increases the need for barrier-free, senior-friendly housing close to healthcare and retail. Eindhoven is expected to turn into a local hot spot thanks to the rapid growth of the High Tech Campus, drawing more specialists and boosting demand for rentals and purchases.

Подсказки: Netherlands, housing market, rental market, Amsterdam, Rotterdam, Utrecht, The Hague, Groningen, Eindhoven, CBS, Pararius, rent regulation, supply shortage, building permits, ECB, mortgages, inflation, GDP, unemployment, sustainability, smart home, e