Real Estate / Investments / Analytics / Research / Greece / Germany / Кипр / Bulgaria / Romania / Ireland / Hungary / Slovakia / Latvia / Estonia / Litva / Real Estate Greece / Real Estate Germany / Real Estate Cyprus / Real Estate Bulgaria / Real Estate Romania / Real estate Ireland / Real Estate Hungary / Real Estate Slovakia / Real Estate Latvia / Real Estate Estonia / Real Estate Litva 01.12.2025

How the EU Real Estate Market Has Changed in 14 Years: Housing Prices, Costs, and Investments

Photo: pro

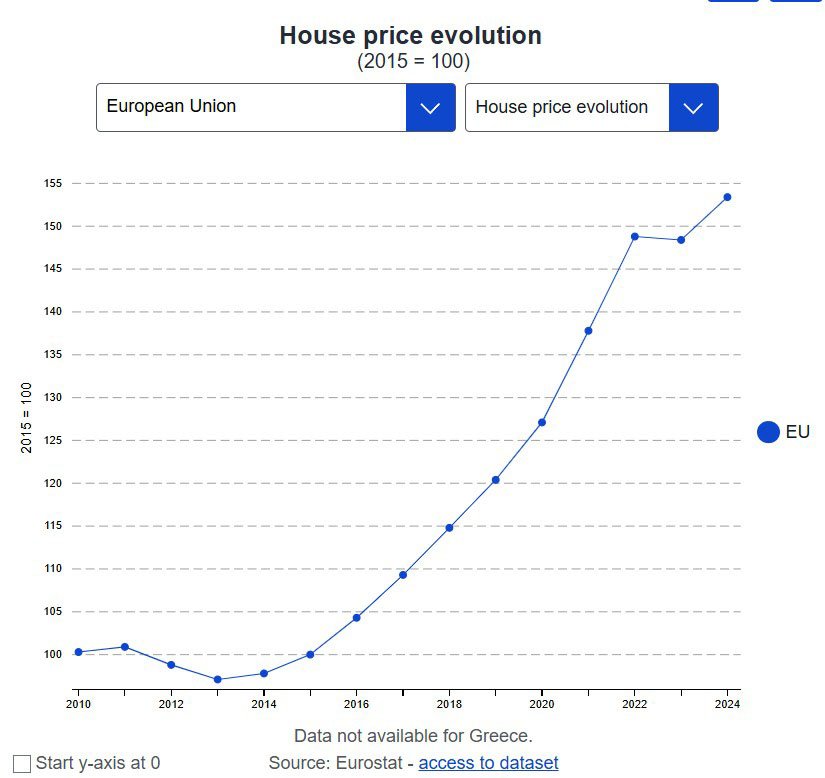

Housing prices in the European Union increased by 53% over 14 years, while construction costs rose by 56%, surpassing the inflation level of 39%. Greece led in the share of spending on housing, Germany stood out with the highest proportion of renters, and Romania recorded the highest rate of overcrowded households, Eurostat reports in an overview based on data from 2010–2024.

Rent or Buy?

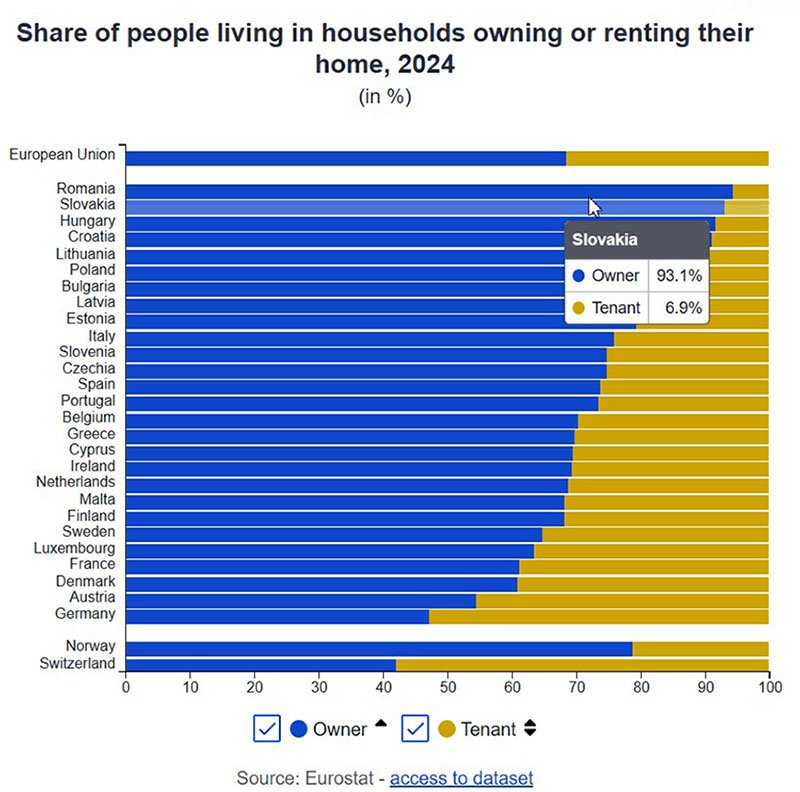

Most Europeans owned their homes in 2024 — 68%, while renters accounted for 32%. Differences between countries were significant. For example, in Romania, over 94% of the population owned their homes. High rates were also recorded in Slovakia (93%), Hungary (92%), and Croatia (91%). In Lithuania, ownership reached 87.4%, in Poland — 87.1%, and in Bulgaria — 86%.

The TOP-10 also included Latvia (83.7%), Estonia (79.3%), and Norway (78.8%), which is not part of the EU but belongs to the EEA — its data and Switzerland’s are also included in the report. Germany had the highest share of renters — 52.8%, followed by Austria (45.5%), Denmark (39%), and France (38.8%).

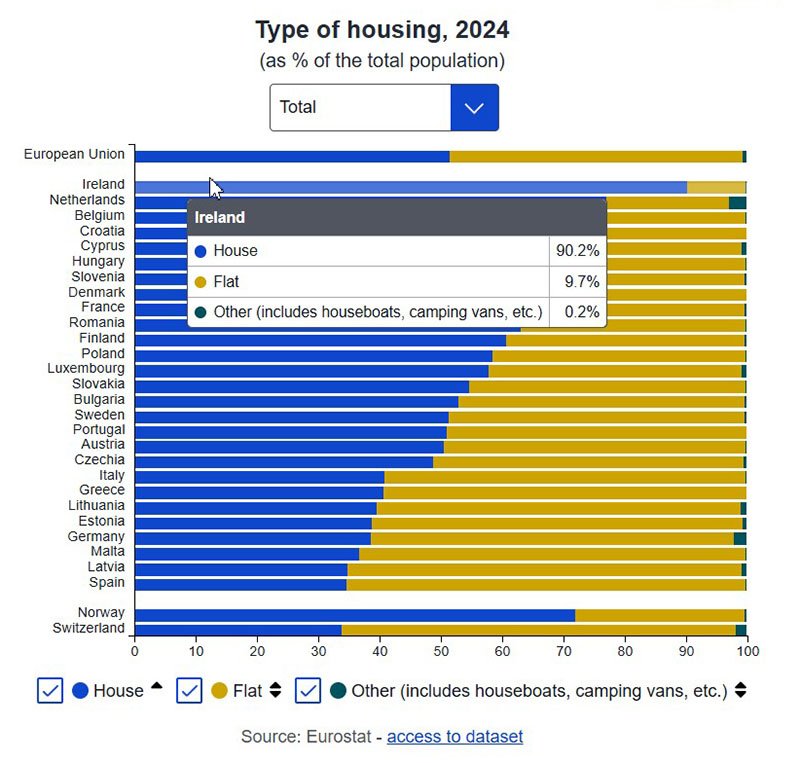

Half of EU citizens (51%) lived in houses, 48% — in apartments, and 1% — in other types of housing, including caravans and floating structures. In cities, 73% of residents lived in apartments, while in rural areas this format accounted for only 16%.

Differences between countries were also substantial.

Ireland led in the share of houses — 90%. In the Netherlands and Belgium, this figure reached 77%, in Croatia — 76%. Cyprus had 74%, and Romania — more than 73%. Spain ranked first in the share of apartments — 65%, followed by Latvia — 64% and Malta — 63%.

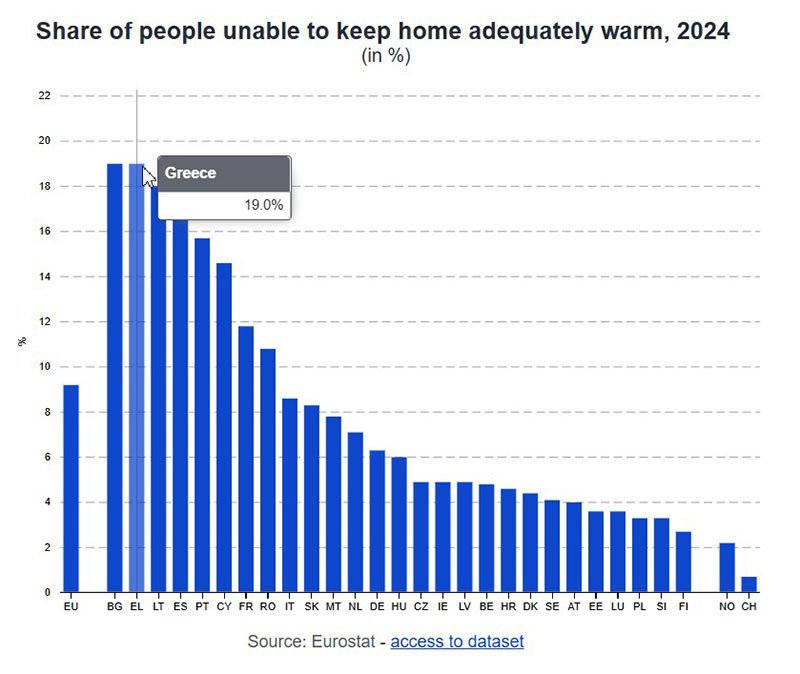

Who Gets Cold in Winter

Around 9% of the EU population could not afford adequate home heating. The highest shares were recorded in Bulgaria and Greece — 19% each, followed by Lithuania and Spain — 18% each. The lowest rates were in Finland, Slovenia, and Poland (under 3%).

The average number of rooms per person in the EU was 1.7. The most spacious homes were in Malta — 2.2, and in Belgium, Luxembourg, and the Netherlands — 2.1 each. The lowest indicators were found in Romania and Slovakia — 1.1 each, and in Poland and Latvia — 1.2. On average, 2.3 people lived under one roof. In Slovakia — 3.1, in Poland — 2.9, and in Finland and Lithuania — 1.9.

In 2024, around 17% of EU citizens lived in overcrowded homes — lacking enough rooms for their household composition. The highest rates were recorded in Romania (41%), Latvia (39%), and Bulgaria (34%). At the opposite end were Cyprus (2%), Malta (4%), and the Netherlands (5%).

How Much Housing Costs

Housing prices in the EU rose by 53% between 2010 and 2024. Almost all countries showed positive dynamics, with the only exceptions being Italy and Cyprus. The strongest growth was recorded in Hungary (+231%), Estonia (+228%), and Lithuania (+179%).

Rental prices increased by 25% over 14 years. The largest rises were seen in Estonia (+208%), Lithuania (+177%), Ireland (+108%), and Hungary (+107%). Only in Greece did rental costs fall — by 16%.

[

url=https://internationalinvestment.biz/real-estate/6472-skolko-let-nuzhno-rabotat-chtoby-kupit-kvartiru-v-evrope-dannye-deloitte.html]How Many Years One Must Work to Buy an Apartment in Europe: Deloitte[/url]

Share of Household Spending

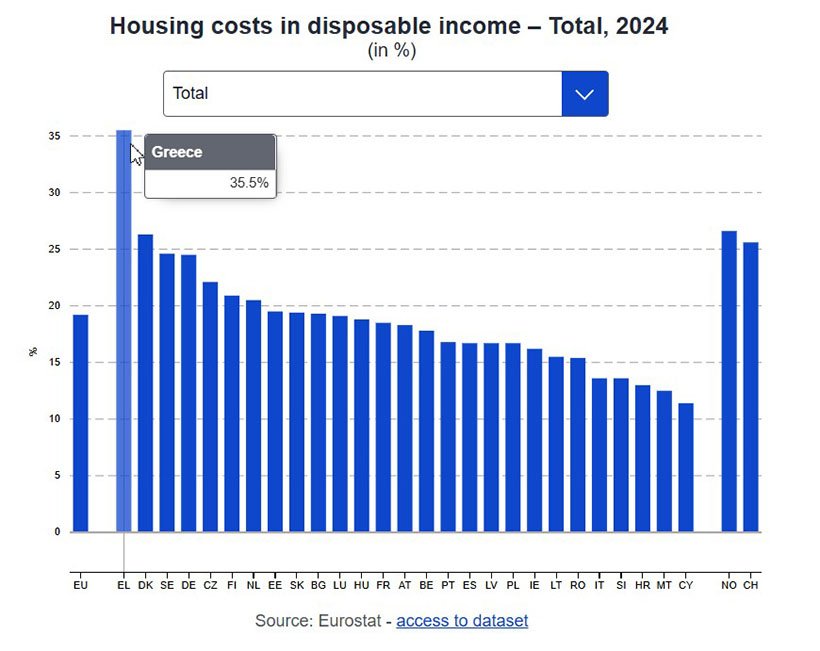

On average, about 19% of a family’s income in 2024 went toward housing, though this figure varied greatly. In Greece it reached 35.5%, in Norway — 26.6%, in Denmark — 26.3%, and in Switzerland — 25.6%. High burdens were also recorded in Sweden (24.6%) and Germany (24.5%). The lowest shares were seen in Cyprus — 11%, followed by Malta (12.5%), Croatia (13%), Slovenia and Italy (13.6%).

In 2024, the highest spending on housing and utilities relative to the EU average was recorded in Ireland (+87%), Denmark (+86%), and Luxembourg (+78%). The lowest — in Bulgaria (–38%), Croatia (–44%), and Poland (–49%).

More than 40% of disposable income was spent on housing by nearly 10% of EU residents in cities and around 6% in rural areas. Low-income families were especially vulnerable: those earning below 60% of the national median income spent an average of 37% on housing, while higher-income groups spent around 16%.

Construction and Investments

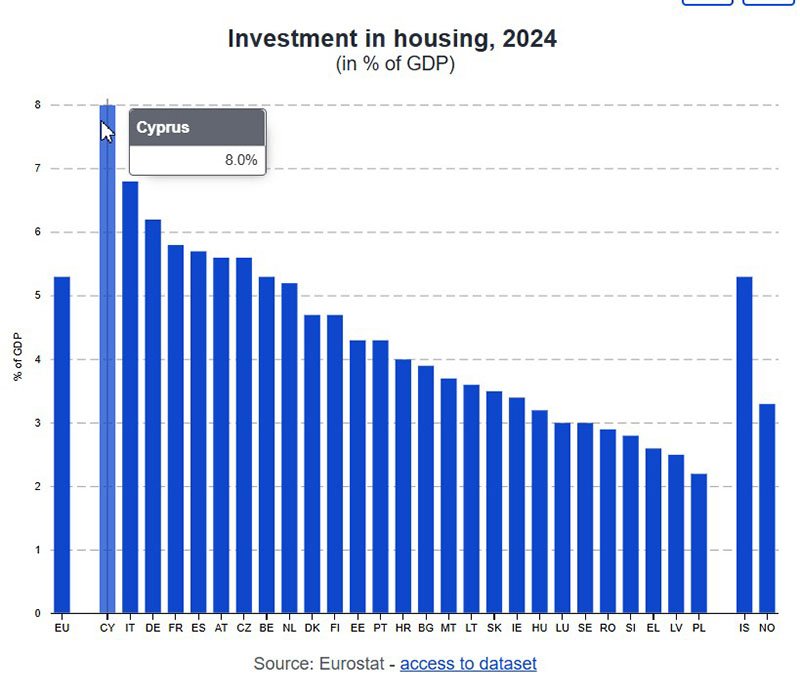

Between 2010 and 2024, construction costs rose by 56%, while the consumer price index increased by 39%. The strongest growth was recorded in Hungary (+172%), Bulgaria (+145%), and Romania (+137%). In Greece, construction costs increased by only 6%. In 2024, 5.3% of EU GDP was invested in residential construction. The highest shares were recorded in Cyprus — 8%, Italy — 6.8%, and Germany — 6.2%. The lowest — in Poland (2.2%), Latvia (2.5%), and Greece (2.6%).

Conclusion

Eurostat data shows that the European housing market is developing unevenly: expenses are rising faster than incomes, construction is becoming more expensive, and the gap between countries is widening. In such conditions, investment decisions require particular caution. According to International Investment, the high transparency of European markets comes with significant accompanying costs — taxes, fees, energy-efficiency requirements, and lengthy approval procedures.

The European Central Bank points to persistent financial risks, pressure on national budgets, and weak growth dynamics. Therefore, investors must consider not only conditions in specific national markets but also the broader context, which increasingly determines the resilience of investments in European real estate.