read also

Tourism in China 2024: A Disappointing Start and a Record-Breaking Finish

Photo: Pxhere.com

In 2024, China took an unprecedented step, opening its doors to 1.9 billion potential tourists by implementing widespread visa waivers. However, as reported by Bloomberg, the anticipated influx of foreign visitors failed to materialize. From January to September, the number of arrivals was only a shadow of Beijing’s ambitions.

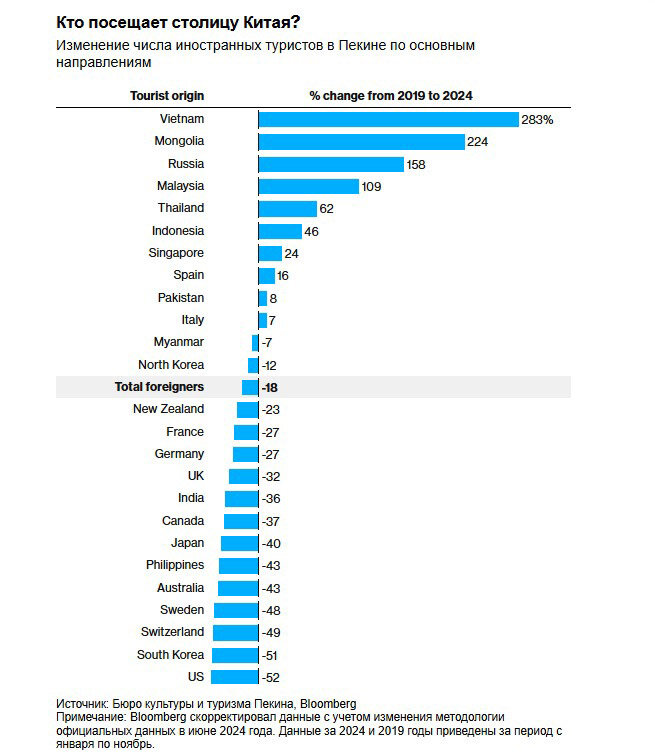

During the first nine months of 2024, fewer than 23 million foreign tourists visited China. That’s double the disastrous figure from 2023 but only 63% of the 2019 level, and significantly below expectations following the radical easing of entry requirements. Despite expanding visa-free access to citizens from 38 countries and easing transit rules for travelers from 54 nations, most visitors came from Asian countries and less-developed markets. Tourists from the US and Western Europe remained hesitant to visit China. The reasons include strained relations between Beijing and the West, reduced international flights, and a tarnished national image amid geopolitical tensions.

Senior analyst at Bloomberg Intelligence Tim Backus noted that the overall perception of China as a tourism and business destination has suffered due to Beijing’s policies and the lingering effects of the pandemic. He said the visa-free policy helps slightly but “doesn’t change the trend of tourists turning away from China.”

Challenges for China’s tourism sector are compounded by the slow recovery of international aviation. In 2024, total international flight volumes reached only 74% of 2019 levels, with foreign airlines restoring just 58% of their routes. European carriers have had to avoid Russian airspace, increasing flight times and fuel costs, making many routes unprofitable. Chinese airlines swiftly filled some gaps, but this wasn’t enough to bring back Western tourist flows.

Data from ForwardKeys shows ticket bookings from Malaysia to China in 2024 rose 69% compared to 2019, and from Thailand by 30%. In contrast, key European markets granted visa-free access saw sharp declines: bookings from Germany and France fell 38%, and from Italy 29%. These figures illustrate that visa waivers alone cannot offset cooling relations with Western countries.

Financial analyst Alexander Wado from Tokyo, who visited China in 2024, said he was impressed by the country’s modernity but was disappointed by everyday experiences—like people cutting lines. “If you grew up in Europe, media portrayals of China often create a negative perception,” he said. His personal experience reflects a broader trend: even those who do visit face cultural and language barriers that discourage return trips.

Business travel has also declined, dealing another blow to China’s tourism industry. According to Bloomberg calculations based on ForwardKeys data, business trips to China in 2024 recovered only to 52% of 2019 levels, while leisure travel reached 79%. Previously, companies frequently organized business trips to China, but now many hold meetings in Tokyo or Seoul instead, and business travelers prefer relaxing afterward in Bali or other popular destinations rather than in China.

Significant obstacles remain for foreigners, including technological barriers: even in major cities, English is limited, and the national cashless payment system requires installing Chinese apps and basic Mandarin knowledge. Moreover, China’s internet is heavily censored: without a VPN, accessing Google, Instagram, and many other familiar sites is impossible. For many potential travelers, these factors become insurmountable hurdles.

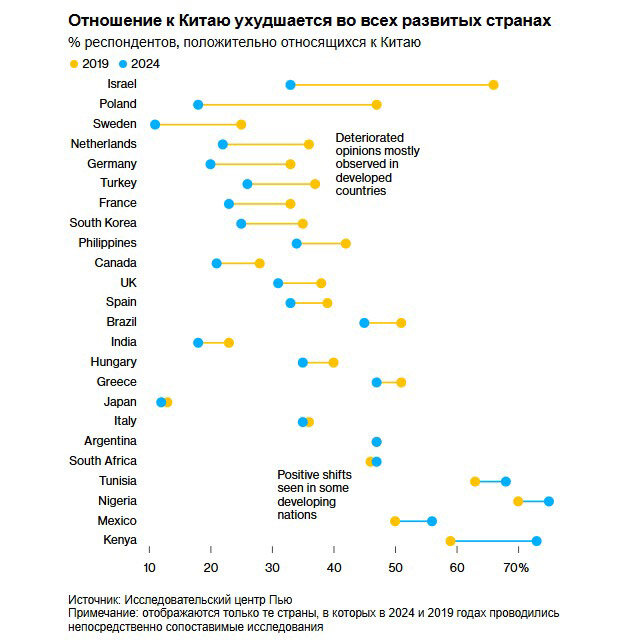

Concerns about safety and geopolitical conflicts also play a major role. According to a Pew Research Center survey, the share of citizens from developed countries who view China’s economic influence positively has significantly declined since 2019. Interest in visiting China has dropped sharply in Japan amid attacks on its citizens. The flow from the US and Canada has nearly dried up due to rising anti-China sentiment.

In 2019, foreign visitors spent $132 billion in China. In the first three quarters of 2024, that figure fell by 26% to just $98 billion. Leading tour operators specializing in Western tourists have also seen declining interest. For instance, Imperial Tours, founded in 1999 and known for luxury China tours, has been forced to diversify its business into destinations like South Korea, as its American client base has dwindled.

In April 2025, the World Travel & Tourism Council (WTTC) published a report summarizing the results of 2024. It noted that the tourism industry contributed nearly 12 trillion yuan ($1.68 trillion) to China’s economy—a 23% increase over 2023. International tourist spending reached a record 1 trillion yuan ($140 billion), rising 66% year-on-year and exceeding 2019 levels by 9.6%. Domestic tourism also showed impressive results, accounting for 85% of all spending and growing 14.4% compared to 2023.

WTTC analysts forecast record-breaking numbers for 2025. They predict that the travel and tourism sector’s contribution to the economy will reach 13.7 trillion yuan ($1.98 trillion), 10.3% higher than pre-pandemic levels. Tourism already supports more than 83 million jobs, with 1.3 million new positions created in the last year alone, underscoring its importance for employment in the country.

The sector still lags about 1 million jobs behind pre-pandemic levels, but growth rates suggest full recovery in the coming years. According to WTTC estimates, domestic travel spending in 2025 is expected to reach 7 trillion yuan ($980 billion), while international tourists are forecast to spend $33 billion more than in 2019, exceeding pre-COVID figures by 13%.

WTTC projects that by 2035, China’s tourism sector could grow to 27 trillion yuan ($3.78 trillion), accounting for up to 14% of the national GDP. The industry could employ as many as 100 million people, creating approximately 20 million new jobs over the next decade. Domestic spending is projected to approach 14 trillion yuan ($1.96 trillion) by 2035, while international spending may reach 1.5 trillion yuan ($210 billion).

The organization emphasizes that China’s success has been driven by infrastructure investments, visa facilitation measures, and massive digital service development in tourism. However, challenges remain, including tense trade relations with the US. The overall economic outlook remains complex: China faces deflation, slowing consumer spending, and real estate market instability. These factors could constrain tourism growth despite WTTC’s optimistic forecasts. Experts caution that sustainable recovery will require not only boosting domestic demand and easing entry rules but also reducing geopolitical tensions, especially with the US and key Western markets.

See also:

Chinese, Moroccans, and Russians Lead Visa Applications to Spain in 2024

Netherlands Issued Most Visas to Citizens of Turkey, India, and China in 2024

Germany Issued 1.29 Million Schengen Visas in 2024: China and Turkey Top the List, Spain Ahead

Switzerland: Russian and Chinese Citizens Lead in Golden Visa Acquisitions

China Increases Housing Market Support with $1.5 Trillion Fund