Tourism & hospitality / Ratings / Research / Analytics / Reviews / France / Spain / Japan / USA / Netherlands / Italy / Thailand / United Kingdom / China / Turkey / United Arab Emirates / Georgia 05.12.2025

Top Tourist Cities of 2025: New Euromonitor Ranking

Photo: Unsplash

The ranking of the world’s top tourist destinations for 2025 was published by Euromonitor International together with Lighthouse. The Top 100 City Destinations Index highlights the accelerated recovery of international travel, the strengthening of European cities, and rising interest in the Asia-Pacific region. Paris, Madrid and Tokyo lead in overall attractiveness.

Global Scale

The number of international visits to the top 100 cities reached 702 million people, an 8% increase compared to last year. Together, these destinations account for 46% of global inbound tourism and continue to outperform the global average growth rate of about 4%. The Asia-Pacific region made the largest contribution to expanding tourist flows, posting a 10% increase. It is followed by the Middle East and Africa, which recorded a 7% rise, indicating ongoing recovery and a growing regional role in global tourism.

Analysts assessed cities across six parameters: tourism attractiveness, infrastructure, sustainability, business activity, safety, and quality of governance. This approach reflects not only the volume of international arrivals but also the level of service, urban environment quality and the ability of destinations to adapt to shifting demand.

TOP 10 Most Attractive Destinations

Paris holds first place for the fifth consecutive year, receiving more than 18 million international tourists. The reopening of Notre-Dame after extensive restoration significantly boosted interest. Visitor numbers were also influenced by an influx of football fans who came to see the Champions League trophy after Paris Saint-Germain (PSG) claimed the title for the first time.

Madrid retained second place, reinforcing its status as one of Europe’s most technologically advanced and eco-friendly cities. Its advantages include sustainable mobility solutions, a modernised transport system and improved public spaces.

Tokyo ranks third — the largest tourism hub in Asia. In 2025, the city enhanced its appeal through major sporting and cultural events, renewed urban districts and expanded services for international visitors. Rome, in fourth place, continues to grow thanks to the active expansion of its hotel sector — including new luxury properties — and ongoing airport development improving city accessibility.

Milan rounds out the top five, strengthening its role as a major business and cultural centre. It stands out for its strong fashion and design industries and an advanced transport network. The only American city in the top ten is New York — sixth place. Amsterdam ranks seventh, showing steady growth in attractiveness and urban infrastructure.

Barcelona holds eighth place, climbing two positions thanks to improvements in the urban environment and new sustainability initiatives. Singapore ranks ninth, maintaining its reputation as one of the world’s most technologically advanced and efficiently organised destinations. The top ten also includes Seoul, which rose two positions amid growing international tourism and modernisation of its urban infrastructure.

Analysts additionally note London’s decline: the city dropped from 13th to 18th place. Despite strong performance in tourism infrastructure, London lagged in sustainability, safety and hospitality policy, resulting in a lower composite score.

International Travel: Key Indicators

Bangkok leads all destinations in 2025 for international arrivals, having received 30.3 million tourists. This comes despite a 7% decline due to currency factors, safety concerns and intensifying regional competition. The city maintains its position as a global tourism hub thanks to large-scale infrastructure, an extensive event calendar and digital services for travellers.

Hong Kong ranks second with 23.2 million arrivals (+6%), supported by the opening of Kai Tak Stadium, airport terminal expansion and new events attracting global audiences. London is third with 22.7 million arrivals (+4%), maintaining its role as one of the world’s largest aviation and tourism hubs. Despite dropping in the attractiveness ranking, the UK capital remains strong in international traffic.

Macao takes fourth place with 20.4 million visits and a 14% increase, driven by updated entry rules for Zhuhai and Hengqin residents and rapid growth in day trips. Next is Istanbul with 19.7 million arrivals (+6%), one of the key transit nodes of Eurasia, followed by Dubai with 19.5 million tourists (+7%), supported by active digitalisation of visitor services and expanding air connections.

Mecca (18.7 million) and Antalya (18.6 million) hold seventh and eighth places, reflecting strong, stable demand for religious tourism and beach holidays respectively. Paris ranks ninth with 18.3 million arrivals. Completing the top ten is Kuala Lumpur with 17.3 million international visits, strengthening its role as a major Southeast Asian destination.

Tourism Performance and Tech Drivers

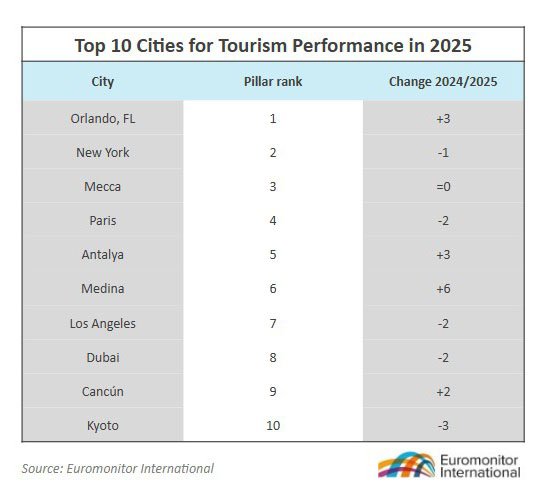

Orlando leads in overall tourism performance, surpassing New York. Growth was fuelled by strong domestic travel, the opening of the Epic Universe theme park at Universal Orlando Resort, upgrades at SeaWorld and Disney World, and hosting FIFA Club World Cup matches.

Dubai maintains dominance in international tourism flows, focusing on marketing initiatives and digital services that enhance visitor experience. Medina shows the fastest growth — driven by increased hotel occupancy, expanding air travel and rising airport traffic. Sustainability leaders include Madrid, Palma de Mallorca, Valencia, Seville, Helsinki and Oslo — cities consistently implementing long-term environmental practices.

The report also highlights the growing role of artificial intelligence: New York is developing smart city platforms, Bangkok is rolling out digital arrival cards, and Abu Dhabi is expanding AI-based services for visitors.

Experts also note a shift toward a “value over volume” model. Instead of maximising visitor numbers, cities increasingly prioritise travellers who stay longer, spend more and engage responsibly with local communities — reducing pressure on infrastructure and residents.

Changes in travel regulations also influence global mobility: the UK and US have raised entry fees, the EU is preparing to launch ETIAS, and Japan is considering higher visa fees and an electronic travel authorization system by 2028. These measures are shaping a new landscape of travel accessibility and may redirect tourist flows over the long term.

Infrastructure and New Investment Projects

Infrastructure investment remains one of the key drivers of sustainable tourism growth. Alongside Rome, luxury-hotel development continues in Tokyo and Paris, where new properties are being built and airports expanded.

High development activity is observed in Batumi, which for several consecutive years has won the title of “Europe’s Leading Tourist Destination” at the World Travel Awards. In 2025, the city confirmed its status once again. The luxury segment is especially dynamic in the resort district of Gonio, one of the most prestigious areas of Georgia. Here construction is underway on Eastern Europe’s largest hotel complex — Wyndham Grand Residences Batumi Gonio — along with a major new development planned by a leading UAE developer.

Experts link this growth to visa liberalisation, infrastructure expansion and digitalisation. “Cities are entering a new phase of development that unites investment, innovation and large-scale digital transformation. The leaders are those destinations that can adapt and provide a personalised experience,” says Nadezhda Popova, Global Head of Loyalty at Euromonitor International.

Conclusion

Experts at International Investment emphasize that global tourism in 2025 has fully recovered from the pandemic and entered a stable growth trajectory. International travel has not only returned to pre-crisis levels but exceeded them, while major cities once again generate nearly half of all global inbound flows. Increased mobility, eased visa policies, expanded air routes and major infrastructure projects have all contributed to this recovery.

As the industry normalises, travel patterns are shifting: tourists increasingly choose destinations offering high-quality service, safety, modern infrastructure and predictable comfort. This is driving demand for the premium segment and international hotel brands that guarantee consistent standards and a familiar guest experience.

The luxury market is showing some of the strongest growth. Branded properties are at the centre of this trend: they provide higher occupancy, stronger average rates and lower operational risks. Investors note that such assets offer structural advantages over independent properties and are shaping a new architecture of tourism supply in major global cities and emerging resort regions.