read also

Record Tourism Revenues in Georgia: 2025 Results

Photo: 1tv.ge

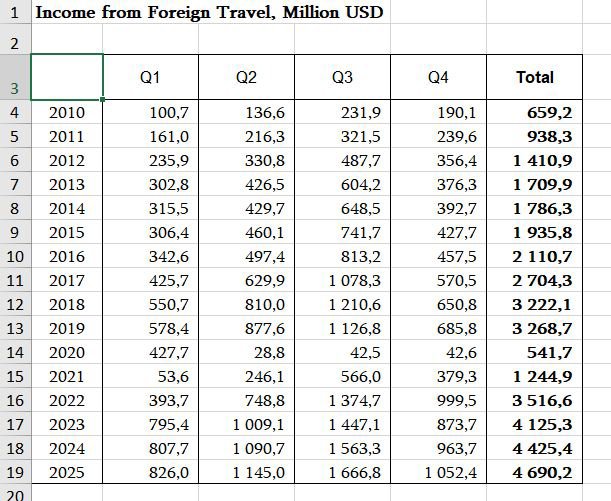

International tourism revenues in Georgia exceeded $4.69 billion in 2025. This is 6% higher than in 2024, note analysts at the National Bank of Georgia. The sector has been showing steady growth for several consecutive years and has reached a new historical high, firmly establishing itself among the key sources of foreign currency inflows for the economy. The dynamics reflect the exit from the post-pandemic crisis and a shift toward a more mature demand model.

Key trends

The largest contribution traditionally came from the third quarter — $1.66 billion, a record result for this period. In April–June, revenues amounted to about $1.1 billion, in October–December — $1.05 billion. January–March ranked fourth with $826 million. At the same time, even the “low” first quarter of 2025 exceeded the same period of all previous years.

In a longer-term perspective, the current level is almost nine times higher than the Covid low of 2020, when revenues fell to $541.7 million. In 2023, the sector already surpassed $4.1 billion, in 2024 — $4.4 billion, and in 2025 consolidated above $4.6 billion.

The National Bank of Georgia also points to a change in the growth structure: while in previous years the main contribution came from the summer season, the second and fourth quarters have now strengthened noticeably. This indicates a gradual decline in seasonality and the formation of a more evenly distributed tourist flow throughout the year, which is considered one of the key signs of market maturity.

Top countries by revenue

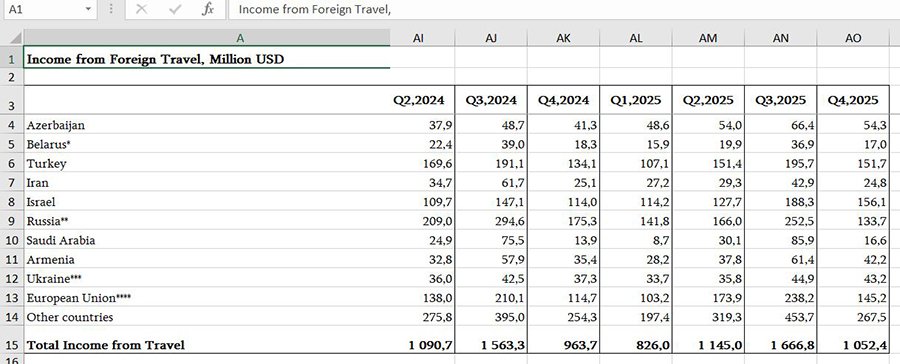

Russia remained the largest source of income — $694 million. The highest inflows were recorded in the third and second quarters — $252.5 million and $166 million, respectively. This was followed by Turkey ($605.9 million), where the strongest result was seen in October–December. Israel ranked third, showing a sharp increase of 34.3% — up to $586.3 million. Azerbaijan accounted for $223.3 million (+32.5%), Armenia — $169.5 million (+7.7%).

The Ministry of Economy and Sustainable Development of Georgia also reports growth in tourism revenues from European Union countries — up 15.6% to $660.4 million, as well as from Saudi Arabia — up 15.8% to $141.3 million. Positive dynamics were also recorded for Ukraine — up 5.9% to $157.6 million. Iran ($124.2 million) and Belarus ($89.7 million) maintain moderate but stable positions.

According to estimates by investment bank Galt & Taggart, Georgia’s tourism revenues could increase to $4.9 billion in 2026. The government forecasts that by 2028 annual revenues from the sector will reach $6.4 billion.

Visits to Georgia

Earlier, the National Tourism Administration reported record figures for visits: the total number increased by 5.9% compared to 2024 and exceeded 7.8 million. The largest number of trips came from Russia — over 1.5 million (+11.1%), Turkey — more than 1.2 million (-6.6%), and Armenia — 948,242, with no significant changes compared to the previous year.

The most pronounced growth was again recorded for Israel and Azerbaijan — up 29.4% to 402,426, and up 33.2% to 292,149, respectively. Strong dynamics were also observed for China — 127,895 visits (+44.4%), and India — 142,476 (+14.6%). In the Persian Gulf segment, the total figure increased by 3.4% to 145,513, with the largest contribution coming from Saudi Arabia, where visits rose by 9.1%.

The regional structure shows the dominance of Europe: the number of trips from these countries reached 6.86 million. Asia-Pacific countries accounted for 512,737 visits, the Middle East — 232,626. The figure for the Americas grew by 11.1% to 78,043.

What this means for investors

Analysts at International Investment note that the growth in revenues and visits indicates Georgia’s tourism sector is entering a phase of structural expansion. For investors, this means the formation of a more stable market with predictable dynamics.

The practical effect is already visible in the acceleration of the hotel business, the development of serviced apartments, resort real estate, and related infrastructure. One of the largest branded luxury projects is being implemented in the resort area of Gonio. The guaranteed yield of the hotel complex Wyndham Grand Batumi Gonio is estimated at 10%, with potential returns of up to 19% and higher. The reduction in seasonality makes investment projects less dependent on summer peaks and increases the potential for year-round occupancy, which is especially important for medium- and long-term strategies.

Подсказки: Georgia, tourism, international tourism, revenues, economy, travel, investments, hotels, 2025