Вusiness / Tourism & hospitality / Analytics / Research / Reviews / News / Georgia / Tourism Georgia 13.01.2026

Groceries and Hotels Lead Non-Cash Spending: The Impact of Foreigners in Georgia

Georgia’s consumer market in 2025 was shaped by external demand and the services sector. Within the structure of non-cash payments, categories linked to tourism and leisure played a prominent role. The activity of foreign visitors became a significant factor in the distribution of spending across economic segments, shifting the balance of consumption and highlighting the dependence of certain industries on international mobility, the TBC Capital study notes.

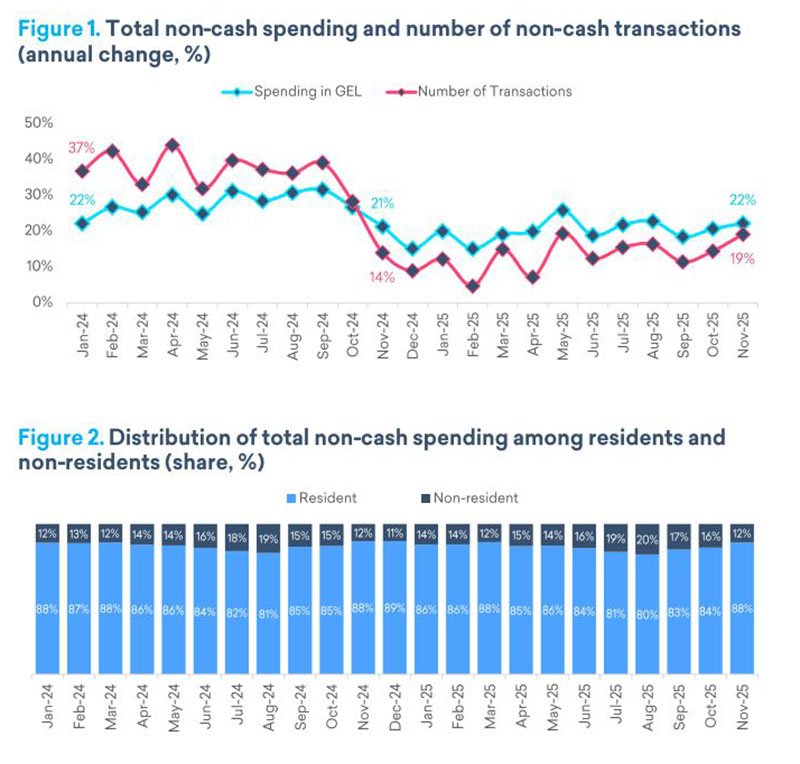

According to the Consumer Spending Tracker, the total volume of non-cash spending through TBC Bank channels increased by 22% year on year, while the number of transactions rose by 19%. Residents accounted for the majority of operations in November, representing 88%. At the same time, heightened activity by foreigners was recorded in several segments.

Grocery purchases

Groceries remained the largest category of non-cash spending in November, accounting for 25% of the total payment turnover through TBC Bank channels. On a yearly basis, this segment expanded by 23%, with the value of a single transaction at ₾17. The trend unfolded amid food and non-alcoholic beverage inflation of 10%, indicating growth in physical consumption volumes rather than price effects alone.

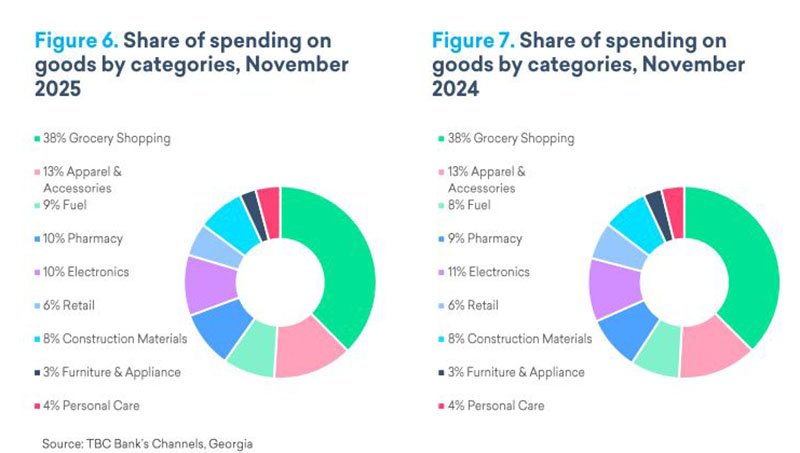

Overall, goods accounted for 66% of total non-cash turnover, while services made up 34%. Within the goods segment, groceries dominated, with their share reaching 38% of all goods-related spending, underscoring the central role of basic consumption in the demand structure.

Hotel and restaurant segments

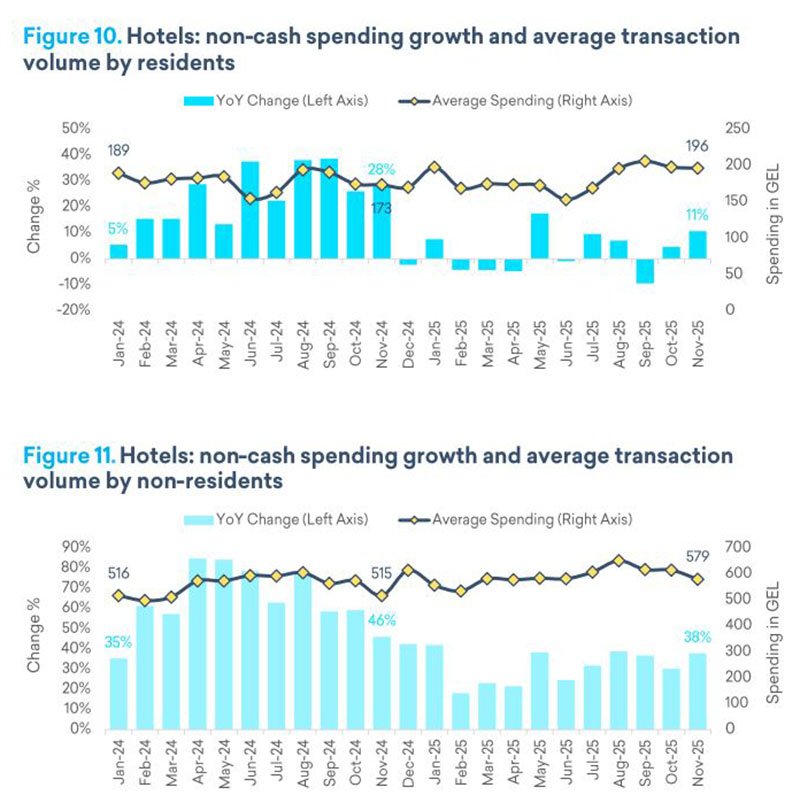

In the hotel sector, the total volume of non-cash payments increased by 32%, with the value of a single transaction at ₾425. Non-residents accounted for the bulk of turnover in November 2025—81%—with the amount per transaction for this group reaching ₾579. Payments by residents rose by 11%, with a ticket size of ₾196.

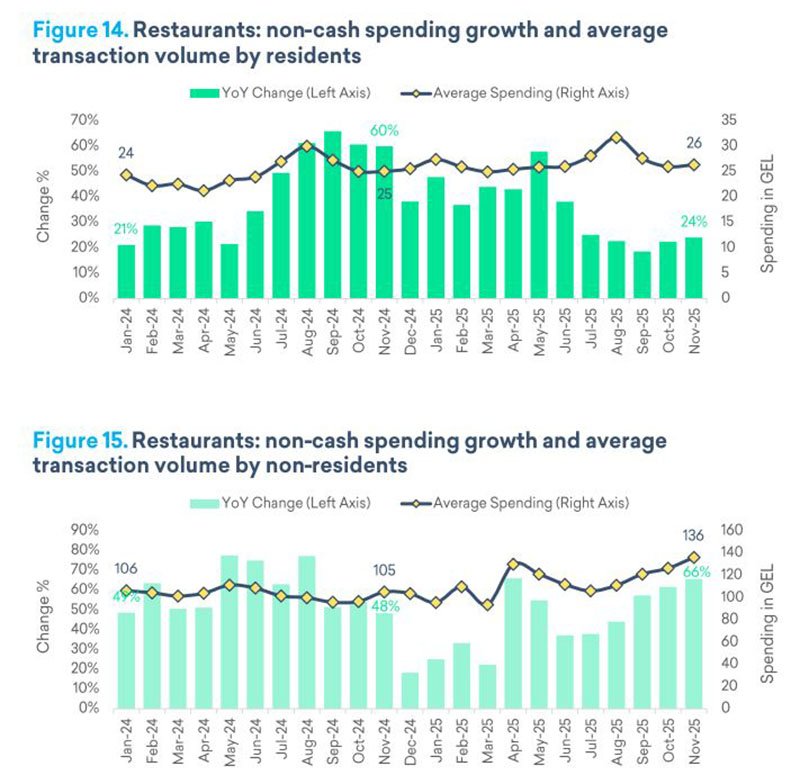

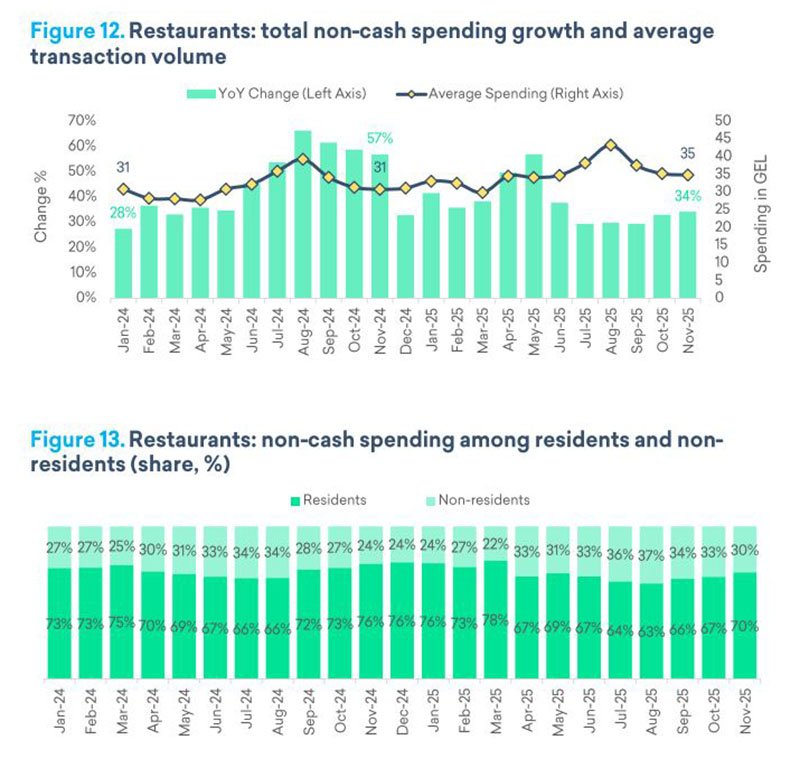

In the restaurant segment, non-cash spending increased by 34%. The value of a single transaction stood at ₾35. Residents generated the majority of turnover—70%—with their spending up 24% year on year and a ticket size of ₾26. Growth among non-residents was more pronounced at 66%, while the amount per transaction reached ₾136, roughly five times the residents’ figure.

Other categories

In apparel and accessories, non-cash spending increased by 23%, with the value of a single transaction at ₾127. Residents accounted for 86% of turnover; their spending grew by 20%, with a ticket size of ₾118. Among non-residents, the increase was notably higher at 46%, with a payment of ₾248.

Growth was also recorded in other segments:

personal care products — ₾91 (+33%);

fuel — ₾55 (+29%);

auto services — ₾47 (+7%);

pharmacy segment — ₾31 (+28%).

In building materials, non-cash spending rose by 26%; in electronics by 18%; and in furniture and household appliances by 10%.

Conclusion

Analysts at International Investment note that in many segments non-residents provided a significant share of revenue. These include restaurants and retail, while in the hotel sector external demand determined the main parameters of performance. Rising spending was also supported by the development of hotels catering to high-net-worth travelers—a segment that attracts not only tourists but investors as well.

Although this segment is still at an early stage in Georgia, one of the largest projects is the Wyndham Grand Batumi Gonio complex, where guaranteed returns are estimated at 10% and potential returns at 19% or higher. Branded luxury hotels are regarded as the most resilient and profitable segment, contributing to the formation of a more structured hotel market.

Overall, the study’s findings show that in 2025 the increase in non-cash spending was driven primarily by higher transaction values, while the number of transactions changed more moderately, reflecting a shift in the consumer model.

Read more:

Georgia’s Passport Recognised as the Strongest in the Region

World Bank Recognizes Georgia as One of the Best Countries for Doing Business

Tbilisi and Batumi Airports Reach Historic Passenger Traffic High in 2025

Russian New Year Travel Abroad: Georgia, Belarus and Thailand Lead Demand

Colliers Forecast: Georgia’s Housing Prices to Remain Stable in 2026

Подсказки: Georgia, economy, consumer spending, non-cash payments, foreign visitors, hotels, groceries, TBC Capital, tourism, retail