UK Tightens Immigration Rules: Rising Risks for Businesses and Skilled Migrants

The UK government plans to extend the qualification period for obtaining permanent residency (Indefinite Leave to Remain, ILR) from five to ten years, Bloomberg reports. This measure, part of a wider immigration crackdown, has raised concerns among employers and foreign professionals. It remains unclear whether current residents will be affected.

Who Will Be Impacted

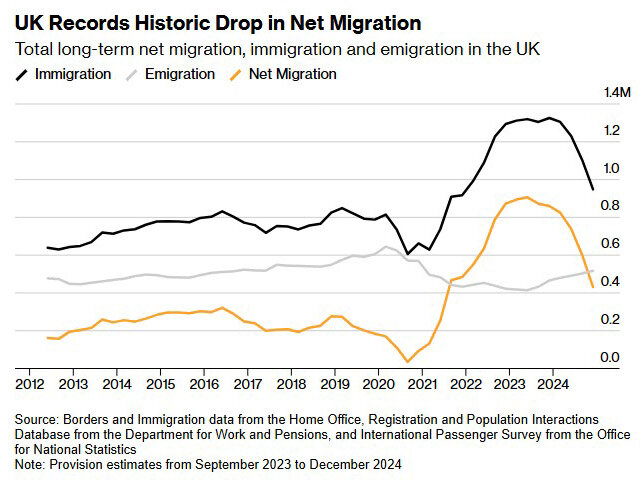

Net migration to the UK quadrupled between 2019 and 2023. Although inflows of foreign students have decreased and EU citizens face more barriers, net migration remains above pre-pandemic levels. The government is aiming for further reductions.

The reform may severely harm the care sector, which heavily relies on foreign workers. The exemption introduced in 2022, allowing employers to hire foreign care workers, will soon be removed. According to the charity Care England, this would deal "a devastating blow to an already fragile sector." Care home operators claim they cannot offer higher salaries due to budgetary constraints, making it difficult to attract staff.

Pharmaceutical companies and hospitality businesses also warn of risks. New salary thresholds will increase costs and create additional bureaucratic burdens. One large British multinational expects higher staff relocation expenses but won’t discuss the issue publicly, opting to absorb the costs—an impossible approach for small businesses. "Small business owners aren’t immigration officers," said Craig Beaumont, Director of External Affairs at the Federation of Small Businesses.

Education, Taxes & Financial Burdens

Many foreigners relocate to the UK to give their children access to British universities. However, without ILR, international tuition fees of up to £50,000 per year apply, compared to £9,535 for residents.

Sima Farazi, Head of Immigration at EY, notes that many live in the UK for over three years, pay taxes, and plan to purchase homes. But now, mortgage eligibility is uncertain with ILR potentially taking another six to seven years.

Further pressure comes from tax changes. Foreign bankers are already facing higher fiscal burdens as the non-dom regime is being phased out. One employee of a large international investment bank, who relocated to London from Asia and bought property, had expected ILR after five years. With stiff competition in the sector, maintaining her position for ten years is not guaranteed.

Employers also face extended mandatory payments — the immigration surcharge of £1,000 per worker will apply for twice as long. While major banks may manage, small companies could face existential risks.

Some aspects of the reform remain undecided. According to Richard Harris (Robert Walters Group), the new rules "impose additional burdens and make it harder to hire highly skilled specialists." The government is considering fast-track ILR options based on economic contribution, but no criteria have been confirmed.

Immigration lawyer Catherine Taroni warns: "The government is looking for every opportunity to tighten immigration channels. The UK White Paper covers virtually everything." Even current residents face ongoing uncertainty.

Risk of Talent Drain

The debate over the UK’s immigration policy goes far beyond ILR timelines. International outlets warn of long-term economic and reputational risks.

The Guardian reports that PM Keir Starmer’s comments about Britain becoming an "island of strangers" triggered criticism even within the Labour Party. Opponents warn that such rhetoric fuels social polarization and undermines trust in migration policies.

The Financial Times highlights that policymakers are overlooking key issues: migrants' contributions to regional economies, the sustainability of higher education, and NHS reliance on foreign staff. The paper criticizes the government for focusing solely on reducing migration numbers without fully assessing long-term consequences.

Sectors face fears of chronic talent shortages. Arabella Rammage, Legal Director at Lloyd’s Market Association, warns that without family reunification visas, retaining talent will become increasingly difficult. She predicts the insurance industry may lose up to 260,000 professionals by 2035 as many retire.

Louise Haycock, Partner at immigration firm Fragomen, says companies are increasingly seeking legal advice. “Ten years is an exceptionally long time to live without stability. The UK immigration system is already among the world’s most expensive,” she stresses. With growing uncertainty, many global firms are quietly exploring relocation options in more predictable jurisdictions, while highly skilled workers increasingly consider more immigration-friendly destinations.

Подсказки: UK, immigration, ILR, visa, residency, business impact, skilled workers, care sector, education, taxation, talent drain, migration policy, international investment