Вusiness / Investments / Analytics / Research / Reviews / News / Georgia / China / USA / Ireland / Japan / Russia / Turkey / Spain / Germany / Thailand 15.09.2025

The Global Economy Is Recovering but Remains Vulnerable — IMF Forecast

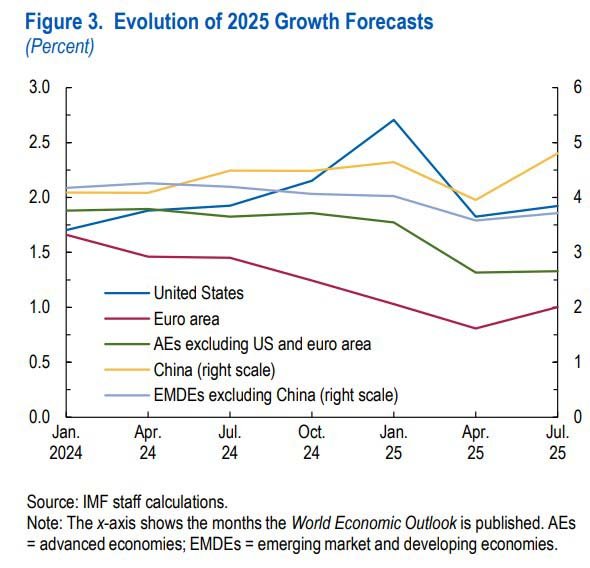

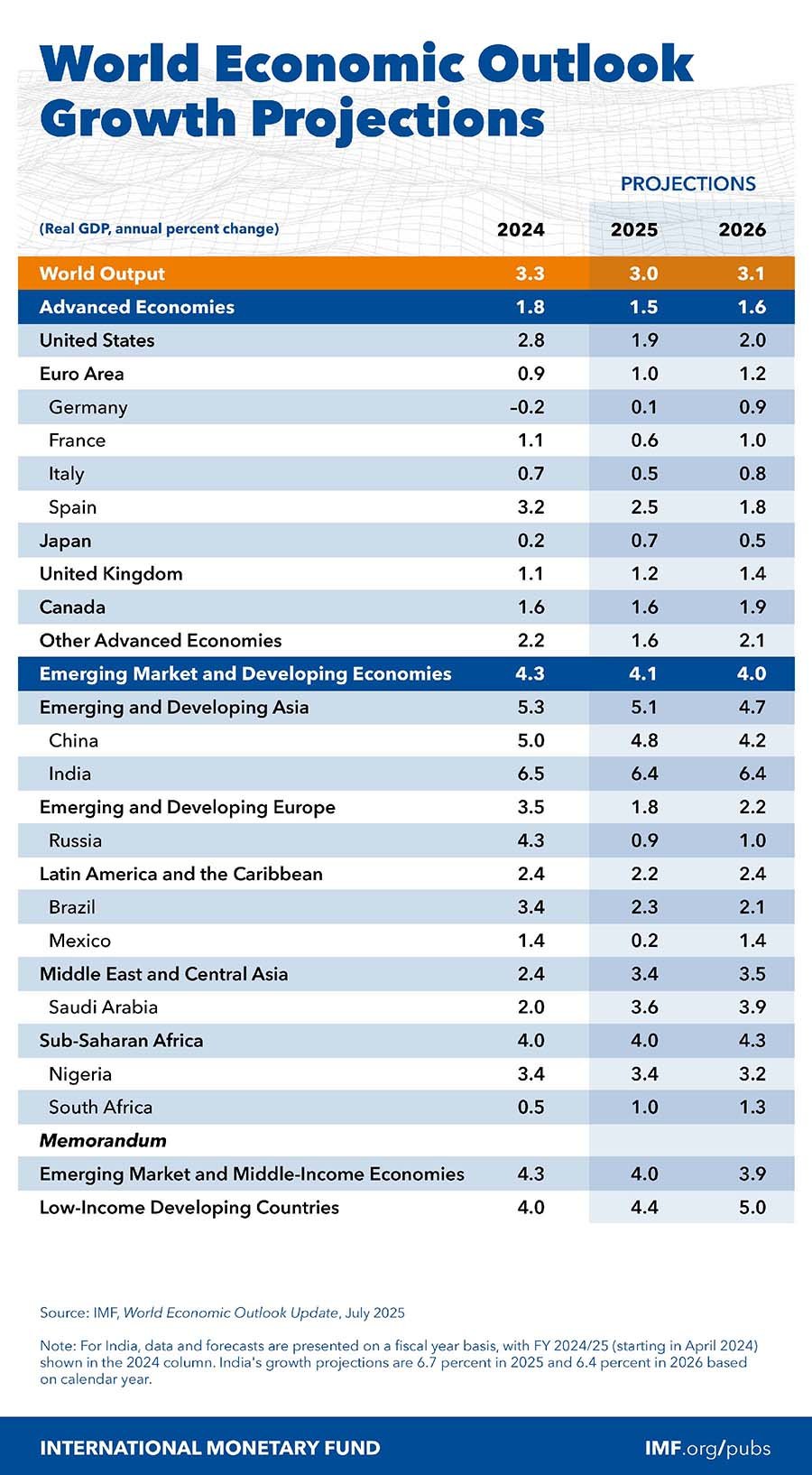

The IMF has upgraded its view of the global economy but called the outlook fragile. In the new forecast, global GDP growth is raised from 2.8% to 3.0% in 2025 and from 3.0% to 3.1% in 2026. Inflation expectations, by contrast, are lowered—from 4.3% and 3.8% to 4.2%–3.6%, respectively. The situation will be tougher in the US and softer in Europe and Asia. The key risks remain the same: trade wars, geopolitics, and record public debt.

Financial Markets and Commodities

Financial markets have rallied since spring: equity indices recovered April’s losses and hit new highs, credit spreads tightened, and volatility fell. A weaker dollar gave emerging markets more room for monetary policy and supported capital inflows. At the same time, developed-market bond yields rose: sovereign curves steepened amid higher borrowing and larger deficits.

Commodities are moving in different directions. Oil prices jumped after the June strikes by Iran and Israel, but the increase was driven by “risk premium” alone—physical supplies were unaffected. Now an oversupply inside and outside OPEC+ is pressuring prices again: the IMF projects $68 per barrel in 2025 and $64 in 2026. Gas prices remain stable thanks to growing LNG supplies and the EU’s flexible storage policy.

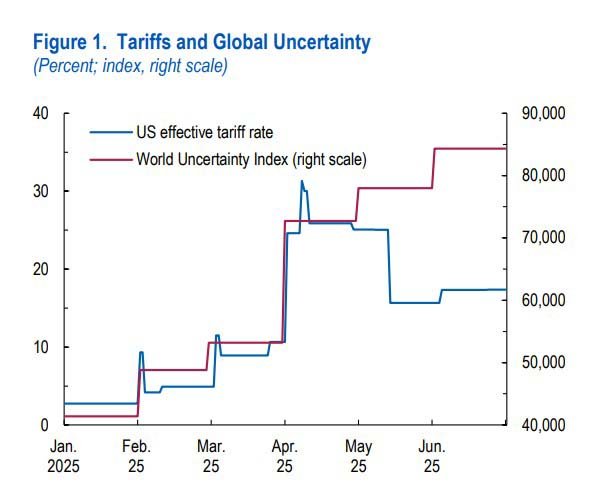

Global trade accelerated in Q1, but high-frequency indicators in Q2 signaled a reversal. Inflation trends varied across countries: it undershot forecasts in the euro area, while US tariffs began weighing on consumers. Overall, the global core gauge fell below 2%.

Economy: Contraction in the US and Growth in Georgia

The IMF stresses that the numbers for the first half of 2025 look stronger than usual, but not because of a genuine upswing—rather due to front-loading: companies and households rushed to buy goods and equipment in advance, before tariffs rose. In the US this led to the first quarterly GDP decline in three years—minus 0.5% year-over-year. Consumer spending rose just 0.5% after a late-2024 surge, while imports and investment in information equipment jumped, reflecting aggressive stockpiling.

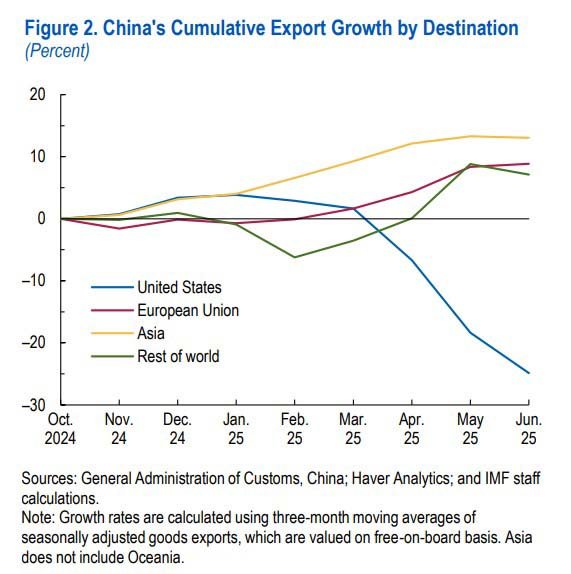

In the euro area, growth accelerated to 2.5%: investors and exporters drove momentum while consumption lost steam. Ireland’s contribution was decisive—without its record pharma exports, quarterly growth would have slipped to 1.4%. China posted 6% year-over-year: a weaker yuan and fresh fiscal measures supported exports and partly consumption, offsetting lower US sales with gains in other regions. Japan contracted by 0.2% as weak consumption and exports outweighed growth in private investment.

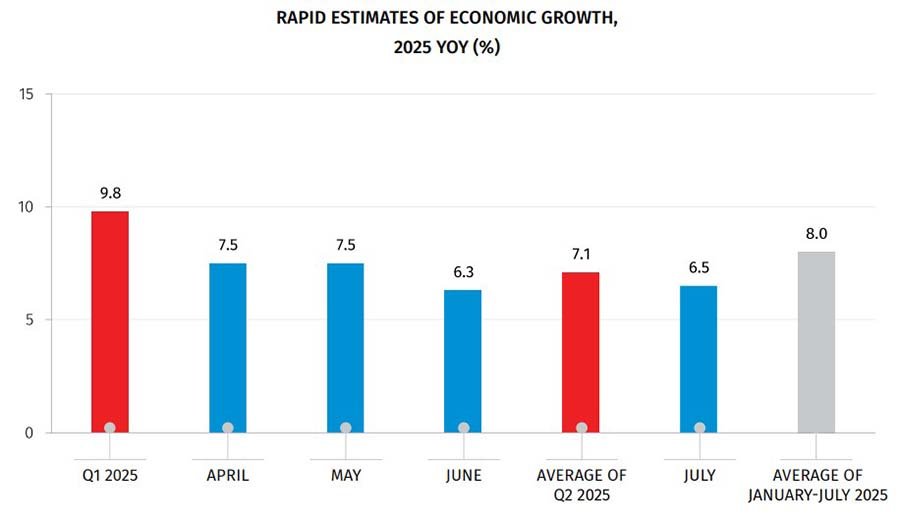

Some emerging economies are expanding rapidly despite global turbulence. Georgia, for example, is growing much faster than the world average. According to the National Statistics Office, in July 2025 Georgia’s GDP increased by 6.5% versus July 2024, with average growth of 8% for January–July. The main drivers were transport and logistics, information and communication services, trade, and entertainment.

External activity also strengthened. In the first seven months of 2025 exports rose 9% to $3.85 billion; imports grew 10.8% to $10.3 billion. Total foreign trade turnover climbed 10.3% to $14.2 billion. The consumer price index in July stood at 104.3 points, close to last year’s level (99.8%), and the producer price index remained at 103.6—moderate.

Business is supporting growth: VAT-payer turnover in July reached GEL 16 billion (about $6 billion), up 9.2% year-on-year. Some 6.1 thousand new companies were registered in the month. The banking sector and the state budget maintained positive dynamics, boosting resilience. According to the IMF, Georgia will remain a growth leader through 2030 not only in its region but also among European countries. Average growth is projected at 5.2%, and the authorities expect actual figures to traditionally exceed forecasts.

Forecasts: Modest Europe, Faster Asia

Expectations for other economies are more subdued. The US will add 1.9% in 2025 and 2.0% in 2026, helped by a new tax-stimulus package (the One Big Beautiful Bill Act), but the 2026 budget deficit will widen by 1.5 pp of GDP. The euro area will grow only 1.0% and 1.2%, much of the improvement linked to Ireland. Germany will post a symbolic 0.1% in 2025 and 0.9% in 2026; France 0.6% and 1.0%; Italy 0.5% and 0.8%. Spain looks stronger at 2.5% and 1.8%. Japan will remain weak—0.7% and 0.5%. The UK will accelerate to 1.2% and 1.4%, Canada to 1.6% and 1.9%.

Asia is expected to remain the world’s main growth engine. China should grow 4.8% in 2025 and 4.2% in 2026; India will hold at 6.4% in both years—nearly triple the pace of advanced economies. Southeast Asia is seen at 4.1% in both 2025 and 2026: Indonesia and Malaysia at 4.8–4.5%, the Philippines and Thailand above 5%, and Singapore slowing only slightly. South Korea will manage just 0.8% in 2025 but recover to 1.8% in 2026. Turkey will reach 3.0% and 3.3%, though it continues to struggle with inflation; both domestic politics and external risks weigh on the economy, eroding investor returns.

Elsewhere, dynamics will be modest. Latin America will add 2.2% in 2025 and 2.4% in 2026. Brazil will stay in the 2.1–2.3% range, while Mexico will slump to 0.2% in 2025 and rebound to 1.4% in 2026. The Middle East and Central Asia will grow 3.4% and 3.5%, with Saudi Arabia at 3.6% and 3.9%. Sub-Saharan Africa will hold 4.0% in 2025 and accelerate to 4.3% in 2026. In emerging Europe, the IMF expects just 1.8% and 2.2%. The outlook for Russia is particularly sharp: growth is seen slowing to 0.9% in 2025 and 1.0% in 2026 after 4.3% in 2024.

Global Prospects: Geopolitics and Debt Undermine Stability

Global trade will accelerate to 2.6% in 2025 but slow to 1.9% in 2026. The front-loading effect will depress imports as inventories weigh on new orders. A weaker dollar amplifies the tariff shock in the US: on one hand, it improves the current account; on the other, stimulative fiscal policy fully offsets the gain.

Inflation will continue to ease: 2.5% in advanced economies in 2025 and 2.1% in 2026; 5.4% and 4.5% in emerging markets. The US will remain in a “special zone” due to tariff policy and keep inflation above the Fed’s target. Euro-area inflation will be restrained by a stronger euro and one-off budget measures. In China, headline inflation will barely move, while core inflation will rise to 0.5% in 2025 and 0.8% in 2026.

Risks are tilted to the downside. If the US restores tariffs to April peaks and adds new duties in electronics or pharma, global growth could drop by 0.2 pp as early as 2025. Further threats include geopolitics—from Ukraine to the Middle East—and debt vulnerabilities in major economies. The IMF explicitly names the US, France, and Brazil as countries where deficits and public debt are at historic highs and could trigger a jump in term premia, increasing market volatility.

IMF Recommendations

Uncertainty can be reduced only through transparent trade rules and a pullback from large-scale industrial subsidies that distort markets, the Fund argues. Only targeted measures aimed at specific failures are acceptable. Budgets should regain strength via consolidation and higher revenue; any new support must be targeted and time-limited. For central banks, the priority is independence and clear communication: where tariffs are imposed, policy will have to be tighter to curb inflation; where tariffs are suffered, a looser stance may be appropriate. The IMF also emphasizes: scenario analysis and preparedness for multiple outcomes must be part of economic policy.

In conclusion, the IMF underscores that the only way to resolve the global economy’s contradictions is by raising potential growth. Labor- and education-market reforms, stronger competition, and digitalization can deliver sustainable growth and soften the blow from tariff conflicts and debt pressure.

Against a backdrop of elevated uncertainty, the least vulnerable segment remains hotel projects within major branded chains in Georgia. This resilience is supported by steady inbound and domestic tourism flows, FX-denominated revenue (rates/settlements in USD/EUR), international brand standards and booking systems, chain loyalty and marketing power, and management/franchise contracts with transparent economics (base fee + incentive) that smooth operating risks and support occupancy.

Подсказки: IMF, global economy, GDP, inflation, tariffs, public debt, oil, LNG, United States, euro area, China, India, Southeast Asia, Georgia, hotel investment, branded hotels, tourism, monetary policy, trade