read also

Gulf Attacks Raise Concerns for Tourism and Aviation

Gulf Attacks Raise Concerns for Tourism and Aviation

Indonesia tightens compliance rules for Bali short-term rentals

Indonesia tightens compliance rules for Bali short-term rentals

Ireland plans new restrictions on short-term rentals

Ireland plans new restrictions on short-term rentals

Europe Faces Growing Housing Crisis

Europe Faces Growing Housing Crisis

Budapest Joins European Crackdown on Airbnb Rentals

Budapest Joins European Crackdown on Airbnb Rentals

Oman Air Launches Bus Route From UAE to Muscat

Oman Air Launches Bus Route From UAE to Muscat

Вusiness / Investments / Tourism & hospitality / Analytics / Research / Spain / Turkey / Кипр / Slovenia / Montenegro / Greece / Italy / Croatia / Tourism Spain / Tourism Turkey / Tourism Cyprus / Tourism Slovenia / Tourism Montenegro / Tourism Italy / Tourism Greece / Tourism Croatia 08.12.2025

Tourism and Hospitality in Southern Europe: Market Dynamics, Investment Trends and Mid-Term Outlook

Colliers has released a new EMEA Hotels report analysing the key trends shaping tourism and hospitality markets in the Mediterranean and Southern Europe. The study confirms the region’s continued global leadership in popularity, even as the strongest spending growth over the next few years is expected in the Asia-Pacific region. Analysts also point to evolving seasonal patterns, shifting demand sources and a changing investment landscape across the hotel sector.

Tourism Flows: Recovery Trajectory

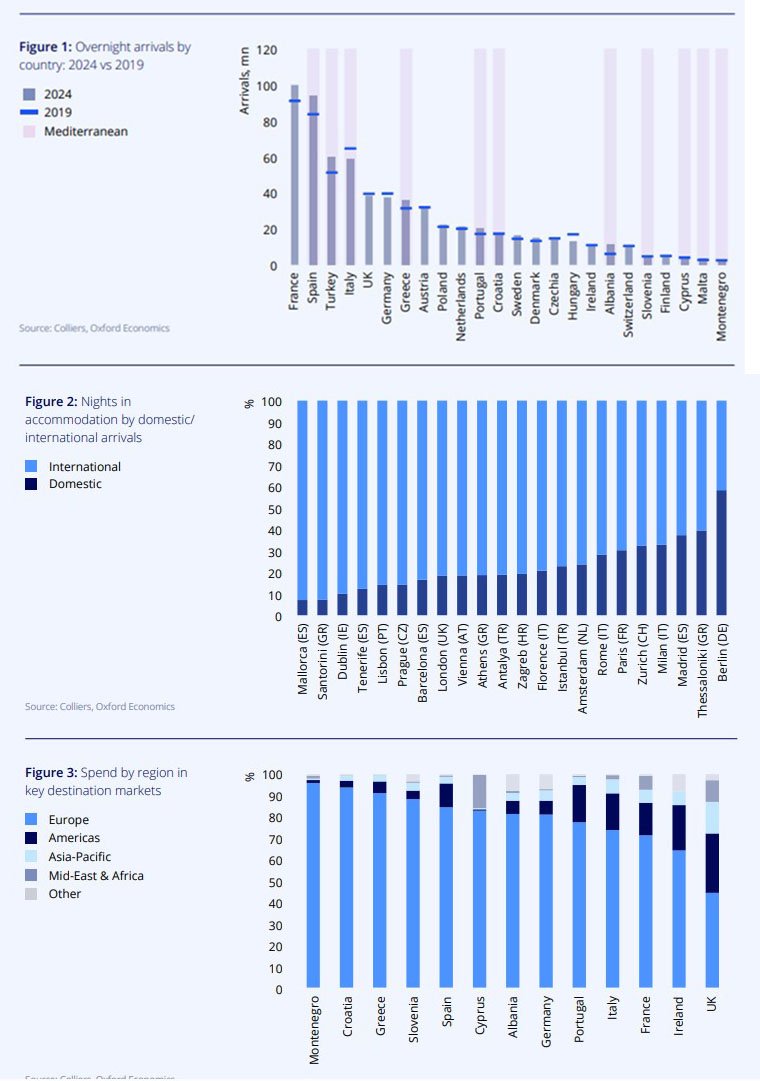

Mediterranean and Southern European tourism remains the largest in the world: according to UNWTO, the region accounted for 44% of all inbound trips to Europe in 2024. It includes mature global destinations such as Spain, Italy, Portugal, Greece and Türkiye, as well as fast-growing Adriatic markets including Montenegro and Albania. Croatia and Slovenia continue to strengthen their positions, while Cyprus and Malta maintain steady demand in the compact island segment.

Recovery speeds differ by country, but most leading destinations have already reached or surpassed pre-pandemic arrival volumes. Spain, Türkiye, Cyprus, Malta, Slovenia and Montenegro have fully recovered. Albania stands out as the fastest-growing market, with 2024 arrivals 80% above 2019 levels — a sign of rapid expansion from a low base. Spain and Italy boast some of the highest repeat-visit rates, while Greece, Croatia and Portugal are among the most popular choices for first-time visitors. Spain leads in total tourist spending, followed by France, Italy and Türkiye.

Demand Shifts and New Drivers

Most demand remains intra-European: in Greece, Italy and Spain over 80% of arrivals come from within Europe. Montenegro, Croatia, Greece and Cyprus show particularly high shares of international overnights; Spain and Portugal stand at around 70%, while Italy is more evenly split. Albania’s strong domestic tourism resembles trends seen in Central and Eastern Europe.

APAC travellers are becoming a key long-term engine of growth. The forecast for APAC spending in Europe in 2025 has been revised to about +11%, yet acceleration to +16% is expected in 2026 — comparable to MEA and above Europe and the Americas. Growth is driven by the expanding middle class: 332 million households have joined this group in the past decade, and the number is projected to exceed 1 billion by 2034.

Colliers highlights APAC’s digital-first behaviour. The region is home to nearly half of the world’s Generation Z, highly engaged in mobile payments, social commerce and livestream-based travel inspiration. This strengthens the hotel sector’s need for technology-driven engagement and personalisation.

Hotel Revenues

Rate-driven growth has been the primary revenue driver in 2024–2025. According to ETC, accommodation prices rose 10.6% in January–May 2025, compared with just 3.2% in Western Europe. The cities with the highest rates include Rome, Athens, Barcelona and Milan. At the country level, Greece and Italy rank just behind Switzerland.

Seasonality remains a major challenge. In Greece, Croatia, Montenegro and Albania, 38–41% of all hotel nights fall in July–August — far above the European average of 26%. This intensifies peak-season pricing and complicates year-round profitability. Yet the pattern is shifting: more travellers now choose May, June and autumn months, while tour operators extend programmes to November — especially in Türkiye and Greece. This helps mitigate peak-season congestion and stabilise off-season occupancy.

Emerging Destinations and Occupancy Outlook

Emerging Mediterranean destinations — Croatia, Montenegro, Albania — show strong growth but face structural constraints. Rapid demand pushes prices up sharply, raising sustainability concerns. Montenegro’s decision to raise VAT on accommodation from 7% to 15% in 2025 has weakened its price competitiveness. Croatia’s heavy reliance on short-term rentals increases competition for hotels, while administrative hurdles slow new project development.

In 2025, Mediterranean hotel nights are expected to grow moderately — about +2% year-on-year, in line with the European average. In 2026, acceleration to +6.4% is forecast, outperforming expected growth for Europe overall (5.6%). The strongest increases are projected for Greece, Croatia and Montenegro. After several years of explosive expansion, Albania will shift toward a more balanced trajectory.

Investments and Capital Structure

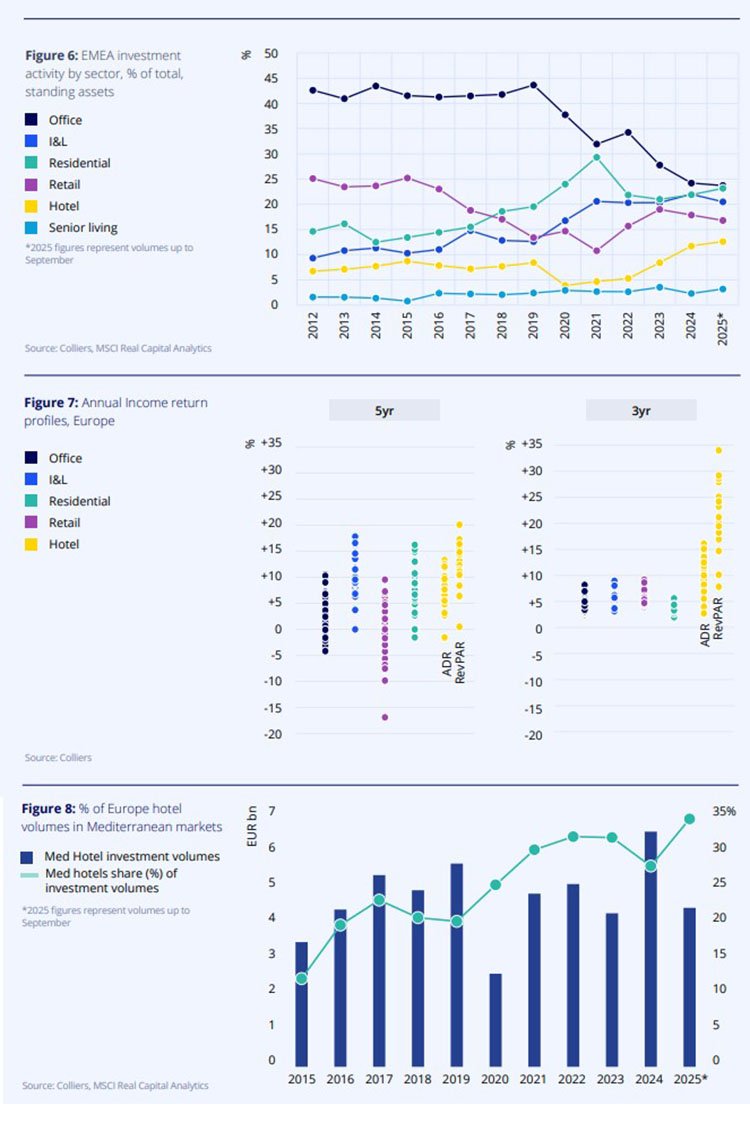

Investment activity in the hotel sector has increased significantly. In 2020, hotels accounted for only 4% of EMEA transaction volume, compared with 13% in 2025 — surpassing pre-pandemic levels. In the first nine months of 2025, total investment reached €15.8 billion, slightly below €17 billion the previous year.

The sector’s recent performance — driven by stronger occupancy, higher rates and rising RevPAR — has boosted investor appetite. Capital continues to concentrate in major Western European markets, as well as Spain and Italy. Between 2020 and 2024, five countries — the UK, Spain, France, Italy and Germany — accounted for 74% of all deals. Leading cities include London, Paris, Barcelona, Madrid and Amsterdam.

Mediterranean countries increased their share of European hotel investment from 19% in 2015–2019 to 28% in 2020–2024, and nearly 33% by September 2025. Among major transactions is the €430 million acquisition of the Mare Nostrum Resort Tenerife.

US travellers remain an important revenue stabiliser: ETC data shows Americans spend more on accommodation than any other long-haul market, reinforcing resilience in destinations with strong US demand.

Branded Luxury Segment

Analysts at International Investment note that branded luxury hotels remain the most profitable investment segment, offering strong returns and lower exposure to market volatility. Regional resort markets in Eastern Europe and along the Black Sea are becoming new growth hotspots for global operators. In Georgia, the Wyndham Grand Batumi Gonio is a leading example of rising international interest.

Located in a prestigious part of Batumi, the complex blends minimalist architecture, natural aesthetics and modern comfort. It offers spacious sea-view rooms, a wellness area, conference facilities and restaurants featuring local and Mediterranean cuisine. Sustainability is a core element, with energy-efficient systems, water-saving technologies and eco-friendly materials.

Experts report growing investment diversification: global brands expand beyond capital cities, while new operators develop specialised formats ranging from wellness concepts to eco-friendly and hybrid accommodation models. The rise of the Upper Upscale segment demonstrates that modern premium travel values sustainability, technology and emotional comfort as much as traditional luxury. The period 2026–2027 may become a phase of consolidation and deep technological renewal across the hotel industry, driven by intelligent booking tools and smart resource-management systems.

Outlook 2026–2030

According to Colliers, after a calmer 2025, Southern Europe’s hotel market will accelerate. In 2026, overnight stays are projected to increase by 6.4%, above the Western European average. International arrivals in key Mediterranean destinations will grow by 4–6% annually through at least 2030, with tourist spending rising at similar rates.

The report emphasises the region’s resilience even amid economic uncertainty: its leisure-centric profile makes it less sensitive to cyclical demand shifts. Competition between accommodation formats is intensifying as travellers scrutinise value for money. Season extension — from roughly April to November — is increasingly used to balance load and improve operating performance.

Infrastructure investment remains a key success factor, including Albania’s new airport and extended tax incentives for 4- and 5-star hotels through 2026. In the long term, hotel transactions are expected to stabilise at around 15% of Europe’s total investment volume. As the potential for rapid ADR and occupancy gains becomes exhausted, operators will need to focus more on efficiency, differentiation and long-term competitiveness.

According to International Investment analysts, Southern Europe’s hotel market is entering a phase of mature growth, where technology, sustainability and product quality become decisive competitive drivers. Despite intensifying competition, the region remains highly attractive for investors thanks to stable demand, season extension and diversified source markets. Between 2026 and 2030, operator success will depend on their ability to innovate, sustain rate strength and deliver a distinctive emotional guest experience that short-term rentals cannot replicate.

Подсказки: Southern Europe, tourism, hotels, investments, Mediterranean, hospitality, market trends, Colliers, APAC travellers