read also

Over €175 Million in Tax Refunds Remain Unclaimed in Greece

Over €175 Million in Tax Refunds Remain Unclaimed in Greece

Citizenship in South America: How the Mercosur Agreement Works

Citizenship in South America: How the Mercosur Agreement Works

Rising Crime Levels in Several Canadian Cities

Rising Crime Levels in Several Canadian Cities

Türkiye strengthens its role in global tourism

Türkiye strengthens its role in global tourism

Slovenia Work Permits Become a Key Hiring Bottleneck

Slovenia Work Permits Become a Key Hiring Bottleneck

Asset Reinvention Reshapes Thailand’s Hotel Market

Asset Reinvention Reshapes Thailand’s Hotel Market

Вusiness / Real Estate / Investments / Analytics / Research / Ratings / USA / Real Estate USA 22.12.2025

Top US Cities for Real Estate Investment in 2026: PwC Overview

The US real estate market is entering 2026 amid a noticeable redistribution of investor interest, as follows from the Emerging Trends in Real Estate 2026 report prepared by PwC and the Urban Land Institute. Investors are reassessing major metropolitan areas and increasingly focusing on fast-growing markets that combine job creation, migration inflows and limited new supply. The updated methodology provides a clearer view of the cities shaping industry trends and concentrating capital.

The study places the largest metropolitan areas into a separate group — Primary Markets. They receive higher scores thanks to their scale, broad labor markets and resilient demand. This year, several submarkets within the New York metropolitan area have strengthened their positions. Dallas–Fort Worth maintains one of the strongest profiles in the country, while southern cities continue to expand amid migration inflows. Several technology-oriented hubs in the West are also showing signs of demand recovery after a challenging period.

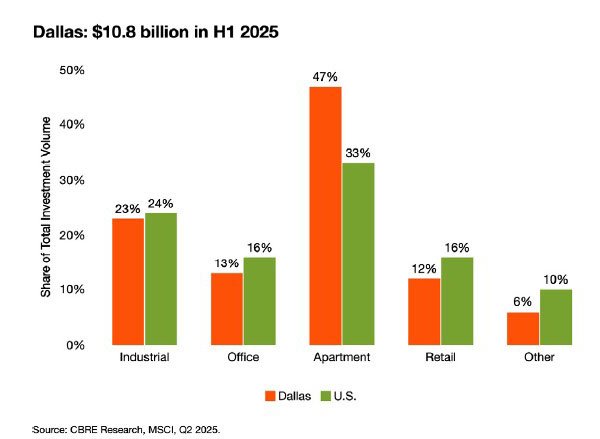

Dallas–Fort Worth

Dallas–Fort Worth continues to solidify its status as one of the most resilient markets in the US. The region attracts companies thanks to its affordability, diversified economy and business-friendly environment: since 2018, one hundred corporate headquarters have relocated here. The expansion of the financial sector and plans to launch the Texas Stock Exchange strengthen the investment base. Despite elevated overall vacancy, high-quality offices are being actively leased: sublease space is shrinking, and new buildings secure tenants already at the construction stage. Uptown, Legacy and the Knox District are emerging as key magnets for businesses and residents, while office conversion projects are renewing the urban stock. Migration of Generation Z strengthens long-term prospects and enhances the region’s demographic profile.

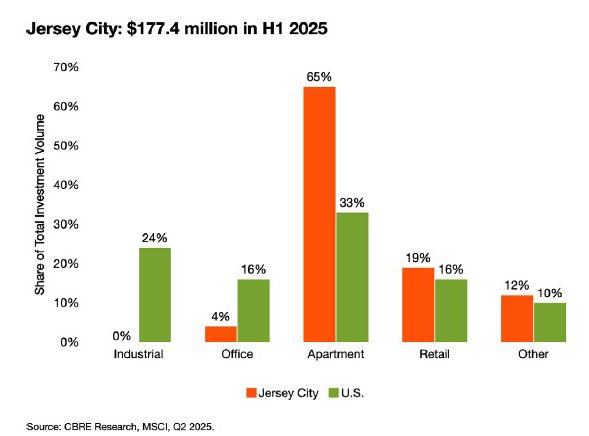

Jersey City

Jersey City is emerging as an independent business hub within the New York metropolitan area. Proximity to Manhattan combined with more flexible conditions makes it attractive to technology, financial and research companies. A developed transport network — from PATH trains to light rail — обеспечивает convenient mobility, while a wide range of modern office and lab space expands business opportunities. More than half of residents hold a higher-education degree, creating a strong talent base. In the multifamily segment, vacancy remains minimal, and rent growth is most pronounced in high-quality assets. Hudson River waterfront districts remain in demand thanks to an attractive balance of pricing and access to New York’s business core.

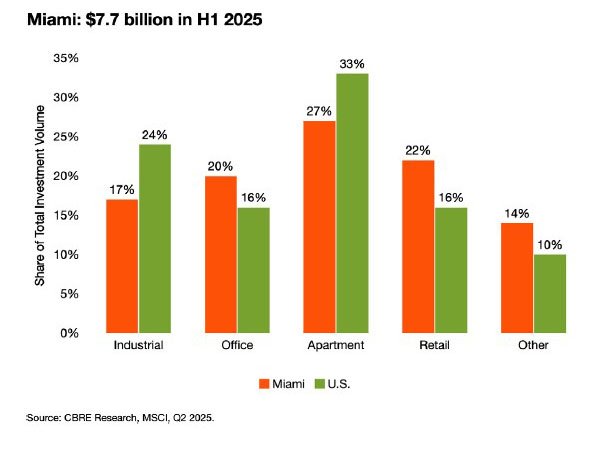

Miami

Miami is strengthening its position as one of South Florida’s key markets. Over recent years, dozens of companies have relocated to the region, generating strong office demand and increasing absorption by more than two million square feet. South Florida shows sustained corporate inflows, including Am Law-level legal firms and financial institutions. The prime segment is experiencing one of the fastest rent growth rates in the country: in some buildings, rents have doubled over five years. Low levels of sublease space and gradually declining vacancy point to stable demand. Tourism remains a major driver: Florida leads the US in domestic travel and ranks among top destinations for international visitors. PortMiami and the international airport reinforce the region’s role as a logistics hub.

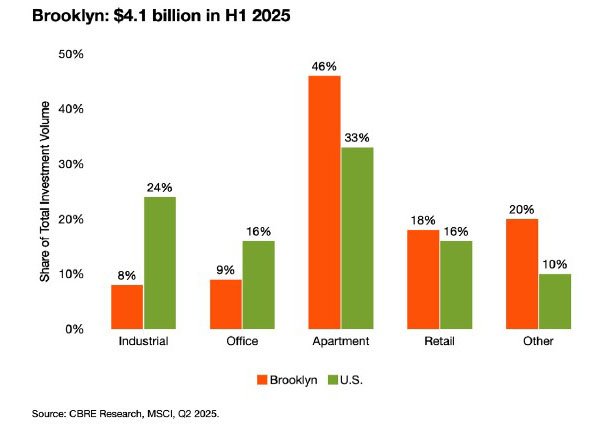

Brooklyn

Brooklyn retains its status as a major center within the New York metropolitan area, combining a strong labor market, a vibrant cultural scene and well-developed residential districts. Submarkets from the South Brooklyn Waterfront to the Brooklyn Navy Yard show a steady decline in vacancy, reflecting corporate interest in locations closer to where employees live. In the central part of the borough, some offices continue to feel the effects of remote work, yet high-quality buildings maintain stable demand. The residential market remains one of the strongest in the country: vacancy holds at around two percent, while rent growth exceeds the national average. Brooklyn combines business and cultural activity, making it one of the most resilient urban nodes in the metro area.

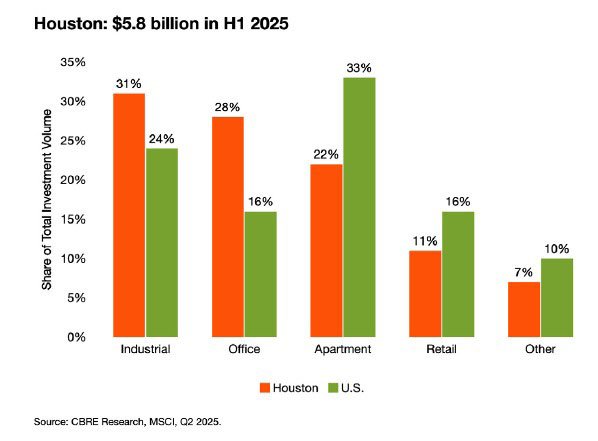

Houston

Houston is developing as a multi-profile мегаполис with a rapidly growing economy. The city relies on energy, healthcare, technology, manufacturing and logistics. Regional GDP is expanding by nearly eight percent annually, and the Port of Houston ranks among the leading container hubs in the US. In the office market, demand is shifting toward modern buildings: along the Katy Freeway, vacancy stands at around 7.4 percent, well below the citywide average. The Energy Corridor shows strong absorption dynamics. New assets perform best, while older stock is gradually withdrawn or redeveloped. Infrastructure projects support the city’s high business momentum.

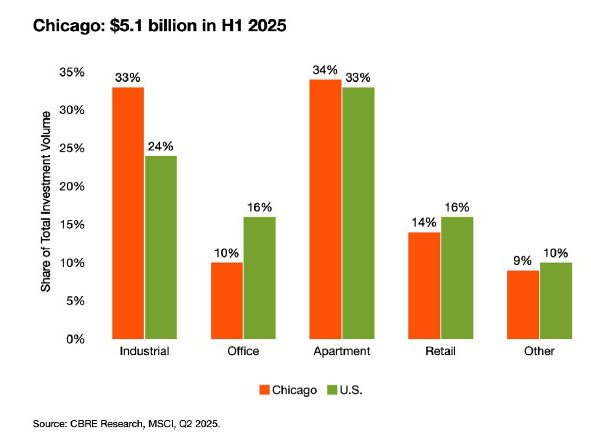

Chicago

Chicago remains one of the country’s largest economic centers thanks to its industrial base, financial sector, higher education and transport system. Since 2022, nearly 450 corporate expansion and relocation projects have been implemented. Modernization of two international airports strengthens the region’s logistics potential. The office market is uneven: overall vacancy remains high, but the prime segment shows signs of stabilization. Limited new construction and a growing number of redevelopment projects improve prospects for stock renewal. A young and skilled workforce supports long-term demand across both office and residential segments.

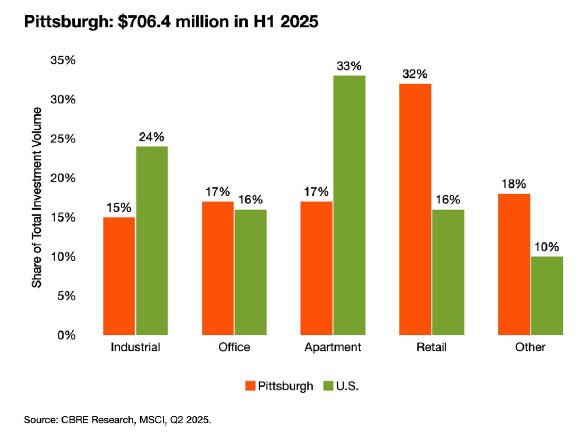

Pittsburgh

Pittsburgh is accelerating its transition into a science and technology hub. World-class universities generate a constant inflow of research and engineering talent, attracting companies in IT, healthcare, biotechnology and robotics. An affordable urban environment makes the market appealing to businesses and employees seeking alternatives to expensive мегаполисы. The office segment still feels the aftereffects of the pandemic, but limited new supply and active conversions of obsolete buildings are gradually rebalancing the market. A strong research cluster provides a solid foundation for investment.

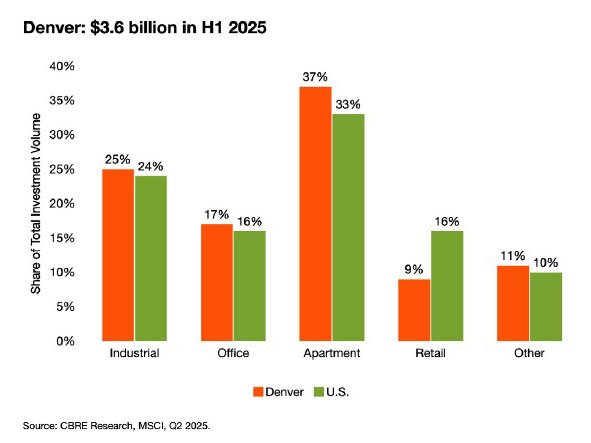

Denver

Denver is reinforcing its role as one of the most balanced markets in the US thanks to a diversified economy and high quality of life. The city has become a center for aerospace, biotechnology, research and high-tech industries. In recent years, more than twenty companies have relocated to Denver, supporting activity across multiple segments — from offices to housing. Vacancy remains elevated, but sublease volumes are declining, and limited new project deliveries are aiding stabilization. The international airport and развитая transport network enhance competitiveness, while migration inflows ensure steady demand.

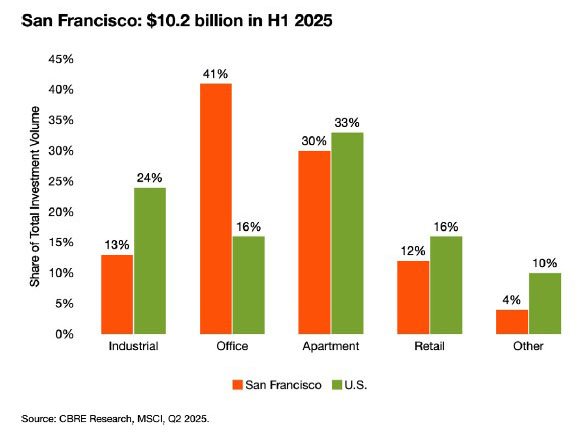

San Francisco

San Francisco is receiving a significant boost from the growth of the artificial intelligence industry. Since 2024, AI companies have attracted more than one hundred billion dollars in investment and occupied over six million square feet of office space, revitalizing the Financial District and Mission Bay. In prime buildings, vacancy remains at around fourteen percent, well below levels seen in older stock. The region continues to be one of the world’s key centers for scientific and biotech research, anchored by Stanford University and the University of California. Growth in high-paying tech jobs is increasing interest in both residential and commercial real estate.

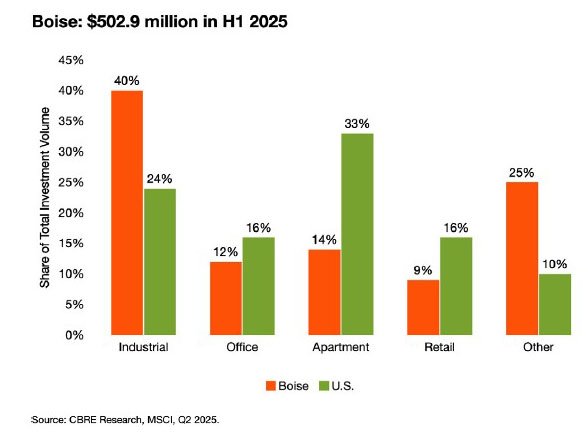

Boise

Boise is emerging as one of the most promising second-tier markets. Housing affordability, quality of life and steady migration inflows make the city attractive to residents and companies alike. Idaho has ranked among the fastest-growing states for many years, supporting consistent demand for both residential and commercial space. A young and skilled population chooses Boise for its natural environment, safety and hybrid-work opportunities. Low office vacancy and strong business interest create favorable conditions for long-term investment.

Conclusion

Overall, Emerging Trends in Real Estate 2026 points to a shift in investment focus toward markets that combine economic growth, population inflows and the capacity to scale new projects. Major metropolitan areas retain their strategic importance, but increasing attention is being paid to second-tier cities where demand is driven not only by traditional industries, but also by technology, science, logistics and corporate relocations. This is shaping a more diverse development map and makes 2026 a period in which market resilience is defined not by individual segments, but by the quality of the urban environment, the strength of the talent base and the ability of regions to adapt to new economic models.