read also

Вusiness / Real Estate / Investments / Analytics / Research / Bulgaria / Real Estate Bulgaria 23.12.2025

Bulgaria’s Real Estate Market in 2025: Local Investment and Expectations of the Euro

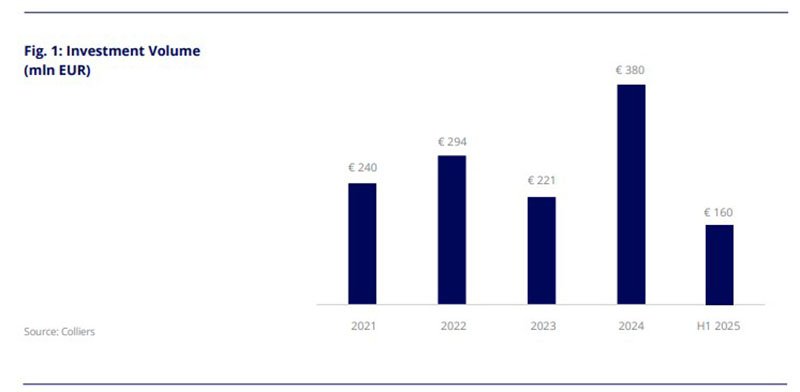

Bulgaria’s real estate market in the first half of 2025 developed amid sustained investment activity and expectations linked to the country’s preparation for adopting the euro, as noted in a Colliers report. Investor interest shifted toward income-generating assets, the role of domestic capital strengthened, and the office segment retained its leading position.

The Real Estate Market Overview study shows that between January and June the volume of transactions on Bulgaria’s real estate market amounted to around €160 million. Domestic investors played a notable role in the deal structure in the first half of 2025, accounting for 47% of total investment. By transaction type, income-generating properties dominated, representing 57%. Yield levels remained unchanged: 7.75% for prime office and retail assets and 7.5% for the industrial and logistics segment.

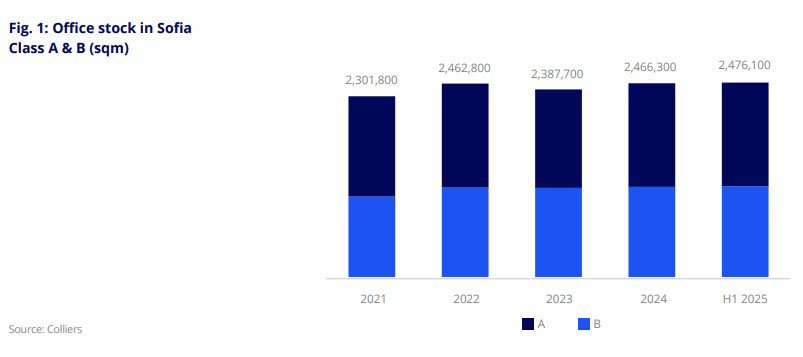

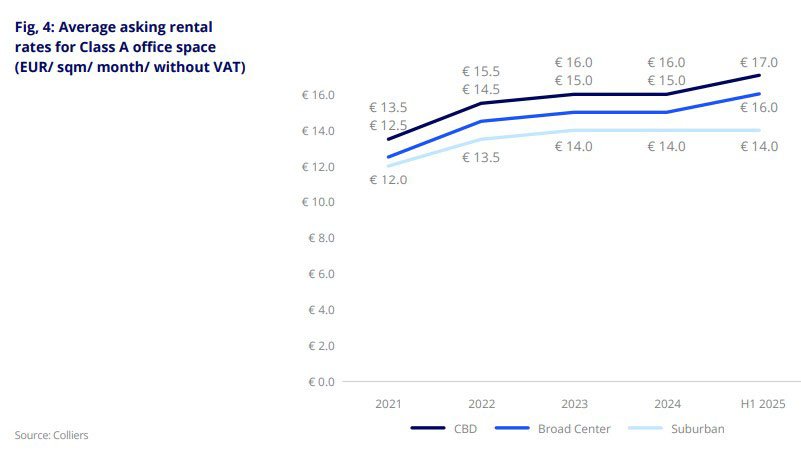

Offices — the key market segment

In the first half of 2025, the office segment occupied a central position in Bulgaria’s real estate market. It accounted for more than 70% of total investment volume, driven by steady demand for high-quality assets amid a limited supply of liquid properties.

The total stock of Class A and B office space in Sofia exceeded 2.47 million sq. m. New supply remained moderate and was partially offset by the reclassification of certain buildings. The volume of concluded and renewed lease agreements increased from 75.2 thousand sq. m in the first half of 2024 to 88.4 thousand sq. m in January–June 2025. Rental rates for Class A offices ranged between €14–17 per sq. m per month, while Class B rates stood at €9–11.

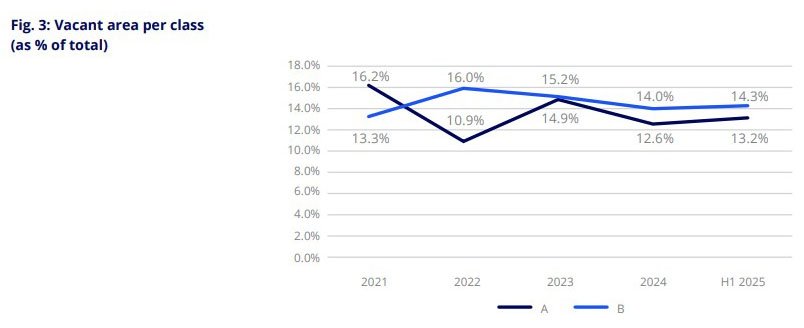

Net absorption increased from 32.5 thousand to 39.3 thousand sq. m. The bulk of this growth was driven by lease renewals and tenant relocations to higher-quality premises. Vacancy rates in Class A offices rose from 12.6% to 13.2%, and in Class B from 14.0% to 14.3%. The IT sector remained the key demand driver, followed by financial and professional services.

Forecast. The hybrid work model is expected to remain dominant, with employees spending more time in offices. This will support demand for modern buildings with flexible layouts, developed infrastructure, and an expanded range of services. Against the backdrop of limited supply of high-quality space, rental rates in new and under-construction projects may continue to rise. Additional pressure on the market will come from higher fit-out costs, as well as stricter energy efficiency and ESG compliance requirements, widening the gap between modern offices and outdated stock.

Logistics and warehouses: demand and constraints

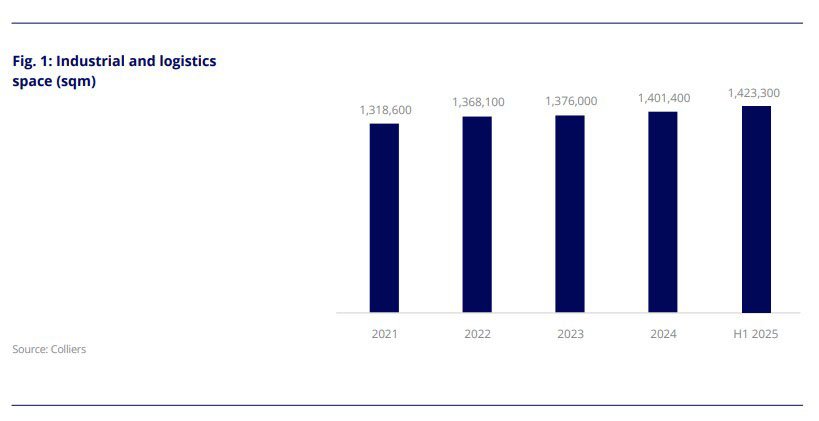

By mid-2025, the volume of Class A and B warehouse and logistics space in Sofia reached 1.42 million sq. m, increasing by 21.9 thousand sq. m compared to the end of 2024. The sector ranked second with a 28% share. New supply remained limited, while 157.3 thousand sq. m were under active construction.

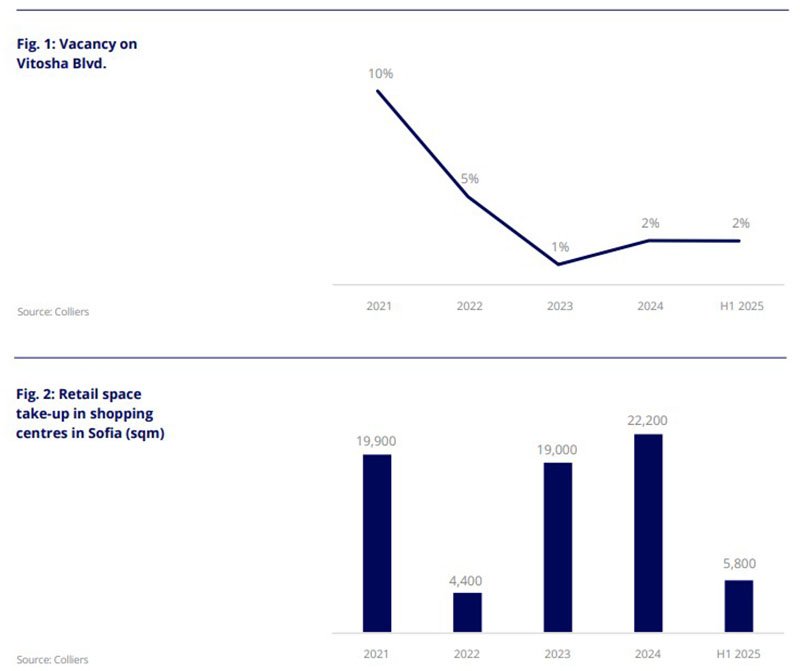

The demand structure changed. Traditional drivers — logistics and 3PL operators — showed low activity. Retail companies accounted for the bulk of transactions, representing 58% of leased space. Developers and construction materials suppliers followed with 23%. Total leasing volume amounted to 8.6 thousand sq. m, significantly below the first half of 2024, when it exceeded 44.25 thousand sq. m.

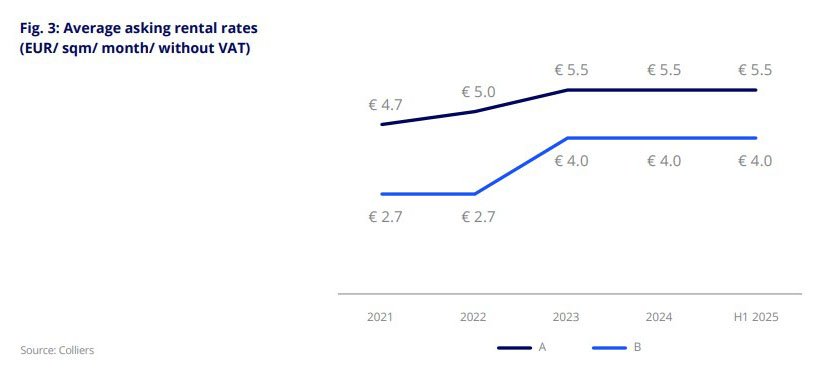

Leasing activity declined, yet vacancy remained at a record low of 2.1%. Rental rates were largely unchanged: €5.5 per sq. m per month for Class A properties and €4 for Class B. Operating costs ranged between €0.8–1.5 per sq. m per month.

Forecast. Gradual recovery of interest in the sector is expected amid the reshoring of production and logistics chains to Central and Eastern Europe. Stabilisation of construction costs and lower interest rates may have a positive impact. Additional demand could be generated by the development of e-commerce, which in Bulgaria remains among the lowest in the region. Persistently high rental rates will continue to support interest in more affordable Class B and C properties, primarily within Sofia.

Retail: stability without growth

Retail assets accounted for just 1% of total investment. The volume of the retail real estate market in Sofia exceeded 477 thousand sq. m. The bulk of supply was concentrated in eight major shopping centres with a combined area of over 357.6 thousand sq. m. During the half-year period, another phase of reconcepting and rebranding of West Mall was completed, XOPark Sofia expanded by 19 thousand sq. m, and construction of the new Estrea retail park in the Hadzhi Dimitar district began.

Leasing activity in the segment remained high. Vacancy on Vitosha Boulevard held at 2%, retail parks were almost fully occupied, and average vacancy in shopping centres stood at 3.2%. The volume of new lease deals in shopping centres reached 5.8 thousand sq. m, excluding internal tenant relocations within projects.

Fashion and footwear stores dominated, followed by restaurants and other foodservice formats. Retailer interest focused on established shopping centres and new high-footfall retail parks. Rental rates in key retail formats remained unchanged compared to the end of 2024: shopping centres — €58 per sq. m per month, prime high streets — around €45, retail parks — €12.

Forecast. In the short term, Colliers expects retail rental rates to remain stable, with potential growth in the highest-quality and best-located projects. Investor and developer interest will continue to shift toward retail parks, which offer lower construction and operating costs and high occupancy levels. Development of new projects will become more selective amid local market saturation. Physical stores will strengthen their role in retailers’ strategies, combining traditional sales with click-and-collect and returns functions.

Residential projects: declining affordability

Household spending on housing in Bulgaria in 2023 amounted to 10.6% of GDP, below the EU average, indicating continued development potential for the segment. By mid-2025, Sofia had 1,870 houses grouped into 118 residential projects. Supply increased, while the trend toward smaller average unit sizes persisted. Detached houses remained the most common format, followed by townhouses with small plots.

A total of 1,520 units were under active construction, nearly half of them concentrated in the ten largest projects. The main development zones were located along the southern arc of Sofia’s Ring Road, as well as in nearby suburbs including Bistritsa, Pancharevo, and Lozen. Demand for such properties declined compared to peak pandemic levels. In recent years, the number of transactions fluctuated between 1,100–1,300 per year, with a significant share involving houses outside organised residential complexes.

Prices for houses in residential complexes grew faster than household incomes. Since 2021, their value has increased by more than 75%, while construction costs rose by around 63%. This led to reduced affordability: by mid-2025, one average salary could buy about 0.75 sq. m of residential space. Banks maintained accommodative mortgage conditions, with average loan rates close to 3.5%.

Forecast. Colliers experts expect Bulgaria’s transition to the euro in 2026 to improve banking sector liquidity and support lending activity. Demand will focus on new properties with high energy efficiency and modern engineering solutions. Interest in development will remain in areas with good transport accessibility and lower prices compared to central Sofia, while growth in the city’s northern districts will continue to be constrained by infrastructure limitations.

Regional context

The Colliers forecast points to sustained investment momentum in Bulgaria’s real estate market in 2025. The key constraint remains the limited presence of international capital, although the country’s expected entry into the eurozone on January 1, 2026 may gradually alter this structure. In the near term, domestic investors will retain a leading role, with offices remaining at the forefront due to stable demand for modern workspaces.

According to Cushman & Wakefield, investment volume in commercial real estate across Central and Eastern Europe increased by 51% to €5.36 billion in the first half of 2025. More than 70% of all regional deals were concentrated in the Czech Republic and Poland, with Slovakia also contributing. Against this backdrop, Bulgaria’s figures appear modest — around €154 million, or 3%.

Bulgaria’s restrained position in regional statistics is explained by structural factors, including the smaller market size, a limited number of institutional assets, and the dominance of local capital. The Bulgarian market developed through selective transactions without the participation of large international investors.

Analysts at International Investment note that slowing inflation and monetary policy easing are creating a more favourable environment for the CEE real estate market. Segments with predictable income streams are expected to remain the most resilient. Less competitive assets will continue to face challenges in attracting capital.

Подсказки: Bulgaria, real estate, property market, investment, euro adoption, offices, logistics, retail, residential, Sofia, Central and Eastern Europe, Colliers