Вusiness / Real Estate / Investments / Analytics / Research / Reviews / USA / Tourism & hospitality / Netherlands / Spain / Turkey / Italy / Canada / United Arab Emirates / France 12.01.2026

Short-Term Rental Regulation: How Markets Are Changing

Photo: Storyresidential.com

Short-term rental markets worldwide are adapting to increasing regulatory pressure. City and national authorities are consistently tightening rules by introducing requirements for registration, licensing, and rental duration in order to reduce pressure on housing stock and bring greater order to the sector. An analysis by Lighthouse shows how these rules have affected actual market performance.

New York

New York applies one of the strictest short-term rental regulatory regimes. Local Law 18, in force since September 2023, has fundamentally reshaped the market. Rentals of less than 30 days are permitted only if the owner is present in the apartment and for no more than two guests. Each property must be registered, and online platforms are prohibited from processing bookings for unregistered listings. The law was intended to eliminate the self-contained apartment rental model and return part of the housing stock to the long-term market.

The impact of regulation became visible relatively quickly. While average citywide occupancy reached 35.91% in 2022 and remained at a comparable level of 35.17% in 2023, it fell to 24.98% in 2024. In 2025, the decline halted: occupancy for January–October stood at 25.34%, slightly above the previous year but still well below pre-regulation levels.

Booked prices rose throughout 2024, reaching $664 in October, $610 in November, and a peak of $696.40 in December. In 2025, a correction followed: the average booked price for January–October amounted to $442.87, which is 24.89% below the peak levels of the previous year. Even so, New York remains among the most expensive urban short-term rental markets, significantly outperforming most other major cities in terms of pricing.

Amsterdam

Short-term rental regulation in Amsterdam has been in place since 2019 and was initially designed to limit tourism pressure in residential areas. The city reduced the maximum number of nights for renting entire properties to 30 per year, required owners to register their properties, and mandated advance notification to the municipality for each rental period. In certain high-pressure districts, outright bans on short-term rentals were introduced.

The market adapted to these conditions without a contraction in supply. In January 2023, Amsterdam recorded 6,015 short-term rental listings, rising to 7,725 by January 2024. Supply peaked in August 2025 at 8,559 listings, before easing slightly to 8,199 by January.

Occupancy remains among the highest across major European cities and is characterized by pronounced seasonality. In 2022, the average rate reached 52.19%, increasing to 60.33% in 2023 before declining to 53.28% in 2024. For January–October 2025, occupancy fell further to 50.45%. While occupancy above 60% had previously been typical in late summer and early autumn, last year such a level was recorded only in April.

Pricing dynamics have also been uneven. In 2022, peak prices ranged between $290 and $305. In October 2024, peak levels reached $435.50. In 2025, summer peaks formed around $400.

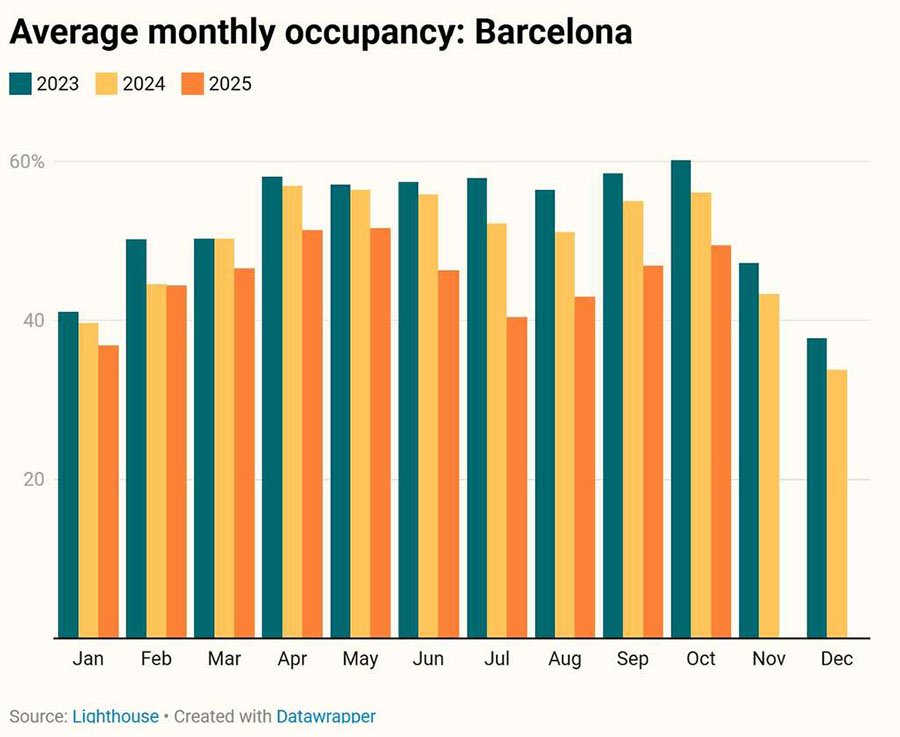

Barcelona

Barcelona has adopted one of the most interventionist approaches to short-term rental regulation in Europe. In August 2021, the city banned the short-term rental of private rooms, effectively limiting legal activity to licensed tourist apartments. Authorities later announced plans to abolish all existing licenses by November 2028, which would result in a phased withdrawal of tourist apartments from the market by 2029. These measures aim to improve housing availability and reduce tourism pressure in residential neighborhoods.

Against the backdrop of tighter regulation, supply continued to grow and reached a peak in June 2025, when the market recorded 21,815 listings. At the same time, occupancy indicators deteriorated. In 2025, average occupancy was 4 percentage points lower than in 2024 and 7 points below 2023 levels, with the high season performing weaker than usual.

In previous periods, peak monthly occupancy regularly exceeded 55%, but this threshold was no longer reached in 2025, reflecting more restrained demand amid rising regulatory uncertainty. Pricing followed a different trajectory. In 2022, peak booked prices ranged between $260 and $270; in 2023, they increased to $340–360; and in 2024, they exceeded $400, reaching a high of $408.80 in August. In 2025, summer peaks formed around $350, while average prices for January–October were 5.4% lower year on year.

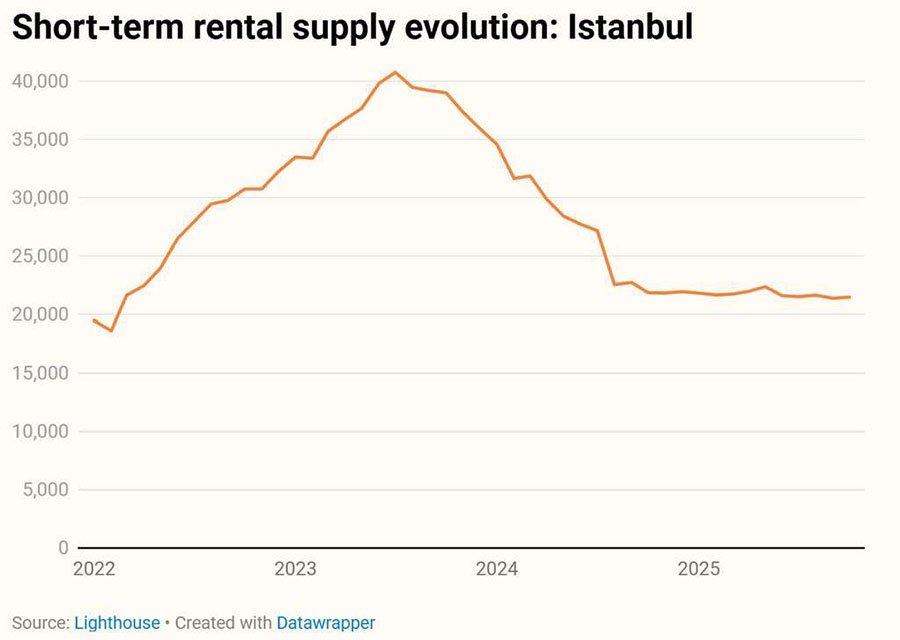

Istanbul

Unified rules for short-term rental regulation in Turkey came into force on January 1, 2024, under the Law on Leasing Residential Properties for Tourism Purposes. The new framework introduced mandatory government permits, set a rental cap of 100 days per year, and required the display of an official plaque at the property entrance. A key barrier is the requirement for unanimous consent from all neighbors in the building to obtain a permit, significantly complicating legal operation. The regulation applies nationwide and is enforced through licensing and platform oversight.

Following the introduction of the new rules, supply in Istanbul declined sharply. In January 2024, the market recorded 34,576 short-term rental listings, falling to 21,469 by October 2025. Over this period, supply contracted by approximately 37.9%, illustrating the impact of a strict administrative filter.

Occupancy levels in Istanbul are traditionally lower than in most other European destinations and are characterized by strong seasonality. In 2022, average occupancy stood at 25.33%, declining to 19.96% in 2023 and falling to a period low of 17.38% in 2024. In 2025, a partial recovery emerged, with occupancy reaching 20.21% for January–October. Peaks continue to occur in summer and early autumn.

Pricing dynamics remained relatively subdued. The average booked price for January–October 2025 amounted to $122.28, slightly above the 2024 full-year average of $117.62. During peak periods in 2024, prices reached $138.30, while in 2025 peak values generally ranged between $130 and $133.

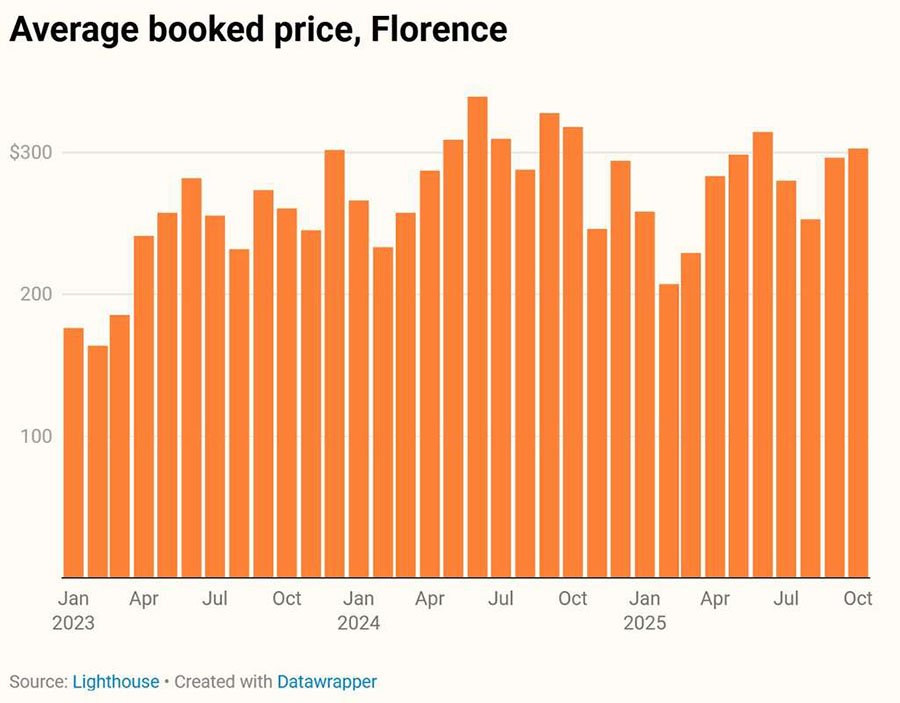

Florence

Florence restricted the expansion of its short-term rental market in June 2023 by banning the issuance of new licenses in the historic city center, a UNESCO World Heritage site. The measure was intended to curb overtourism and protect housing accessibility in central districts. Existing properties retained the right to operate under grandfathering provisions, while new licenses within the protected zone ceased to be issued.

At the citywide level, supply continued to grow. In June 2023, the market recorded 12,520 listings, increasing to 15,431 by October 2025 (+23.3%). Demand retained strong seasonality, with occupancy during peak spring and autumn months regularly exceeding 70%.

In 2025, average occupancy declined by around 2 percentage points compared to 2024, reflecting weaker performance during the high season. Prices also adjusted. The average booked price for January–October 2025 was $272.35, compared with $289.73 a year earlier. While monthly values in 2024 frequently exceeded $300 and peaked at $339, this threshold was crossed only twice in 2025, in June and October. Even so, price levels remained well above those of earlier years.

Vancouver

Vancouver applies a regulatory model aimed at limiting investment-driven short-term rentals. Accommodation is permitted only in a host’s principal residence or in an additional residential unit on the same property. In May 2024, authorities in British Columbia tightened enforcement, effectively eliminating the use of investment condominiums for short-term rental purposes.

Following stricter rules, supply declined moderately. In May 2024, the market recorded 3,427 listings, falling to 2,965 by October 2025 (–13.5%). The market remains active but has become noticeably more compact. Occupancy shows a sustained downward trend: from 48.07% in 2022 to 44.98% in 2023 and 40.45% in 2024. In 2025, January–October occupancy fell to 36.32%, with summer peaks remaining but at lower levels than the previous year.

Pricing in the high season adjusted moderately. In 2024, peak values exceeded $420, while in summer 2025 they reached $413.50 in July and $398.00 in August, representing a year-on-year decline of around 2–5%.

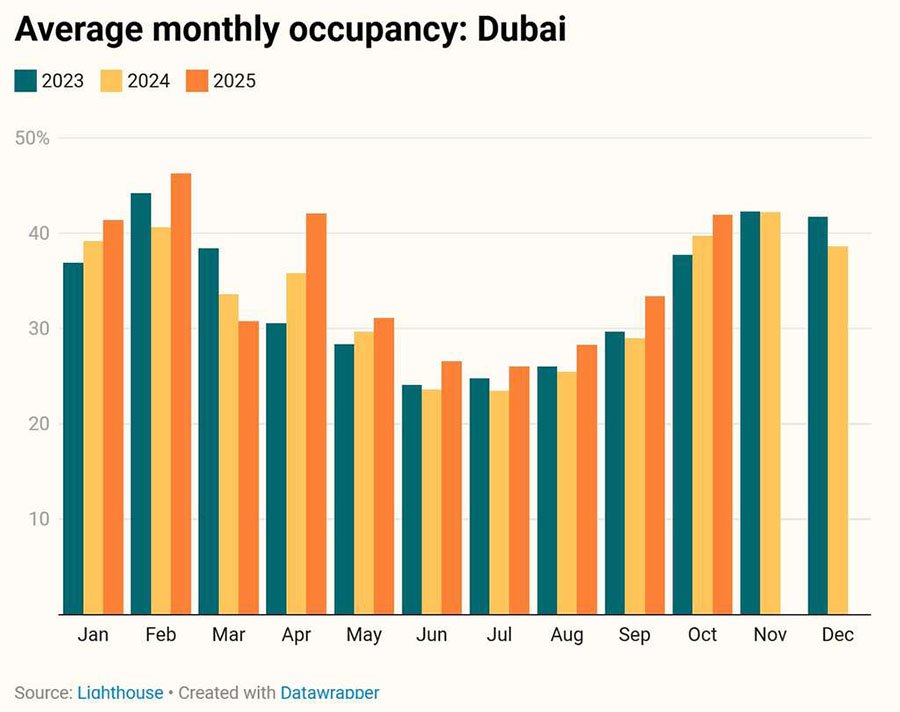

Dubai

Dubai regulates its short-term rental market through mandatory registration and licensing overseen by the Department of Economy and Tourism. Unlike many European cities, the model focuses on formalization and compliance rather than numerical caps. In 2025, enforcement was tightened through inspections of unlicensed properties and updated requirements for permits and QR codes.

Supply declined only marginally. In January 2025, Dubai recorded 40,464 active listings, falling to 39,176 by October, a decrease of 3.2%. The market remains one of the largest globally in terms of short-term rental scale. Demand is highly seasonal. In winter 2025, occupancy rose to 46.3% in February, up from 40.6% a year earlier, while summer levels remained significantly lower, with a gap of around 20 percentage points compared to winter peaks.

Pricing followed the same seasonal pattern. In December 2024, the average booked price reached $457.80; in early 2025, the winter peak was $382.10; and during summer, prices fell to a low of $182.90 in August.

Los Angeles

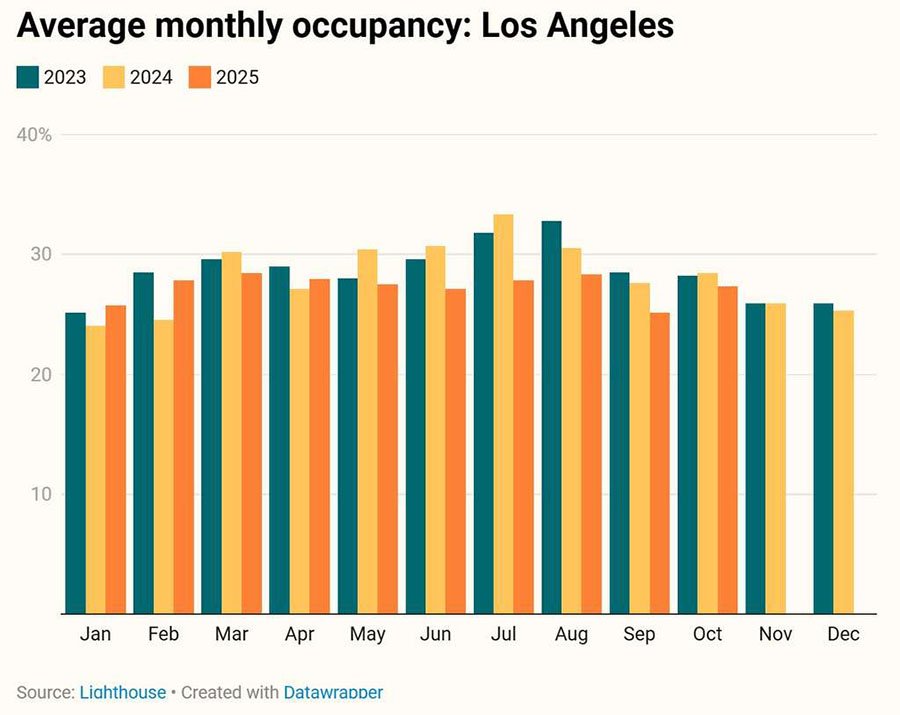

Los Angeles regulates short-term rentals through a home-sharing framework, limiting accommodation primarily to owner-occupied residences. Additional rules were introduced at the county level and fully came into force in October 2024, strengthening registration requirements and restricting permitted formats.

The market remains one of the largest in absolute terms, though supply dynamics have shifted. From January 2022 to October 2025, the number of listings increased by 36.6%, but in 2025 a contraction emerged, from 36,043 in January to 34,966 in October. Occupancy remains relatively stable, but seasonal fluctuations have narrowed. In 2025, monthly rates ranged between 25% and 28%, compared with summer peaks of over 32–33% in previous years.

After a sharp increase in 2024, pricing corrected. Average booked prices stood at $407.27 in 2023, rose to $470.83 in 2024, and declined to $413.24 for January–October 2025.

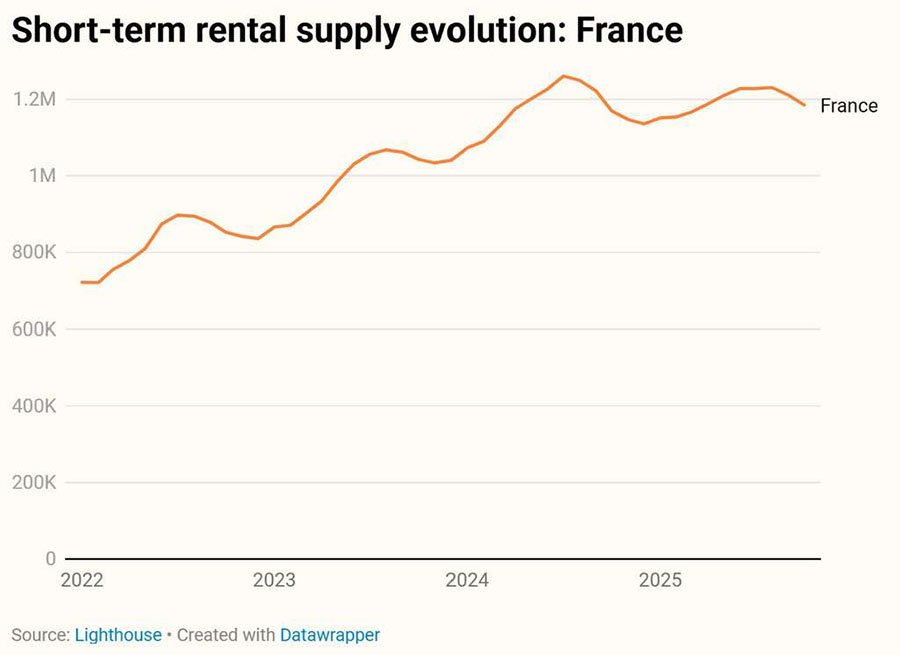

France

France tightened short-term rental regulation in late 2024 with the adoption of the Le Meur law. The legislation allows municipalities to reduce the rental cap for primary residences from 120 to 90 nights per year, strengthens energy efficiency requirements, and reduces tax allowances for owners. The country hosts more than 1.18 million short-term rental properties. Supply continued to grow in 2024, peaking in July during the Paris Olympic Games, before declining in 2025.

Occupancy follows a pronounced seasonal pattern. In 2023, the average rate reached 38.4%, declining to 34.5% in 2024 and to 29.0% for January–October 2025, reflecting a weaker peak season. Prices also adjusted. Summer peaks reached $205.70 in 2023 and $241.90 in 2024, before easing to $216.30 in 2025.

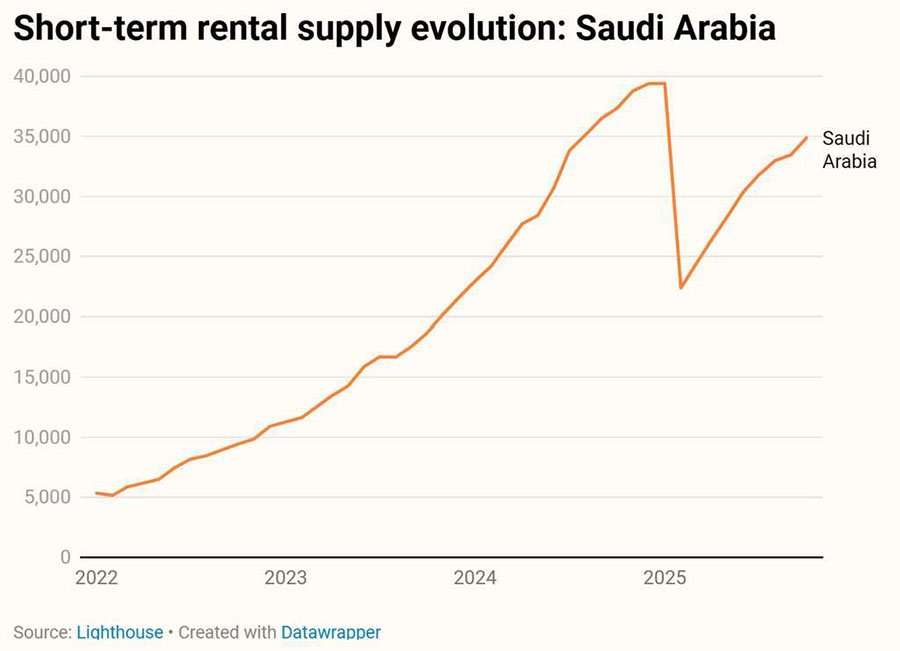

Saudi Arabia

Saudi Arabia introduced a strict licensing framework for short-term rentals. Owners are required to obtain permits through a government portal, and from March 2025 platforms were required to remove listings without valid licenses. The impact was immediate. In January 2025, supply stood at 39,401 listings, but fell to 22,369 by spring. By October, the market partially recovered to 34,865 listings.

Occupancy remained low, fluctuating between 11% and 19%, reflecting an early-stage market with excess supply. Prices also continued to decline. Average booked prices amounted to $235 in 2023, $196.45 in 2024, and $191.29 for January–October 2025.

Conclusion

Analysts at International Investment note that short-term rental regulation does not lead to uniform market contraction, but rather changes the way markets operate. In most jurisdictions, supply adapts to new rules, while occupancy and pricing dynamics are shaped by destination characteristics and the state of tourist demand. Under these conditions, the role of granular analytics and regular monitoring of market indicators increases.

For investors, this marks a transition into a more complex and capital-intensive phase. Tighter regulation is almost universally associated with higher operating and administrative costs — from licensing and compliance requirements to limits on rental duration and permitted property formats. At the same time, the pool of available assets narrows, and requirements for project due diligence increase.

A further factor is growing market polarization. In the most tightly regulated cities, constrained supply supports high price levels but reduces strategic flexibility. In less restricted jurisdictions, scale remains, but returns become more sensitive to management quality.