read also

Serbia Travel Warning Sparks Debate Over Croatia Tourism

Serbia Travel Warning Sparks Debate Over Croatia Tourism

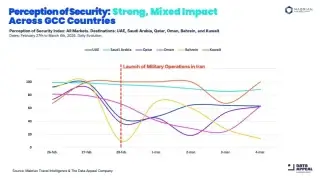

Middle East War Shifts Global Tourism Demand

Middle East War Shifts Global Tourism Demand

Airlines Reroute Flights Around the Middle East

Airlines Reroute Flights Around the Middle East

Dubai Faces Food Shortages Amid Middle East War

Dubai Faces Food Shortages Amid Middle East War

Maldives and Thailand Ease Visa Rules Amid Aviation Disruptions

Maldives and Thailand Ease Visa Rules Amid Aviation Disruptions

EU Launches Repatriation Flights for Stranded Travelers

EU Launches Repatriation Flights for Stranded Travelers

VAT Cut Risks in Apartment Sector in Ireland. Tax authority raises concerns

Photo: Resized.co

Ireland’s Revenue Commissioners have warned that a controversial reduction in VAT on apartment construction could result in accidental or fraudulent underpayments of tax across the construction sector. Internal records show that these concerns were raised ahead of Budget 2026 and communicated to Finance Minister Paschal Donohoe, highlighting the administrative risks of applying different VAT regimes to different types of housing.

Revenue officials cautioned that distinguishing between houses and apartments for VAT purposes would be extremely difficult to monitor in practice, increasing the likelihood of misapplication of tax rates.

Fiscal neutrality and enforcement challenges

Previous advice from the Revenue Commissioners noted that multiple VAT regimes within the housing sector could breach the principle of fiscal neutrality. The classification of developments and the correct application of VAT rates may become blurred, particularly on mixed or complex projects. In a pre-budget submission, officials explicitly warned that such a system could lead to both inadvertent errors and deliberate underpayments of VAT.

The Department of Finance acknowledged these risks in its briefing materials, while accepting that enforcement challenges would intensify under the proposed approach.

Government rationale and housing policy

Despite the warnings, the government confirmed that it would proceed with a VAT reduction applying exclusively to apartments. In a note included in the submission, Minister Donohoe stated that the decision was aligned with broader housing and economic policy objectives, particularly efforts to accelerate housing delivery during an ongoing supply crisis.

Officials argued that many apartment projects are currently not financially viable and that the VAT cut could help bridge this gap. Importantly, the stated intention is to stimulate development activity rather than directly reduce prices for end consumers.

Timeframe and market implications

The VAT reduction will apply to all apartments, including high-value developments and social housing schemes. Authorities stressed the importance of rapid implementation to avoid buyers delaying purchases in anticipation of the change, although they do not expect consumers to gain a direct pricing advantage from waiting.

According to the Department of Finance, the measure should remain in place for at least three years to reflect the full planning and development lifecycle of apartment projects. Given the likelihood of planning delays on larger schemes, a five-year duration was deemed more appropriate. A sunset clause expiring in December 2030 was subsequently agreed by the minister.

As reported by International Investment experts, Ireland’s VAT cut on apartments illustrates the tension between targeted tax incentives and the integrity of the tax system. For investors, the measure may improve project viability in the short term, but it also introduces compliance complexity and policy risk that must be carefully factored into long-term development strategies.