Вusiness / Real Estate / Investments / Tourism & hospitality / Analytics / Georgia / Real Estate Georgia 01.02.2026

Georgia Construction Market 2025: Permit Dynamics and Completed Volumes

Developers Shift Toward Larger Projects

In 2025, the Georgia construction market entered a phase of slowdown in terms of the number of new projects, while the volume of completed construction continued to grow, according to the National Statistics Office. This reflects a change in the structure of development and a shift toward larger-scale projects.

Building Permits

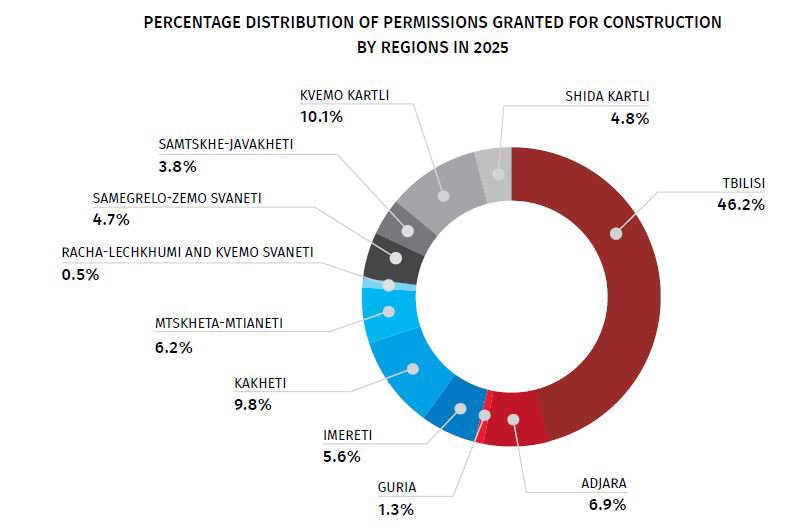

A total of 11,578 building permits were issued in Georgia, which is 4.2% less compared to the previous year. The total area of approved projects amounted to 11.4 million sq m, down by 5.3%.

More than 70% of all permits were issued in four regions of the country. Tbilisi accounted for 46.2% of the total volume. Significant shares were also recorded in Kvemo Kartli (10.1%), Kakheti (9.8%), and Adjara (6.9%). Thus, most new projects remain concentrated in the capital and economically most active regions.

By type of property, multifunctional residential complexes, retail space, and hotels dominated. The list also includes industrial and agricultural real estate. The market structure remains diversified, with no single segment clearly dominating.

How Many Projects Were Completed

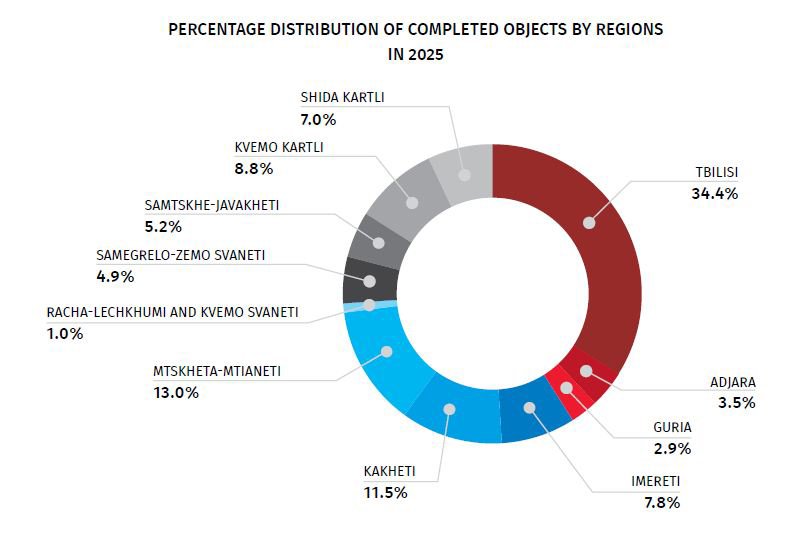

A total of 3,393 projects were completed — 5.9% fewer than in 2024. At the same time, their combined area reached 3.5 million sq m, increasing by 8.1%. The largest share of completed construction was recorded in Tbilisi — 34.4%. Significant figures were also noted in Mtskheta–Mtianeti (13.0%), Kakheti (11.5%), and Kvemo Kartli (8.8%).

In Adjara, the figure stood at 3.5%, which is noticeably lower than its share in the structure of issued permits and reflects a gap between declared projects and their actual completion pace.

What Is Happening in Georgia’s Real Estate Market

Data for 2025 point to a phase of moderate correction in the construction sector. The decline in the number of permits is combined with growth in the average size of completed projects, indicating a shift toward more capital-intensive and large-scale development formats. This trend creates conditions for further market consolidation and strengthens the role of regions with stable investment demand, primarily Tbilisi and Adjara.

A study by Galt & Taggart previously noted a decline in buyer activity in Batumi’s apartment market. In 2022–2023, between 3,000 and 3,400 new apartments were sold, while in 2024 the figure fell to around 2,000. In the first eight months of 2025, only about 1,500 units were sold, against supply of roughly 6,000. The market is experiencing an oversupply of housing. About 30% of new properties move to the secondary market within the first two years after completion, and sales in this segment have almost halved compared to 2022.

At the same time, Batumi’s housing stock continues to expand. In 2020, the city had 86,000 apartments, and by 2024 this number had grown to 119,000. Between 2025 and 2029, around 58,000 new units are planned, of which 46,300 are intended for short-term rental — 80% of the total volume. In some districts, the share of investment apartments reaches 96%.

Real Estate Yields in Georgia

Against the backdrop of housing oversupply, gross yields have started to decline. According to Galt & Taggart, in 2023 they were estimated at 10%, while in 2025 they are around 7.4%. In the future, this показатель may fall to 5.1% or even 3.4%.

Analysts at International Investment note that nominal apartment yields of 7–6% are not achievable in practice. After deducting all operating expenses — cleaning, commissions, maintenance, vacancy periods, utilities, repairs — actual returns shift into the range of 3–4% net, even with professional management.

In many cases, real figures are even lower. Additional calculations show that under a scenario of doubling the apartment stock — exactly the growth projected by Galt & Taggart — net yields could decline to 1.5–2%.

Comparison of Real Estate Yields in Georgia: Apartments vs Hotel Format

A 35 sq m studio priced at $59,500 generates around $1,870 in net annual income from long-term rental, which corresponds to a yield of about 3% and a payback period of roughly 32 years. Short-term rental shows higher gross revenue, but after all expenses net yield remains at around 2.8%. On average, standard apartments with a nightly rate of about $34 and occupancy of 31% generate gross income of approximately $3,847 per year.

The hotel format demonstrates a fundamentally different economic model. In branded hotels, with an average nightly rate of around $286 and occupancy of 68–71%, gross income per room reaches $72,112 per year — 19 times higher than in apartments. After deducting management company expenses, net profit can exceed $34,000, ensuring yields in the range of 10–17%. Hotels have a higher price per square meter, but its return is almost five times higher than in apartments, making this format a more predictable investment instrument.

Among the most attractive luxury branded projects for investors, experts highlight the hotel complex Wyndham Grand Batumi Gonio, where the contract officially specifies a guaranteed yield of 10%. The potential yield can reach 19% or higher.