Singapore Housing Prices Rise Despite Cooling Measures and Declining Demand

Photo: Unsplash

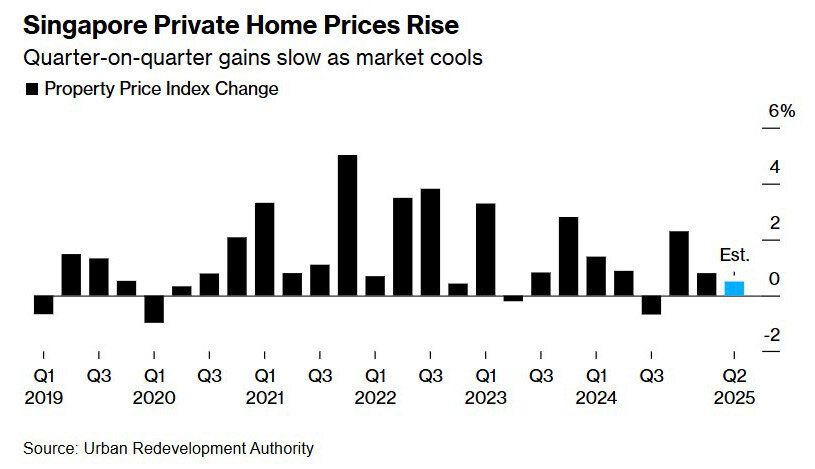

In the second quarter of 2025, Singapore’s private housing price index rose by 0.5% compared to January–March. This upward trend has continued for nine months, despite the government’s efforts to curb price growth. Meanwhile, new home sales fell to the lowest level, reports Bloomberg, citing data from the Urban Redevelopment Authority.

It is worth recalling that at the end of 2024, Singapore saw a sharp price spike, especially in the new condominium segment. The average price per square meter in such projects increased by 2.3% quarterly, reaching the highest level since the beginning of the pandemic. Simultaneously, in December, transaction volumes exceeded a decade-high, with more than 1,400 new apartments sold — the highest figure since 2013.

Experts noted that developers began using competitive pricing strategies to maintain sales momentum and sustain buyer interest amid a growing supply. Some developers are also revising layouts and enhancing marketing approaches, focusing on flexible and high-tech housing to meet new buyer demands. They added that private housing prices in Singapore remain 3.1% higher than last year’s levels.

This was seen as a reflection of the market’s strong fundamentals and the long-term trend of rising property values amid limited land availability. Meanwhile, analysts from Citigroup and Morgan Stanley pointed to the likelihood of further government interventions. In recent years, authorities have repeatedly stepped in, especially after prices surged post-pandemic. Measures included raising stamp duty for foreign buyers to 60% — one of the highest rates globally — as well as tightening lending criteria and restricting resale opportunities. Special attention has been paid to the secondary market for public housing, where most transactions occur. The government has also adjusted land supply mechanisms, reducing plots offered in the main government land sales program while expanding the so-called Reserve List, which includes sites launched for tender only if there’s sufficient developer interest. This structure allows for flexible supply management and adaptation to market dynamics.

In the first quarter of 2025, preliminary data showed a 0.6% increase over the previous three months, later revised upward to 0.8%. Suburban new home demand remained strong, with January and February seeing the highest transaction volumes in the past decade. However, in May, new private home sales fell to a five-month low.

Analysts attribute declining buyer activity to external economic uncertainty and cautious market sentiment. The US’s protectionist trade policies amplify risks for Singapore’s export-driven economy, affecting the behavior of both buyers and developers — some are delaying purchases, while others postpone launching new projects. Against this backdrop, the private housing market maintains positive momentum driven by domestic demand, but growth rates are slowing compared to the beginning of the year.

Interest in specific properties remains. For example, a plot on Dunearn Road, located in a prestigious area, attracted significant attention: in June, nine bids were submitted. This is the highest number for government land sales in the private housing market since 2021, CBRE Group notes. Such competition underscores continued interest in select prime locations despite overall caution among developers.

Market outlooks vary. Morgan Stanley forecasts a 3% drop in home prices for the year — potentially the first annual decline after an eight-year rally. Meanwhile, Citigroup and Bloomberg Intelligence believe the market has adapted to the new environment and may grow by up to 3%. Similar views are held by Tay Huey Ying of JLL, who notes that buyers remain cautious amid external risks and ongoing cooling measures.

Experts at CBRE expect private property prices to increase by 3–4% during the year, citing low levels of unsold inventory and stable household finances as factors supporting demand. Savills estimates price growth could reach up to 7% in 2025. According to their analysts, the market has already adjusted to existing restrictions, and buying activity in well-connected areas remains robust.

See also:

Global Real Estate Trends and Changing Behavior of Ultra-High-Net-Worth Individuals: Wealth Report 2025 Analysis

Global Public Debt in 2025: IMF Ranking

Quality of Life in 2025: Leaders and Laggards According to CEOWORLD

How Startup Support Impacts Economic Growth: Global Ranking