read also

Americans Lead Non-EEA Property Purchases in Iceland

Americans Lead Non-EEA Property Purchases in Iceland

Tourism Crisis in Germany, Iceland and Ireland

Tourism Crisis in Germany, Iceland and Ireland

Tour Operators Lose Millions Due to Middle East Crisis

Tour Operators Lose Millions Due to Middle East Crisis

Lithuania Debates a Housing Bubble: House prices accelerate nationwide

Lithuania Debates a Housing Bubble: House prices accelerate nationwide

China’s Property Crisis Increases Risks for Banks

China’s Property Crisis Increases Risks for Banks

War Spreads Beyond the Middle East: Strike on Europe

War Spreads Beyond the Middle East: Strike on Europe

Tourism & hospitality / Analytics / Research / News / Reviews / Georgia / Tourism Georgia 20.01.2026

Tourism in Georgia in 2025: figures, markets, and trends

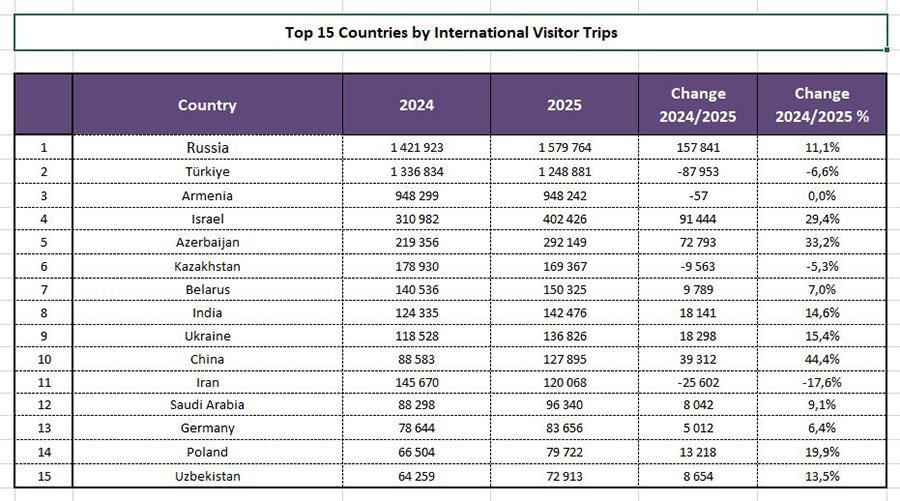

Top 15 countries

The largest number of visits to Georgia traditionally came from Russia — over 1.5 million, up 11.1% compared to 2024. Turkey remains one of the key markets, with more than 1.2 million visits (-6.6%). Armenia ranked third by number of trips, at 948,242, without sharp fluctuations.

Israel increased its figure by 29.4%, to 402,426. Azerbaijan posted an even higher growth rate of 33.2%, reaching 292,149. Kazakhstan ranked sixth with 169,367 visits, showing a slight decline, while Belarus placed seventh with 150,325 visits (+7%).

The presence of visitors from Asia expanded noticeably. In 2025, 127,895 visits were recorded from China (+44.4%) and 142,476 from India (+14.6%).

Positive changes were also recorded in other priority markets. From the Gulf countries, 145,513 visitors arrived during the period, 3.4% more than in 2024. The most active growth within this segment came from Saudi Arabia, where the number of trips increased by 9.1%.

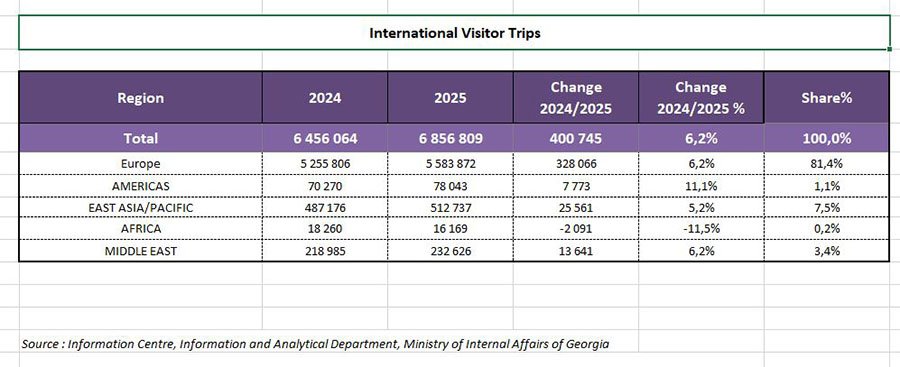

Regional statistics

In 2025, the number of international trips to Georgia reached 6.86 million — 6.2% more than in 2024, or an increase of 400.7 thousand. European countries dominated, accounting for more than 5.58 million trips, with their share exceeding 81% of the total volume.

They were followed by Asia-Pacific countries with 512,737 trips (+5.2%) and the Middle East with 232,626 (+6.2%). The share of the Americas increased by 11.1%, to 78,043. Africa recorded a decline of 11.5%; however, absolute figures for these countries had been low even earlier, remaining at around 16–18 thousand.

Visits from the EU and the UK

Countries of the European Union and the United Kingdom made a significant contribution to the overall result. In 2025, 499,890 visitors arrived in Georgia from these markets, 14% more than in 2024.

Germany led the group with 83,656 visits (+6.4%), followed by Poland with 79,722 (+19.9%). The United Kingdom, closing the top three, saw a 39.1% increase to 45,018. Greece recorded 35,322 trips (+28.2%), while France accounted for 33,219 (+17.4%).

The most notable growth was seen in Spain — up 48.6% to 27,984. Ireland (+41.5%, 14,642), Cyprus (+40.5%, 12,356), and Italy (+39.4%, 27,146) also stood out.

Air travel gains popularity

The structure of trips to Georgia shifted markedly toward air travel. The number of arrivals by air increased to 2.85 million, up 17% compared to 2024. The share of air transport reached 41.6%.

Land routes, while retaining leadership by volume, showed a slight decline. A total of 3.95 million people entered the country via land borders, 0.5% less than in 2024. Their share amounted to 57.6%.

Rail travel remained stable, with the number of trips rising to 20.5 thousand (+2.9%). Maritime transport also showed positive dynamics, increasing by 9.6% to 30 thousand trips; however, its contribution remains minimal and does not exceed 0.4%.

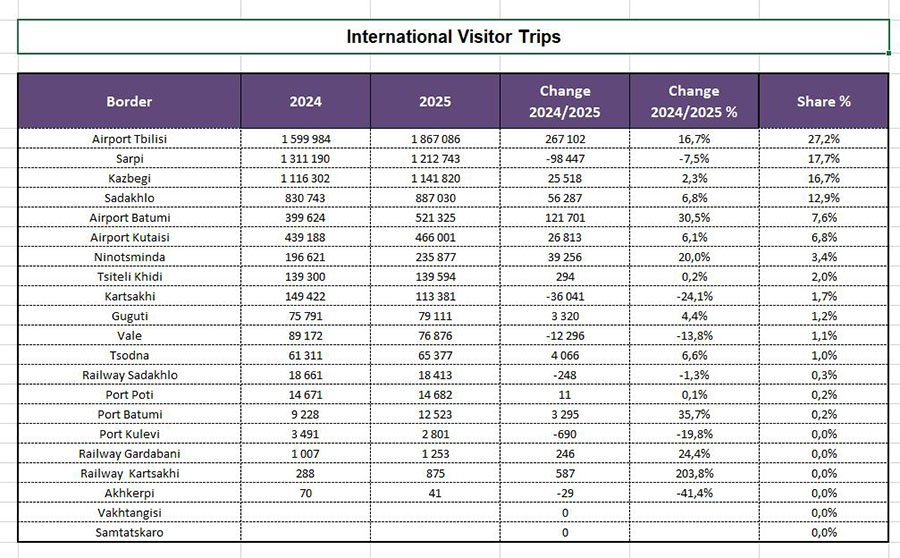

Which border checkpoints lead

In 2025, the distribution of international visits across major border checkpoints reflected a structural shift in favor of air transport. The six largest entry points accounted for a substantial share of the total flow, with growth at airports outpacing most land crossings.

The strongest figures were again recorded at Tbilisi Airport — around 1.8 million visits, up 16.7% compared to 2024. The capital’s terminal accounted for 27.2% of the total.

Sarpi, traditionally one of the busiest land crossings, recorded a 7.5% decline in 2025, to 1.2 million. The checkpoint maintained a high share in the overall structure, but its dynamics contrasted with the growth seen at airports.

Kazbegi closed the period with a moderate increase of 2.3%, reaching 1.14 million. Sadakhlo showed stronger dynamics, with visits up 6.8% to 887,030.

At Batumi Airport, the most pronounced growth was recorded — 521,325 trips, up 30.5%. Such rates point to a strengthening of Batumi’s role as an independent international destination rather than only a seasonal resort hub.

The Kutaisi terminal also showed positive dynamics. In 2025, 466,001 visits were recorded here (+6.1%). Growth was gradual and complemented the broader trend of expanding air connectivity as the main entry channel into the country.

Age and gender structure

The age and gender structure of visits in 2025 indicates that the main volume continues to come from economically active age groups, with growth recorded across all categories. The largest group remains those aged 31 to 50. In 2025, this cohort accounted for about 3.2 million visits (+4.2%) and nearly half of the total volume — 47.4%.

The number of visitors aged 51 to 70 increased to 1.7 million (+8.0%), with a share of 25.8%. A significant contribution also came from tourists aged 15 to 30 — 1.6 million trips (+7.3%).

The highest growth rates were recorded among visitors aged over 71. Although their share remains minimal at 2.5%, the number of visits increased by 17.8%, reaching 173,610.

The gender structure in 2025 remained relatively stable. The number of male visits reached 4.1 million, up 3.6%. Female visitors showed higher growth rates — up 10.4%, to 2.7 million.

Conclusion

Analysts at International Investment note that Georgia’s tourism sector continues to develop at record pace. The expansion of tourism strengthens the industry’s contribution to the national economy and creates a more predictable environment for investors, particularly in hospitality real estate, infrastructure, and related services.

Luxury-level properties are becoming increasingly sought after. This segment is still at an early stage of development in the country. Among the largest projects currently underway is Wyndham Grand Batumi Gonio. Globally, 85 hotels operate under the Wyndham Grand brand in this segment, and only three of them are offered in All Inclusive and Ultra All Inclusive formats. The complex in the prestigious resort area of Gonio will become the third project in this category, implemented in the Premium All Inclusive format.

The guaranteed return on real estate in this project is estimated at 10%, with potential returns of up to 19% or more, exceeding average profitability levels both in Georgia and across many international markets. Overall, investors worldwide are gradually shifting toward hospitality real estate, particularly branded hotels managed by international operators, which remain resilient even during crisis periods and deliver higher returns.

Prepared by Tatyana Borodina

Read more

Tbilisi Airport to Be Modernized: Investments to Reach $150 Million

Growth of Georgia’s GDP in 2026 to Again Outpace South Caucasus Countries: World Bank Forecast

Georgia Expands Investment Cooperation with the UAE: Real Estate and Digitalization

Продукты и гостиницы в лидерах безналичных трат — влияние иностранцев в Грузии

Georgia Recognised as One of the World’s Safest Countries in the Global Terrorism Index (GTI)

Подсказки: Georgia, tourism, travel statistics, 2025, tourism markets, air travel, hospitality, investment