читайте также

German Economy to Rebound in 2026

German Economy to Rebound in 2026

European Hotel Operating Profit: Margins, RevPAR and Costs

European Hotel Operating Profit: Margins, RevPAR and Costs

US housing construction fell to its lowest level since May 2020

US housing construction fell to its lowest level since May 2020

Snow Cyclone “Francis” in Russia: Widespread Disruptions at Airports and on Roads

Snow Cyclone “Francis” in Russia: Widespread Disruptions at Airports and on Roads

Canada tightens scrutiny at land crossings: Asylum claims show a clear decline

Canada tightens scrutiny at land crossings: Asylum claims show a clear decline

Wealthy Americans eye New Zealand luxury homes: Ban lift reshapes the top end of the market

Wealthy Americans eye New Zealand luxury homes: Ban lift reshapes the top end of the market

Вusiness / Real Estate / Investments / Analytics / Research / Reviews / Spain / Italy / Portugal 05.08.2025

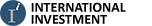

Southern Europe’s Real Estate Investment Soars by 32% – Hotels and Retail Lead the Market

Real estate investment in Italy, Spain, and Portugal reached €12.1 billion in the first half of 2025 — up 32% compared to the same period in 2024. According to a Cushman & Wakefield report, the surge was driven by the hotel and retail sectors, as well as redevelopment projects converting outdated offices into residential units.

Key Highlights

Spain attracted the largest share of investment (47%), followed by Italy (43%) and Portugal (10%).

Hotels and retail combined accounted for 57% of total transactions.

Investment distribution by asset class:

Offices: 18%

Industrial/logistics: 13%

Residential: 7%

Mixed-use: 1%

Other: 4%

Yield rates in Q2 2025 varied across countries and sectors:

Italy: Offices (4.25%), prime retail (3.75%), logistics (5.50%)

Spain: Offices (4.30%), retail (3.65%), logistics (5.00%)

Portugal: Offices (5.00%), retail (4.25%), logistics (5.50%)

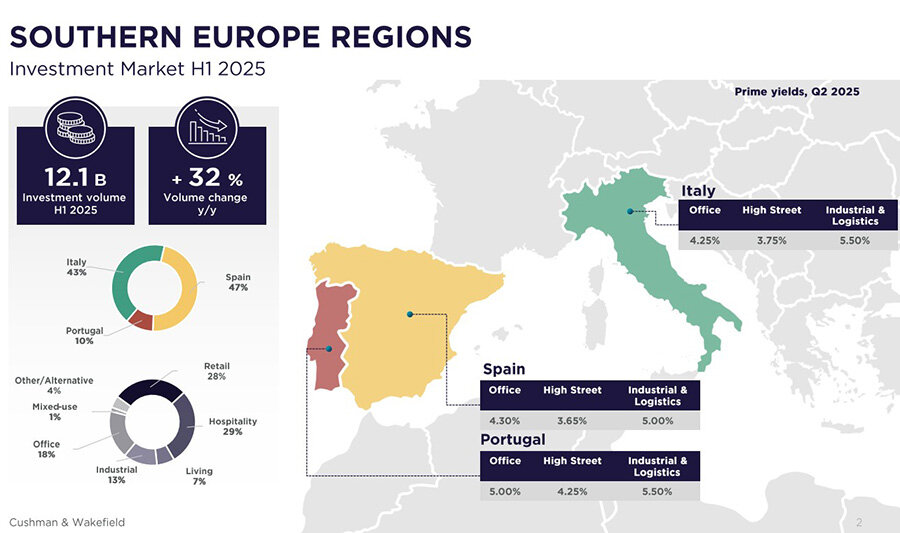

Spain

Spain saw €5.7 billion in real estate investment in H1 2025 (+16% YoY). Hotels (€1.6 billion) and retail dominated, both delivering record-breaking results. Residential maintained momentum, while logistics struggled. Offices began to recover, especially in Madrid.

Redevelopment gained traction — €320 million was spent in H1 2025 alone to convert obsolete offices into homes or hotels. Asset class shares:

Hotels: 28%

Retail: 28%

Offices: 24%

Logistics: 10.7%

Residential: 7%

Alternatives: 2%

Moody’s forecasts for Spain (2025):

GDP growth: 2.4%

Inflation: 2.3%

Unemployment: 10.7%

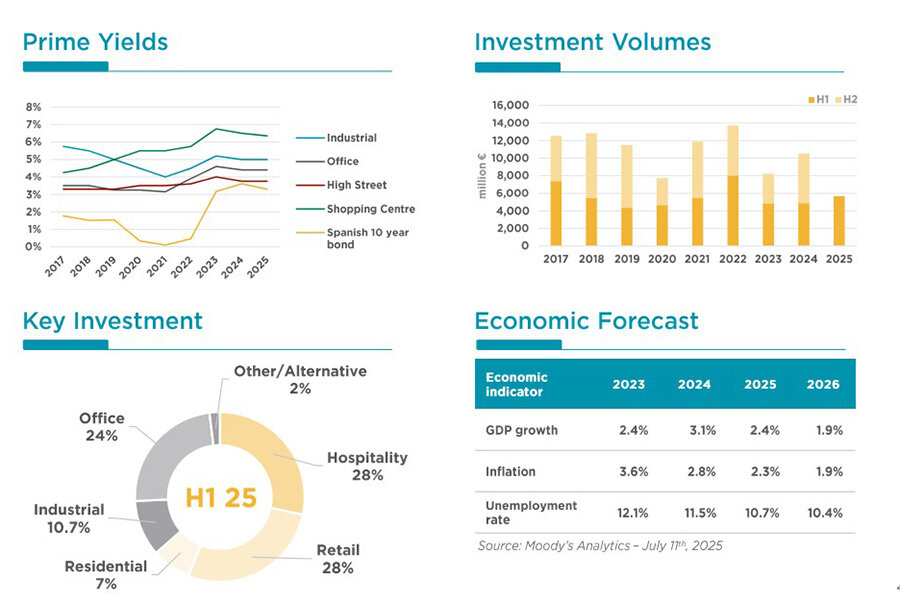

Italy

Italy attracted €5.1 billion in real estate investments in H1 2025 (+46% YoY). Hotels and retail were the primary drivers, supported by rising tourism and institutional interest.

Redevelopment of older assets was a key trend, especially converting offices to housing. Residential demand remained strong in Milan and Rome.

Investment breakdown:

Hotels: 29%

Retail: 24%

Logistics/Industrial: 16%

Offices: 13%

Residential: 6%

Mixed-use: 4%

Alternatives: 8%

Moody’s forecasts for Italy (2025):

GDP growth: 0.3%

Inflation: 1.7%

Unemployment: 6.0%

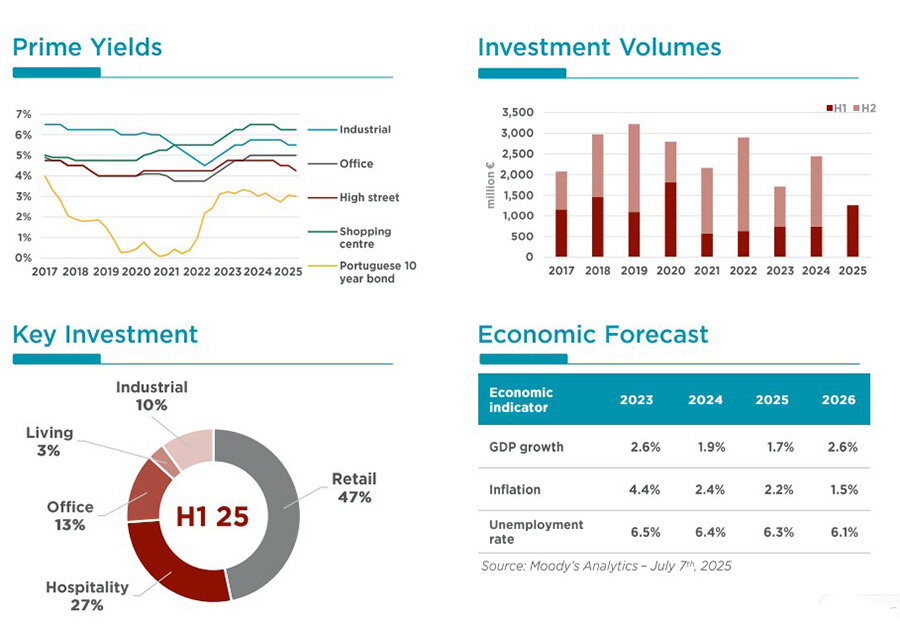

Portugal

Portugal’s commercial real estate investments reached €1.3 billion in H1 2025 (+70% YoY). Retail led with €587 million (mostly shopping centers), followed by:

Hospitality: €341 million

Offices: €163 million

Logistics: significant growth

Residential: decline, with expected recovery by year-end

Investment share:

Retail: 47%

Hospitality: 27%

Offices: 13%

Logistics: 10%

Residential: 3%

Moody’s forecasts for Portugal (2025):

GDP growth: 1.7%

Inflation: 2.2%

Unemployment: 6.2%

Conclusion

Cushman & Wakefield analysts highlight:

Hotels and retail are top performers due to strong fundamentals and tourist activity.

Urban regeneration is accelerating, with many outdated buildings being converted into hotels and housing.

Logistics remains attractive despite supply shortages.

Investors are shifting toward value-added opportunities with transformation potential.

With improving financing conditions and diversified strategies, Southern Europe’s property market is entering a mature, innovative growth phase.