read also

Sterling Falls as Oil Surge Clouds Rate Outlook

Sterling Falls as Oil Surge Clouds Rate Outlook

Air Travel in Europe Disrupted: Nearly 800 Flights Delayed

Air Travel in Europe Disrupted: Nearly 800 Flights Delayed

Brent Surges as Hormuz Risk Shakes Markets

Brent Surges as Hormuz Risk Shakes Markets

Up to 80% of On-Hold Dubai Property Deals Remain Uncertain

Up to 80% of On-Hold Dubai Property Deals Remain Uncertain

Dubai Property Market Faces 2026 Stress Test

Dubai Property Market Faces 2026 Stress Test

European Real Estate Recovery Gains Pace in 2026

European Real Estate Recovery Gains Pace in 2026

Вusiness / Real Estate / Investments / Analytics / Research / Croatia / Real Estate Croatia 21.01.2026

How the Airbnb short-term rental market works in Zagreb: occupancy rates, rates, and apartment profitability

Photo: Unsplash

The short-term rental market in Zagreb, Croatia, is developing with moderate occupancy and rising revenues. Demand is driven primarily by international guests, while the accommodation structure is increasingly shifting toward longer stays. Light regulation and smoothed seasonality allow the market to combine short tourist visits with stays lasting weeks or months, according to AirROI data.

Short-term rental market Size and Key Metrics Zagreb, Croatia

The short-term rental segment in Zagreb is marked by a large supply base alongside moderate actual occupancy. The city counts 2,584 active listings, with an average occupancy rate of 39.6% over the past 12 months. The average nightly rate stands at $104. Median annual income per listing is $11,802, while revenue growth is estimated at 9.3%.

The top 10% of listings earn more than $2,497 per month, with the next performance tier averaging around $1,726. The median level is close to $1,074, while the weakest-performing listings generate roughly $548. A similar gap appears in occupancy: market leaders approach 80%, while weaker performers remain near 20%.

Taken together, these parameters describe a market with a stable cash flow and no supply shortage. Financial outcomes here depend primarily on property characteristics and the chosen management strategy rather than overall demand levels.

Seasonality and Demand Short-term rental market Zagreb, Croatia

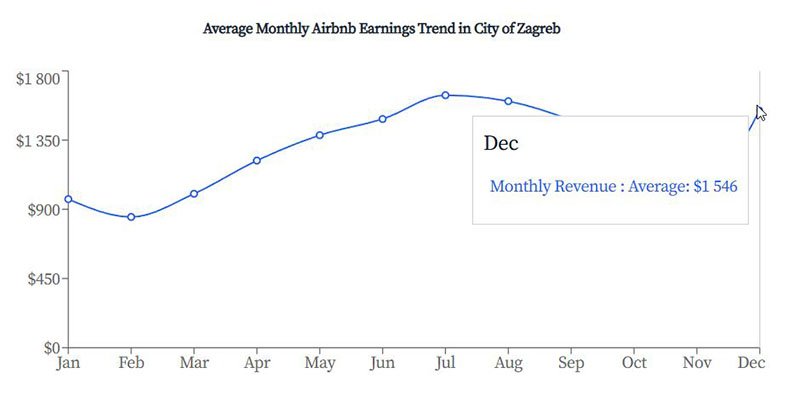

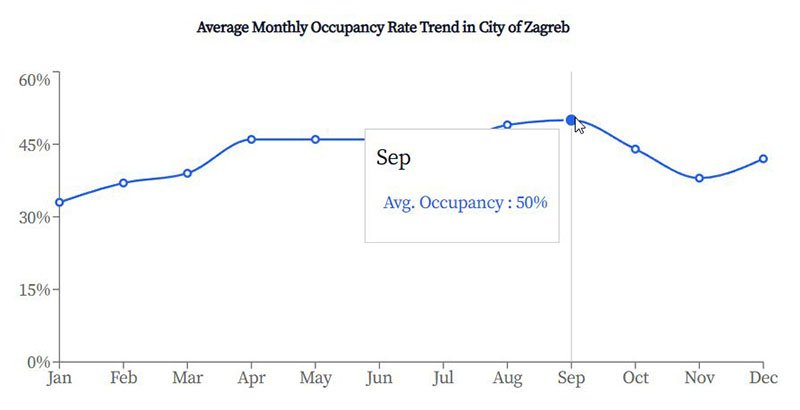

During the peak season, which includes July, August, and December, average monthly revenue reaches $1,597, with occupancy at 45.3% and an average nightly rate of $117. July is identified as the month with the highest revenue ($1,642), and bookings for this period are typically made about 61 days in advance.

In the low season (January–March), average monthly income declines to $939, occupancy stands at 36.5%, and the average rate is $99. February records the lowest figures ($850, 37%, $97) and the shortest booking lead time—around 20 days.

The highest occupancy is recorded in September at 50.1%, while the highest prices appear in December, reaching $122 per night. Across the market, accommodation is booked on average 41 days in advance.

Supply Structure and Accommodation Formats Airbnb apartments Zagreb, Croatia

Supply in Zagreb’s short-term rental market is almost entirely concentrated in self-contained accommodation. More than 93% of listings are entire apartments or flats, which together account for over 91% of the total base. Private rooms represent about 6%, while other formats appear only marginally and have little impact on overall structure.

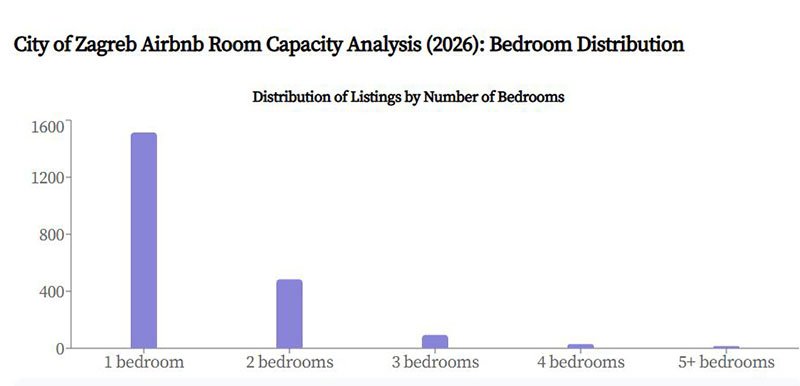

By size, the market remains compact. One-bedroom units make up 58.6% of supply, and together with two-bedroom apartments account for more than 77%. This configuration reflects a focus on solo travelers and couples. Accommodation for larger groups is limited: listings with three bedrooms or more do not exceed 5%.

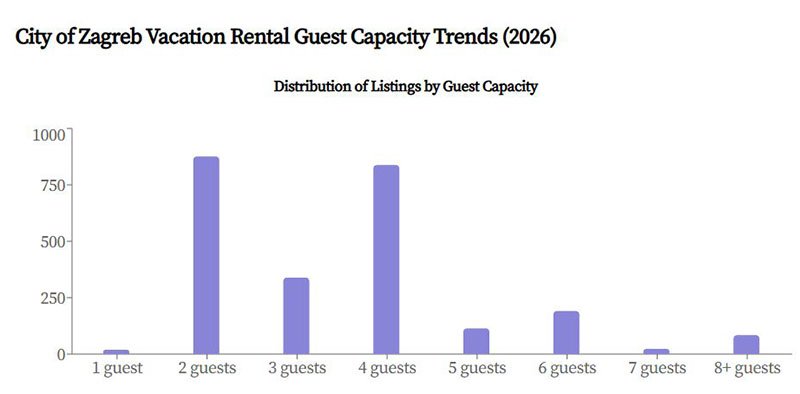

A similar pattern is evident in guest capacity. The most common format accommodates two guests, representing 33.9% of listings. Combined, options for two and four guests form about two-thirds of the market. Average designed capacity is 3.4 guests per unit, while listings for six or more guests remain niche.

Booking Formats and Length of Stay Airbnb apartments Zagreb, Croatia

Zagreb’s short-term rental market shows a mixed accommodation model where short stays coexist with longer-term residence. A minimum stay of one night is allowed by 40.9% of hosts, while another 21.7% set a two-night minimum. Nearly two-thirds of the market therefore targets short visits.

At the same time, a sizable long-stay segment has formed. A minimum stay of 30 nights is set by 27.7% of listings. Intermediate formats are far less common: requirements of three to six nights cover less than 10% of the base.

Cancellation terms also reflect a preference for flexibility. The most common option is a moderate policy, used by 38.3% of listings. Flexible terms are offered by 29.3%, while 24.3% choose firmer conditions. Strict policies are rare and account for less than 6% of the market.

Guest Profile and Demand Geography Airbnb apartments Zagreb, Croatia

Demand for short-term rentals in Zagreb is driven mainly by international visitors. Their share reaches 87.8%, while domestic trips account for about 12%, reinforcing the city’s status as an international destination.

By country of origin, the United States and Croatia lead, followed by the United Kingdom, Germany, and Canada. The language profile mirrors this geography: English dominates, with German playing a notable role, followed by French and Spanish. These factors directly shape communication formats and accommodation requirements.

The age profile skews toward younger travelers. The largest group consists of guests born after 2000. This strengthens demand for functional housing, reliable internet, and the option of longer stays.

Large Operators and Management Concentration Airbnb apartments Zagreb, Croatia

Zagreb’s short-term rental market shows a high degree of management concentration. A significant share of listings is controlled by professional operators managing dozens of units and generating combined annual revenues exceeding $1 million through stable occupancy and standardized processes.

The presence of large managers widens the gap between professional and individual hosting. Competition shifts toward service quality and pricing efficiency, raising the entry threshold for independent owners.

Location Patterns Airbnb apartments Zagreb, Croatia

The main concentration of short-term rental listings is found in Zagreb’s central districts. The highest density appears in the Upper Town (Gornji Grad) and Lower Town (Donji Grad), where demand is supported by tourist traffic, proximity to museums, business areas, and transport hubs. These locations form the core of the market and deliver the most stable occupancy.

Tkalčićeva Street is oriented toward urban leisure and nightlife. Accommodation here is popular with short-stay guests, and demand has a pronounced weekend profile. Ban Josip Jelačić Square is another key concentration point, serving as a universal location for both tourist and business trips.

Outside the historic center, activity shifts to districts with recreational and residential profiles. In Jarun, demand is supported by proximity to the lake and sports infrastructure; in Maksimir, by the park and family-oriented audience. These areas are more often chosen for longer stays and show less pronounced seasonal peaks.

What This Means for Investors in Airbnb apartments Zagreb, Croatia

Analysts at International Investment note that Zagreb’s short-term rental market operates with high supply density and moderate returns. With substantial costs for taxes, maintenance, and promotion, as well as periods of vacancy, there is a risk not only of losing profitability but of operating at a loss. Potential lies not in rate growth but in turnover, location, and management quality. Small apartments in central districts oriented toward international demand remain the most resilient.

Seasonal fluctuations are not extreme, and a sizable share of long-term stays reduces dependence on tourist peaks. This makes cash flows more predictable while simultaneously intensifying competition within the mass segment. Under conditions of light regulation and high concentration of professional operators, market entry requires an active operational model. Passive formats underperform, and investment outcomes depend on strategic precision and execution quality rather than on general market trends.

Подсказки: Airbnb, Zagreb, short-term rentals, rental market, occupancy rate, nightly rates, returns, Croatia, real estate analysis