read also

Sterling Falls as Oil Surge Clouds Rate Outlook

Sterling Falls as Oil Surge Clouds Rate Outlook

Air Travel in Europe Disrupted: Nearly 800 Flights Delayed

Air Travel in Europe Disrupted: Nearly 800 Flights Delayed

Brent Surges as Hormuz Risk Shakes Markets

Brent Surges as Hormuz Risk Shakes Markets

Up to 80% of On-Hold Dubai Property Deals Remain Uncertain

Up to 80% of On-Hold Dubai Property Deals Remain Uncertain

Dubai Property Market Faces 2026 Stress Test

Dubai Property Market Faces 2026 Stress Test

European Real Estate Recovery Gains Pace in 2026

European Real Estate Recovery Gains Pace in 2026

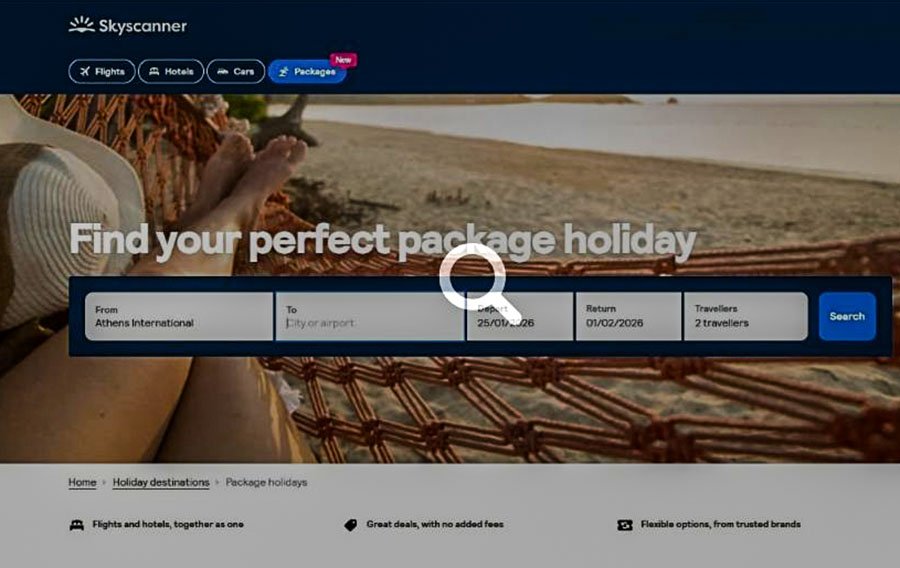

Skyscanner Redefines Package Travel

Photo: Travel Daily news

Skyscanner’s launch of a Package Holidays comparison tool marks a strategic shift for the metasearch giant. Long known primarily for flight comparison, the platform is now moving deeper into the holiday value chain, positioning itself closer to the moment when travelers commit not just to a flight, but to an entire trip.

The quiet comeback of package holidays

Package travel is regaining appeal as travelers seek simplicity amid rising prices, overcrowded destinations, and planning fatigue. By aggregating offers from major players such as TUI, Jet2, easyJet Holidays, and Expedia, Skyscanner taps into this renewed demand. What appears to be a convenience upgrade is, in reality, a bid to capture traffic that once flowed directly to tour operators and OTAs.

Consumer convenience, platform dependence

For users, the value proposition is clear: a single interface, granular filters, and ATOL-protected offers. Yet this convenience deepens reliance on a platform that does not sell holidays itself but increasingly shapes purchasing decisions. Skyscanner remains a comparison engine, but one that now sits higher in the decision funnel.

Why the move matters for the industry

The expansion strengthens the power of metasearch at the expense of suppliers. Operators gain visibility, but at the cost of pricing control and brand ownership. As competition for ranking intensifies, dependence on aggregators risks compressing margins, particularly for mid-sized and specialist travel providers.

Packages as a response to uncertainty

Rising interest in package holidays reflects a broader behavioral shift. Travelers are prioritizing predictability over flexibility, favoring fixed pricing, single-provider accountability, and financial protection. Skyscanner is effectively monetizing this desire for certainty by offering choice within a standardized framework.

A neutral platform or a silent gatekeeper

While Skyscanner insists it remains a neutral comparison service, its growing influence over visibility and user choice positions it as a de facto gatekeeper. The more travelers rely on its results, the more power the platform gains in shaping demand — and, indirectly, market outcomes.

Implications for 2026 travel dynamics

The package holiday comparison tool aligns with a broader trend toward simplification and channel consolidation. In the short term, travelers benefit from transparency and ease. Over time, however, control over distribution and pricing is likely to concentrate further in the hands of a few global platforms.

As reported by experts at International Investment, Skyscanner’s move into package holiday comparison signals a deeper consolidation of platform power in travel. While consumers gain convenience, operators face growing dependence on metasearch visibility, raising long-term questions about margins, competition, and market balance.