Tourism & hospitality / Analytics / News / China / Japan / Tourism China / Tourism Japan / Thailand / Tourism Thailand 02.02.2026

Chinese Tourists Choose South Korea Over Japan for Lunar New Year

Visa easing and politics have reshaped the region’s tourism economy in just a few months

Photo: Bloomberg

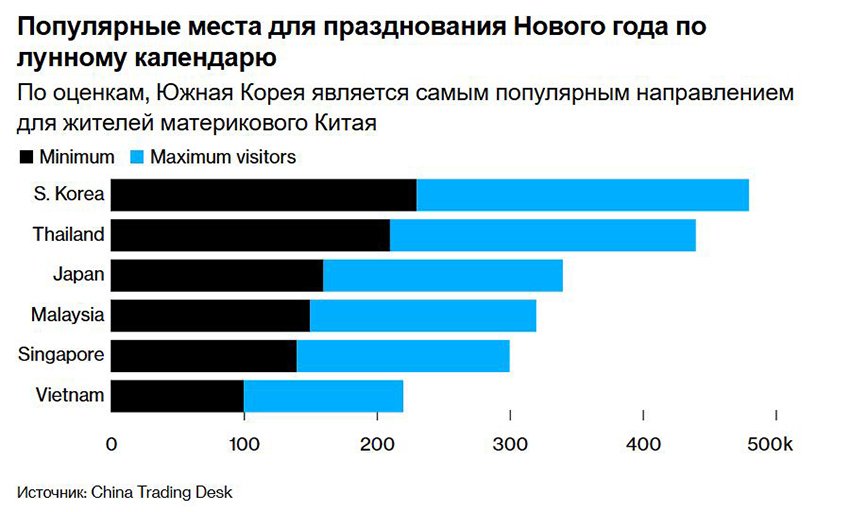

South Korea may overtake Japan for the first time since the pandemic and become the top overseas destination for tourists from mainland China during the Lunar New Year holiday period, Bloomberg reports. The country expects up to 250,000 visitors from China, while the flow to Japan could shrink by nearly 60%. Experts link the new trends to economic factors, visa policy and growing geopolitical tensions.

Scale of demand: up 52% year on year

According to estimates by market research firm China Trading Desk, between 230,000 and 250,000 tourists from mainland China are expected to visit South Korea during the nine-day holiday starting on February 15. This represents a 52% increase compared with last year, when the holiday period was one day shorter. It marks one of the sharpest jumps in Chinese outbound tourism in the region in recent years.

The most popular destinations are Seoul, Busan and Jeju Island. Tourists are drawn not only by urban experiences, but also by shopping, dining and entertainment tailored specifically to international visitors. Another important factor is the exchange rate: with the won relatively weak, trips to South Korea are perceived as more affordable in terms of everyday spending, especially on retail and food.

Cultural appeal also plays a role. The global spread of Korean pop culture, including K-pop, TV series and the beauty industry, has created strong demand among young Chinese travelers, for whom a trip to South Korea is increasingly becoming a самостоятельная цель rather than a fallback alternative to other destinations.

Visa policy and “rewritten itineraries”

The key driver behind the growing interest in South Korea has been the liberalization of visa rules for Chinese citizens. Seoul has extended its visa-free entry policy for Chinese tour groups until June 2026, significantly simplifying travel planning and reducing costs for tour operators.

This decision has led to a rapid restructuring of travel programs. Cruise lines and travel agencies have begun to adjust spring itineraries on a large scale, replacing Japanese routes with Korean ones during the holiday season. Market participants say tour operators are effectively rewriting schedules to match demand that is shifting toward South Korea.

Subramania Bhatt, CEO of China Trading Desk, notes that the market is showing a classic substitution effect: travelers are not abandoning trips altogether, but are choosing more affordable and politically neutral destinations. South Korea is becoming the “default” option for organized tourism from China, while Japan is gradually losing this status.

Japan loses up to 60% of Chinese tourists

Japan is facing a sharp slowdown in tourist arrivals from China. In November 2025, growth fell to just 3% year on year, reaching 562,000 visitors — the weakest performance in almost four years. Beijing restricted travel following comments by Prime Minister Sanae Takaichi on Taiwan and rising diplomatic tensions. In January, state media again advised citizens to avoid trips, citing “serious safety risks” during the holiday period. Overall losses in the tourism sector have already reached nearly 57 billion yen, and Japan could lose up to 1.2 trillion yen in 2026 if restrictions persist.

The number of tourists from mainland China during the Lunar New Year may drop by nearly 60% compared with last season. Japan also risks recording its first annual decline in foreign visitors since the pandemic. In 2026, total arrivals could fall by around 2.8% to 41.4 million, while bookings from China between January and April are already down about 50%. These trends are especially sensitive for the Japanese economy, as Chinese travelers have traditionally formed the largest segment of inbound tourism spending.

Airlines confirm a sharp shift in flows

The change in demand is already visible in airline schedules. The number of flights between mainland China and South Korea during the holiday period has increased by nearly 25% year on year, exceeding 1,330. This is the highest level since before the pandemic and one of the clearest signs that the market is betting on sustained growth in Korean travel.

Japan shows the opposite trend. Scheduled flights from China have fallen by 48%, to just over 800. Major Chinese airlines have extended fee waivers for cancellations on Japan routes until the end of October, in an effort to reduce risks for passengers and maintain demand amid uncertainty.

The gap in air connectivity reinforces the redistribution of tourist flows. Denser flight schedules to South Korea make it more attractive not only for organized groups but also for independent travelers, while the reduced capacity to Japan limits the country’s ability to recover traffic even if political conditions improve.

Regional effect: declining interest in Thailand

An additional boost for South Korea has come from declining interest in Thailand, which until recently was one of the most popular destinations for Chinese tourists. Some travelers canceled trips after a high-profile case in which a Chinese actor was abducted and later rescued from a scam center in Myanmar.

Tensions on the Thailand–Cambodia border have also raised safety concerns across the region. As a result, part of the tourist demand has shifted toward more stable destinations, and South Korea has quickly filled the gap.

This has reinforced the broader shift in travel patterns: Chinese tourists are not cutting back on trips altogether, but are changing destinations, favoring countries with more predictable conditions and clearer entry rules.

How much Chinese tourists spend

The redistribution of flows is also reflected in spending patterns. According to China Trading Desk, tourist spending from mainland China in South Korea during the holiday week is expected to exceed $330 million. In Japan, the figure is projected at $250–300 million. South Korea may surpass Japan in Chinese tourist spending during the peak season for the first time in several years.

Rising demand is already being felt in medical and beauty tourism. Consulting services that connect foreign visitors with Korean skincare and plastic surgery clinics report hundreds of inquiries from Chinese clients for the holiday period. A year ago, such requests were rare.

The financial impact is also visible in equity markets. Shares of South Korean retail and consumer services companies have risen on expectations that tourist spending will increasingly flow into the domestic economy.

Domestic reaction and a new balance of expectations

The surge in tourism has triggered mixed reactions within South Korea. Social media and local outlets have linked the influx of Chinese visitors to rising crime, although authorities have dismissed these claims as unfounded. A petition calling for the cancellation of the visa-free policy for Chinese tour groups has gathered around 60,000 signatures.

For Japan, the consequences look more structural than seasonal. Bloomberg Intelligence analysts forecast that in 2026 the country may record its first annual decline in foreign visitors since the pandemic — about 2.8%, to 41.4 million. Bookings from China between January and April are already down roughly 50%. South Korea, by contrast, expects more than 7 million Chinese tourists in 2026, up 15% from last year. Investors have taken note: shares of South Korean retail and consumer goods companies have risen in recent weeks.

Analysts at International Investment say the current trend reflects a broader shift in regional tourism logic. Chinese outbound travel is increasingly driven not only by prices and visa conditions, but also by political signals and perceptions of safety, weakening the positions of Japan and Thailand. In this model, South Korea benefits as a predictable and manageable market, while competitors face the risk of long-term reassessment of their role in East Asia’s tourism economy. For investors, this implies a growing focus on hotel real estate, retail and service infrastructure in South Korea.