Вusiness / Real Estate / Investments / Tourism & hospitality / Analytics / Research / United Kingdom / Germany / France 29.11.2025

Real Estate in EMEA in 2026: Rising Investor Interest and Emerging Warning Signs

The EMEA region remains one of the key destinations for international capital, according to the Global Investor Outlook 2026 report, as noted in a new study. Colliers analysts expect investment activity to strengthen in 2026 as domestic investors return to major markets. New large office deals are anticipated, along with consistent growth in the industrial, logistics, and hospitality sectors. At the same time, risks related to construction and operating costs, as well as geopolitical pressures, continue to persist.

Europe maintains a strong position in the global investment market: seven regional countries are in the TOP-10 destinations for cross-border capital. Among them is the United Kingdom, as well as Germany and France—markets that historically relied heavily on domestic investors. Luke Dawson, Head of Global & EMEA Capital Markets at Colliers, emphasizes that Europe’s advantages lie in its liquidity, transparency, and stability.

Industrial & Logistics

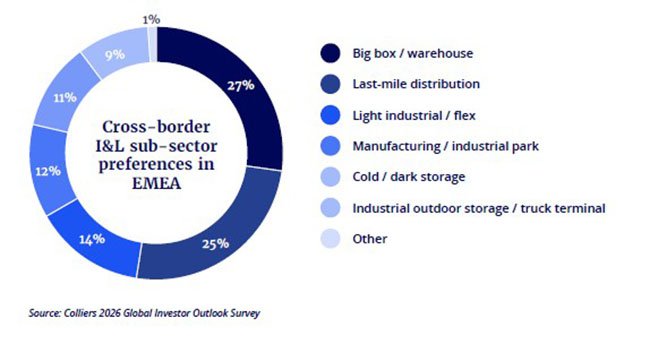

In 2024, investment volumes in the industrial and logistics segment reached €40–50 billion. In 2025, long-term NATO plans to increase defense spending to €50 billion annually are adding positive momentum. The primary driver remains the growth of e-commerce: the still-low share of online trade creates considerable room for market expansion.

Major markets—Germany, the Netherlands, and the UK—remain highly active, but rising prices and a shortage of quality assets are limiting deal flow. Against this backdrop, Central and Eastern Europe is strengthening its position, offering lower costs, available development sites, and moderate yields. Significant investment inflows have already been recorded in Poland and Slovakia.

Offices

The office market is gradually recovering in major capitals as well as secondary cities. Its more attractive yields compared to several other segments are helping to sustain demand. Major transactions are returning to Paris and London: for the first time in several years, most deals now exceed £100 million (US$133 million).

Investor interest in joint ventures is growing—particularly in assets with value-add potential and premium office buildings. These structures allow investors to participate directly in large projects. This trend is expected to continue into 2026, supported by potential recapitalization deals.

Luke Dawson highlights that investors increasingly focus on locations with stable demand and aim to create additional value through discounted acquisitions or modernization—approaches that can ensure future income growth.

Residential & Hospitality

Residential. Multifamily housing remains a core asset class, yet the student housing segment is rapidly narrowing the gap. A chronic shortage of quality properties continues to drive demand, especially in UK university cities. Similar dynamics are gaining momentum in Spain and Portugal, with additional opportunities emerging in Germany and Italy.

Matthew Ardron, Director of EMEA Capital Markets, explains that whereas earlier the primary focus was on new development, investors are now actively considering existing buildings where modernization and professional management can secure stable yields.

Hotels are shifting from traditional lease models toward asset management and franchising approaches. These models offer higher returns and rely on growing operator expertise and lender support.

London maintains its leadership position, followed by France, Germany, and Spain. Further growth is expected in Greece and the Adriatic countries, where favorable macroeconomic conditions and limited new supply provide strong investment prospects.

Other Sectors

Data centers continue to expand, although capital volumes still lag behind the United States. Demand for sites is high: technology development, AI, and defense-related solutions are driving sustained growth. Key constraints include access to energy capacity and environmental regulations.

Self-storage is also gaining momentum: stable demand and limited supply in major cities make such assets attractive for value-add projects and the expansion of operator networks.

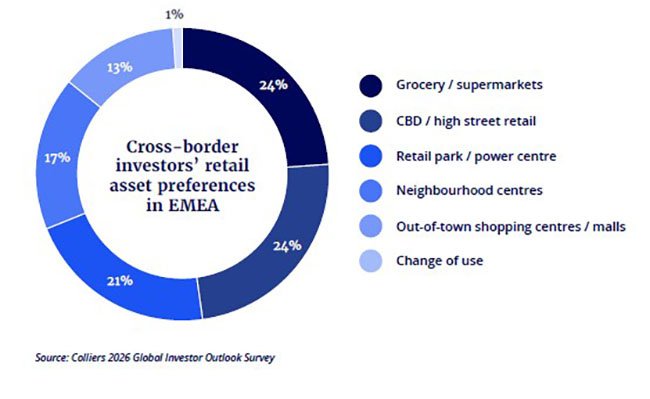

Retail. Investor attention is focused on grocery stores, everyday-goods retail, retail parks, and high-street premises. These will remain the top priorities in 2026. Reduced development activity is increasing the appeal of prime properties: with limited new supply, they are perceived as more resilient assets. Premium retail spaces continue to show particularly strong performance.

Risks & Outlook

The shortage of affordable housing persists, although the activation of government programs may open new opportunities for social and multifamily development. European infrastructure investments and reshoring of supply chains will support demand for industrial assets. Office activity is expected to continue strengthening.

However, growth in the data center and student housing segments may be constrained by limited supply and regulatory uncertainty. The hospitality sector will offer new opportunities for partnership-based projects, especially in branded properties.

At the same time, inflation and slow monetary easing could delay transactions—particularly in the UK. High construction and operating costs remain a major challenge across all asset classes.

Analysts at International Investment note that European real estate markets offer strong transparency and institutional maturity, yet these advantages come with stringent regulations and significant associated costs. Investors must account for high tax burdens, mandatory fees, strict energy-efficiency requirements, and lengthy approval procedures. Against this backdrop, returns on European assets remain significantly lower than in many emerging markets.

Experts also highlight broader macroeconomic risks. A recent ECB report points to persistent financial vulnerabilities—from high sovereign debt levels to weak economic growth. Some analysts even warn of a potential fiscal crisis, with the UK, Germany, and France leading negative forecasts. These factors call for cautious strategies and a thorough assessment of long-term capital allocation.