read also

UBS Bubble Index 2025: overheating risks in housing markets

Photo: Visual Capitalist

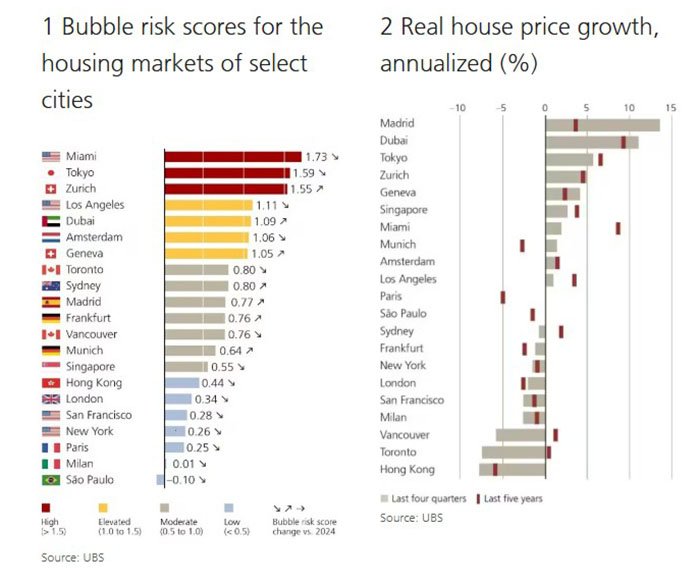

In 2025, real house prices have remained virtually unchanged, as declining affordability continues to restrain demand. At the same time, the risks of bubble formation persist, note UBS experts following their analysis of housing markets in 21 cities worldwide. The Global Real Estate Bubble Index identifies the most pronounced overheating in the property markets of Miami, Tokyo and Zurich.

Bubble formation risks

The bubble index for Miami stands at 1.73, the highest negative rating in the survey. In Tokyo, the indicator reaches 1.59, and in Zurich 1.55. In these cities, house prices in recent years have grown significantly faster than incomes and rents, increasing vulnerability to market correction. Markets with elevated risks also include Los Angeles (1.11), Dubai (1.09), Amsterdam (1.06) and Geneva (1.05). These markets continue to show signs of overheating linked to a divergence between housing price dynamics and fundamental indicators.

The category of moderate risks includes Sydney and Toronto, both with an index value of 0.80, as well as Madrid (0.77), Frankfurt (0.76), Vancouver (0.76) and Munich (0.64). These markets are characterised by a softening of previously pronounced imbalances amid price adjustments and higher borrowing costs in recent years.

Low bubble risk is observed in London (0.34), San Francisco (0.28), New York (0.26) and Paris (0.25). These markets have already undergone a correction phase after previous peaks, and price dynamics in recent years have been more restrained. The lowest index values were recorded in Milan (0.01) and São Paulo (–0.10), where signs of housing market overheating are virtually absent.

Price dynamics

Overall, the situation in global housing markets continues to stabilise. “The overall hype has faded, and the average risk of a real estate bubble in major cities has been declining for the third year in a row,” notes Matthias Holzhey, lead author of the study at UBS Global Wealth Management’s investment division. In cities where overheating was high in 2021, including Frankfurt, Paris, Toronto, Hong Kong and Vancouver, real house prices have fallen by almost 20% from peak levels amid rising interest rates. In cities with less pronounced imbalances, real price declines have averaged around 5%.

At the same time, some markets show the opposite trend. Over the past five years, the fastest real price growth has been recorded in Dubai and Miami, at around 50%. Significant appreciation has also been observed in Tokyo, where prices rose by 35%, and in Zurich, by almost 25%. Compared with last year, Madrid showed the strongest momentum: over the past four quarters, housing prices there increased by 14%, the highest result among all cities analysed.

UBS cities in focus: what is driving the markets

Miami is the market with the most pronounced signs of overheating. Over the past 15 years, the city has recorded the highest average annual real price growth among all cities in the study, at more than 5% per year. However, growth has slowed noticeably over the past four quarters: supply has increased, while pressure from maintenance and insurance costs has intensified. At the same time, international demand remains high, primarily from investors from Latin America, especially in the coastal premium condominium segment.

Tokyo: real house prices are about 35% higher than five years ago, while incomes and rents over the same period have increased by only a few percent. Population growth in the city is increasingly driven by international migration, supporting housing demand, including from foreign investors. At the same time, property prices are outperforming national averages, and affordability is deteriorating. Rising female employment, which supports household incomes, does not offset the shrinking working-age population, negatively affecting the market’s long-term outlook.

Zurich: purchase prices have increased by about 60% over the past decade, twice as fast as rents and five times faster than income growth. As a result, demand is shifting towards more affordable suburban municipalities. Zurich also shows the highest price-to-rent ratio among all cities in the study, only partially compensating investors for long-term risks. Nevertheless, no turning point is expected yet: low financing costs and a steady inflow of international companies continue to support demand.

Dubai: since mid-2023, real house prices have been rising at double-digit rates and are now about 50% above five-year-ago levels, the strongest growth among all cities analysed. Against this backdrop, bubble risk has increased for the second year in a row. Incomes are not keeping pace with price growth, as the emirate’s population has expanded by nearly 15% since 2020, and immigration inflows have intensified pressure on supply. At the same time, building permit data point to a potential increase in new housing volumes to 2017 levels. Competition for investment from Abu Dhabi and Riyadh is also intensifying.

London: real house prices remain about 20% below the 2016 peak and 5% below the 2007 high. Bubble risk has fallen from mid-2010s levels to near historical lows. At the same time, new construction volumes are at record lows, supporting rent growth. Demand from foreign buyers is gradually recovering, aided by a weak pound and the city’s global status, although tax surcharges and a less favourable regime for non-residents continue to restrain market activity.

Frankfurt: house prices have bottomed out after a prolonged downturn and in real terms remain about 20% below the mid-2022 peak. Market imbalances have eased, and bubble risk has declined from high to moderate. Demand is supported by steady growth in the financial sector, while rents in recent years have risen broadly in line with inflation and, according to UBS, will continue to increase in the coming quarters. Overall, limited supply creates a positive outlook for both prices and the rental market.

Affordability and regulation

Housing affordability continues to deteriorate. The highest burden is recorded in Hong Kong: purchasing an apartment of around 60 sq. m requires an income equivalent to roughly 14 years of work. In Tokyo, Paris and London, the average home price exceeds annual household income by more than ten times. On average across the analysed cities, the financially affordable living space for a skilled service worker has shrunk by about 30% compared with 2021.

Rising prices increase the likelihood of tighter regulation, emphasises Maciej Skoczek, author of the study at UBS Global Wealth Management’s investment division. New taxes, restrictions on property purchases and rent control measures have already reduced the attractiveness of previously popular markets, including Vancouver, Sydney, Amsterdam, Paris, New York, Singapore and London.

Nevertheless, in the medium term the housing market may receive new support. Growing public debt and the risk of financial constraints are boosting interest in assets with positive real returns, including real estate. UBS also expects central banks to begin cutting key interest rates by 2026, gradually reducing real financing costs.

Recommendations for investors

Analysts at International Investment note that such rankings can be used when selecting locations for investment. In cities with a high “bubble” risk, a potential price correction could significantly reduce property values and worsen expected returns or lead to losses. This is especially relevant for markets where overheating coincides with rapid price growth in recent years and demand depends heavily on financing conditions. Investors operating in locations such as Miami, Zurich or Dubai may want to reconsider their strategies: more carefully assess investment horizons, downside price scenarios and liquidity, and take into account the likelihood of tighter regulation amid worsening housing affordability.