read also

Denmark Set to Lead Nordic Growth Despite Novo Pressure

Denmark Set to Lead Nordic Growth Despite Novo Pressure

Sweden Urges Citizens to Hold Cash for Emergencies

Sweden Urges Citizens to Hold Cash for Emergencies

Indonesia Faces Growing Credit Rating Pressure

Indonesia Faces Growing Credit Rating Pressure

Poland Rethinks Rate Cuts as Iran War Risks Rise

Poland Rethinks Rate Cuts as Iran War Risks Rise

UAE Airport Losses Reach One Million Dollars Per Minute

UAE Airport Losses Reach One Million Dollars Per Minute

UAE Housing Market Enters Moderate Cooling Phase

UAE Housing Market Enters Moderate Cooling Phase

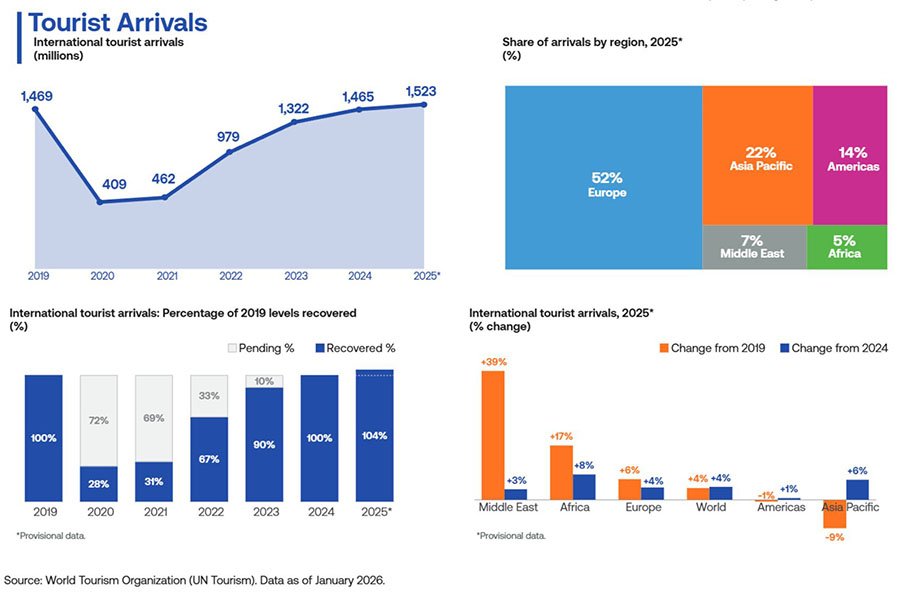

Global Tourism Market in 2025: 4% Growth and New Points of Attraction

Photo: Travel Daily News

Global tourism returned to a steady growth path in 2025 and approached pre-pandemic levels, according to a UN Tourism report. The volume of international travel increased by 4% to reach 1.52 billion, which is almost 60 million more than in 2024. The pace corresponds to average growth rates typical for the period from 2009 to 2019.

Tourism revenues and spending

International inbound tourism revenues, according to the World Tourism Barometer, are estimated at around $1.9 trillion, which is 5% higher than in 2024. Total export revenues, including passenger transport, amounted to approximately $2.2 trillion.

The most significant growth in national currency was recorded in Morocco — 19%, the Republic of Korea — 18%, Egypt — 17%, Mongolia — 15%, Japan — 14%, Latvia — 11%, and Mauritius — 10%. Among the world’s largest tourism revenue earners, the United Kingdom and France increased revenues by 9%, Spain by 7%, and Türkiye by 6%.

Tourist spending from key source markets also continued to rise. The strongest growth was recorded for Spain — 16%, followed by the Republic of Korea — 10%, the United States — 8%, and France — 4%.

Air connectivity and visa policy

Airlines increased the number of international flights and available seats, while the total number of passengers grew by 7% in the first ten months of 2025. The average global occupancy rate for hotels and apartments in November reached 66%, remaining at the level of the same period of the previous year.

The expansion of international air connectivity became one of the key factors behind the recovery of global travel flows. During the year, capacity on intercontinental routes increased and flight frequencies rose between major markets. This helped ease transport constraints that had persisted since the pandemic and supported mobility on long-haul routes.

Changes in visa policy also played an additional role by improving accessibility for international travelers. Combined with the active return of destinations in Asia and the Pacific, this led to a more balanced structure of the global market, where growth was generated across several macro-regions.

Regional dynamics and leading destinations

Europe retained its status as the largest tourist destination, welcoming 793 million international visitors. This is 4% higher than in 2024 and 6% above pre-pandemic levels. Western Europe showed the most stable performance with growth of 5%. In Southern Mediterranean Europe, arrivals increased by 3%, while Central and Eastern Europe recorded growth of 6%, although the region still remained below 2019 levels.

The Americas registered 218 million international visitors, corresponding to growth of 1%: in South America, growth reached 7%, and in Central America — 5%. In the Caribbean, some destinations ended the year with no growth due to the impact of Hurricane “Melissa” in the final quarter. In Africa, arrivals increased by 8% to reach 81 million people, with the main contribution coming from North Africa (+11%). The Middle East approached the mark of 100 million visits (+3%), exceeding pre-pandemic levels by 39%. In Asia and the Pacific, 331 million visits were recorded, which is 6% more than a year earlier, but still 9% below 2019 levels. North-East Asia led the recovery with growth of 13%.

Among individual countries, the most notable growth was recorded in Brazil, where international arrivals increased by 37%, in Egypt — by 20%, in Morocco — by 14%, and in the Seychelles — by 13%. According to data for January–November, Bhutan also recorded growth of 30%, Iceland — 29%, Guyana — 24%, South Africa — 19%, and Japan — 17%.

At the same time, interest in new destinations is increasing, especially in Eastern Europe, where demand is growing due to more moderate prices. Prague, Sofia, Kraków, Budapest, and Sarajevo are among the fastest-growing locations in terms of search queries. Airfare to Sarajevo has fallen by 36% compared to 2025.

Outlook and key drivers for 2026

UN Tourism Secretary-General Shaikha Alnuwais noted that demand for travel remained high throughout 2025 despite inflationary pressure and geopolitical uncertainty. In her view, the positive trend will continue in 2026, as the global economy is expected to remain stable and destinations that have not yet fully returned to pre-pandemic levels will continue to recover.

Factors supporting the market also include the development of air connectivity, rising outbound demand from emerging markets, and major international events such as the Milano Cortina 2026 Winter Olympics and the FIFA World Cup 2026 in the United States, Canada, and Mexico. According to Expedia, around 60% of travelers are willing to include sports events in their travel itineraries, and among Generation Z and millennials this figure reaches 70%. Additional momentum is provided by destinations that gained popularity through films, series, and books. The cruise segment is also showing growth. According to AAA, around 21.7 million US residents are expected to take ocean cruises in 2026, exceeding pre-pandemic levels.

The International Air Transport Association (IATA) expects that around 5.2 billion people will travel by air in 2026, which is 4.4% more than in the record year of 2025. Analysts attribute this to falling airfares: international flights have become cheaper by around 10% or more, while domestic flights declined by an average of 3%. According to Kayak, summer flights to Europe are 14% cheaper than a year earlier. UN Tourism estimates that the global tourism market could grow by a further 3–4% in 2026. At the same time, 58% of experts expect stronger results, 31% forecast performance at current levels, and 11% anticipate a downturn.

Conclusion

Analysts at International Investment note that the future development of the global tourism market will be determined by changes in the structure of demand. The importance of destinations with flexible logistics, diversified offerings, and sustainable pricing is increasing, while traditional tourism centers are facing capacity constraints and rising costs.

In the medium term, key growth points will be markets capable of quickly adapting to fluctuations in demand, implementing digital services, and attracting tourists through event-driven and niche formats. At the same time, the main risks remain the industry’s high sensitivity to geopolitical crises, potential disruptions in air connectivity, and pressure from infrastructure limitations in popular destinations.

From an investment perspective, the most resilient projects are seen in regional air transport, alternative accommodation, and tourism services focused on personalized demand and new travel models.

Read more:

Europe’s Hotel Market: Demand Above Pre-Pandemic Levels Amid Moderate Occupancy

River Cruising Redefines Modern Travel

Florida Leads U.S. Holiday Travel in 2025

Tourism in Georgia in 2025: figures, markets, and trends

India’s Tourism Surges. Year-end travel reaches record levels

Подсказки: tourism, travel industry, aviation, hospitality, global economy, investment, statistics, analytics, destinations, trends